Unlocking Success: The Importance of a Trading Journal

Embarking on the journey of options trading demands meticulous planning and execution. Among the essential tools that fuel profitable trading is a well-maintained trading journal. Just as a compass guides a sailor through treacherous waters, a trading journal serves as an indispensable companion for navigators of financial markets, chronicling every move, decision, and outcome. Not only does it provide a comprehensive record of your trading history, but it also offers a mirror into your trading behavior, empowering you to identify strengths, weaknesses, and areas for improvement.

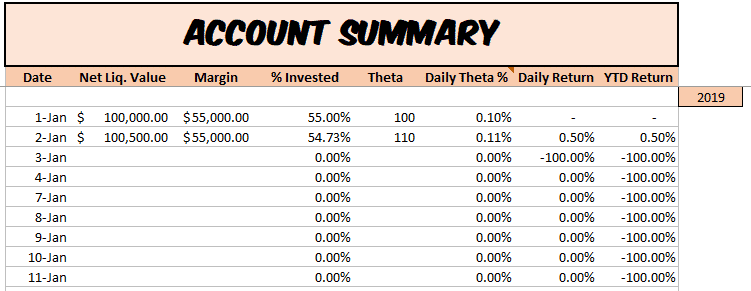

Image: optionstradingiq.com

The relentless quest for market mastery requires constant learning and refinement. A trading journal is a living document that grows alongside your trading knowledge and skills. Regularly reviewing your trades allows you to extract valuable insights, recognize patterns, and glean actionable lessons. By meticulously analyzing your past performances, you can pinpoint mistakes, optimize your trading strategies, and elevate your overall trading prowess.

Essential Components of an Effective Trading Journal

The foundation of any effective trading journal lies in the data it captures. A comprehensive journal should include the following elements:

- Trade details: Time of execution, instrument traded, quantity, price, and trade type

- Decision-making process: Entry and exit reasons, technical indicators, market conditions

- Trade management: Adjustment decisions, risk assessment, position sizing

- Personal observations and reflections: Emotions, biases, and any relevant insights

li>Performance metrics: Profit/loss, risk/reward ratio, win/loss ratio

Choosing the Best Trading Journal: A Journey of Exploration

Navigating the vast array of trading journals available can be a daunting task. To find the perfect fit for your specific needs, consider the following criteria:

- Digital vs. Physical: Digital journals offer convenience and accessibility, while physical journals add a tactile dimension and encourage thorough note-taking.

- Customization: Look for journals that allow you to customize fields and add optional categories to cater to your unique tracking requirements.

- Performance Analytics: Some journals provide built-in performance analytics tools that automatically calculate metrics and generate reports, saving you time.

- User Interface: Opt for a journal with an intuitive and user-friendly interface that makes data entry and analysis effortless.

- Support and Community: Consider journals that offer community forums, support groups, or educational resources to enhance your learning and connect with fellow traders.

- Record Trades Immediately: Fresh impressions are vital for accurate recall. Jot down trade details as soon as possible to capture the key elements of your decision.

- Be Detailed and Objective: Provide clear and unbiased accounts of your trades, avoiding emotional biases or hindsight distortions.

- Regular Review Schedule: Set aside dedicated time for journal review, analyzing trades with a critical eye and identifying areas for improvement.

- Seek Feedback and Share Insights: Engaging with other traders through online forums or community groups can provide valuable perspectives and fresh ideas.

- Stay Adaptable: As your trading style and market conditions evolve, adjust your journal to reflect the changing needs of your trading journey.

- Q: How often should I review my trading journal?

A: Regularly reviewing your journal is essential. A weekly or bi-weekly review cycle is recommended to strike a balance between timely analysis and avoiding over-analysis. - Q: Can I use a physical journal instead of a digital one?

A: Physical journals can be effective, but they have limitations. Digital journals offer advantages such as quick data entry, advanced analytics, and portability, making them a more comprehensive solution. - Q: What are some common mistakes to avoid when using a trading journal?

A: Avoid biased or inaccurate recordings, failing to review regularly, and overcomplicating the journal with excessive data points. Focus on capturing the key elements of each trade and provide clear, objective insights.

Tips and Advice from Seasoned Traders

Harnessing the full potential of a trading journal requires a commitment to regular recording and diligent analysis. Follow these expert tips to maximize its benefits:

Image: www.pinterest.com

Frequently Asked Questions (FAQ)

Embrace the transformative power of a trading journal today. By meticulously documenting, analyzing, and learning from your trading experiences, you equip yourself with the knowledge and insights necessary to conquer the financial markets.

Best Trading Journal For Options

Call to Action

Join the ranks of successful traders who leverage the power of a trading journal. Whether you are a seasoned veteran or a novice eager to embark on the path to financial success, make a commitment to maintaining a comprehensive trading journal. Engage with fellow traders, seek feedback, and dedicate yourself to continuous learning. Your trading journal will serve as your trusted guide, leading you to the pinnacle of trading mastery.

Are you ready to unlock the secrets to successful options trading with the help of a powerful trading journal? Share your thoughts and experiences in the comments below. Let us embark on this trading journey together, fueled by the wisdom of a well-crafted trading journal.