Introduction

Navigating the realm of financial derivatives can be intimidating, but with the right tools and knowledge, you can unlock the potential of option trading. In this article, we’ll delve into the intricacies of option trading using R, a powerful statistical programming language that empowers traders with data analysis and decision-making abilities.

Image: pywoqif.web.fc2.com

Option trading involves the strategic purchase or sale of contracts—known as options—that confer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, commodity, or bond) at a specified price within a predetermined time frame. By harnessing the capabilities of R, traders can optimize their strategies, leverage advanced statistical techniques, and enhance their chances of profitable outcomes.

Data Analysis for Option Trading

One of the key advantages of using R for option trading is its robust data analysis and visualization capabilities. By importing historical data sets into R, traders can perform extensive statistical analyses to uncover patterns, trends, and potential trading opportunities.

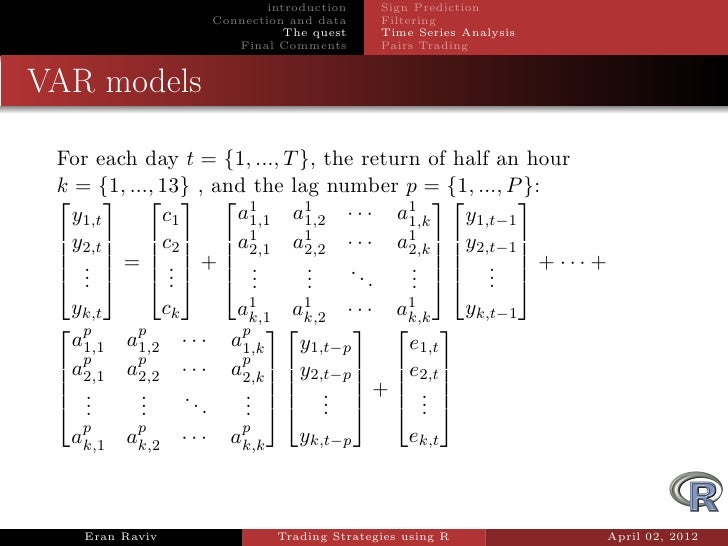

R provides various statistical models and metrics to analyze option price data and underlying asset movements. Traders can employ regression models to identify relationships between factors influencing option prices, such as volatility, interest rates, and economic indicators. Time series analysis techniques enable them to detect patterns and forecast future price movements, while risk management models help traders assess and manage risk levels.

Option Pricing Models

R offers a wide range of industry-standard and cutting-edge option pricing models, including Black-Scholes, binomial trees, and Monte Carlo simulation. These models allow traders to estimate the fair value of options based on market conditions, enabling them to make informed trading decisions.

R’s flexibility and extensibility make it possible for traders to develop and implement custom option pricing models tailored to specific trading strategies. This enables them to incorporate additional data sources, alternative assumptions, and proprietary algorithms to refine their pricing analysis.

Trade Execution and Backtesting

Beyond data analysis and pricing, R also provides support for trade execution and backtesting. Traders can utilize R’s built-in financial trading packages or integrate third-party tools to connect to trading platforms and execute option trades seamlessly.

Moreover, R enables traders to perform rigorous backtesting of trading strategies. By running simulations on historical data, traders can test different strategies, optimize parameters, and evaluate their performance under a variety of market conditions. This empirical validation helps traders improve their trading strategies and reduce the risk of real-money losses.

Image: kofeta.com

Expert Tips and Advice

Harnessing the power of R for option trading requires a combination of technical expertise and practical knowledge. Here are some expert tips to enhance your trading:

- Master the Fundamentals: Gain a strong theoretical foundation in option pricing, risk management, and trading strategies.

- Utilize Data Effectively: Collect and analyze high-quality data to support your trading decisions.

- Practice Discipline: Adhere to a rigorous trading plan that defines your risk tolerance, entry and exit points, and trade management strategies.

- Continuous Learning: Stay updated with the latest advancements in option trading techniques and R packages.

- Seek Mentorship: Connect with experienced traders and seek guidance to refine your strategies and decision-making.

FAQs on Option Trading in R

Q: How do I get started with option trading in R?

A: Begin by installing R and necessary packages, then import historical option data and explore it using data analysis functions.

Q: Which R packages are essential for option trading?

A: Important packages include quantmod, RQuantLib, and OptionMetrics, which offer a comprehensive suite of functions for data analysis, option pricing, and trade execution.

Q: How can I backtest option trading strategies in R?

A: Utilize R’s backtesting functions, such as those in the FinancialInstrument package, to simulate trades and evaluate strategy performance.

Option Trading In R

Image: www.reddit.com

Conclusion

Option trading in R empowers traders with data-driven insights, advanced analytical tools, and the ability to refine their strategies. By leveraging R’s versatility, traders can enhance their decision-making, optimize their risk management, and navigate the complex world of option trading with confidence.

Do you find this article informative and helpful? Share your thoughts and any questions in the comments below.