Options trading offers a unique opportunity to leverage potential gains and manage risk, yet it’s not without its perils. Effective risk management is paramount for navigating the complex world of options and safeguarding your investments. This comprehensive article delves into the intricacies of risk management for options trading, arming you with knowledge and strategies to make informed decisions and mitigate potential losses.

Image: ftmo.com

Options, financial derivatives that derive their value from an underlying asset, have gained immense popularity due to their versatility and hedging capabilities. However, this flexibility also introduces inherent risks that must be carefully considered. Without sound risk management, even seasoned traders can find themselves vulnerable to market volatility and unexpected events.

Understanding Risk in Options Trading

The risks associated with options trading can be broadly categorized into two types: market risk and position risk. Market risk encompasses price fluctuations in the underlying asset, economic factors, and news events that can adversely affect the value of options contracts. Position risk, on the other hand, stems from the unique characteristics of each options position, such as delta, gamma, vega, and theta.

Delta, a measure of an option’s sensitivity to changes in the underlying asset’s price, is crucial for understanding the potential impact of market movements on your position. Gamma, vega, and theta quantify the changes in delta with respect to the underlying asset’s price, volatility, and time, respectively.

Developing a Risk Management Strategy

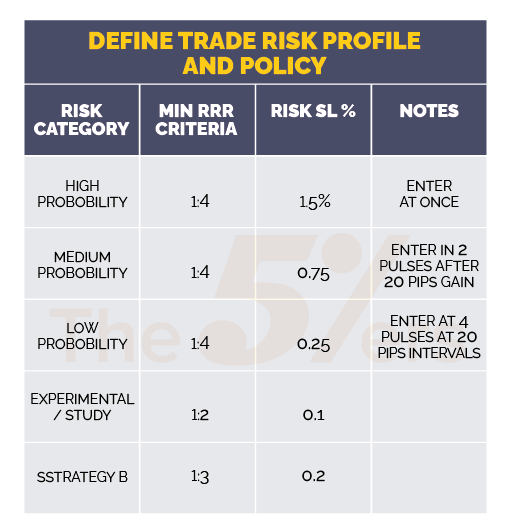

Effective risk management begins with developing a comprehensive strategy tailored to your investment goals, risk tolerance, and trading style. Here are some key elements to consider:

- Position Sizing: Determine the appropriate number of contracts to trade based on your portfolio size, risk tolerance, and market conditions.

- Option Selection: Choose options with appropriate expiration dates, strike prices, and underlying assets that align with your risk appetite.

- Hedging Strategies: Utilize hedging techniques such as covered calls or protective puts to reduce risk and protect against adverse market movements.

- Risk Assessment: Continuously monitor your positions and assess their potential risks and rewards as market conditions evolve.

- Stop-Loss Orders: Set stop-loss orders to automatically close your positions at a predetermined price level to limit potential losses.

Mitigating Risk Through Portfolio Diversification

Diversifying your options portfolio across different underlying assets, expiration dates, and option types can help spread risk and reduce volatility. By allocating investments across various market segments, you can minimize the impact of adverse price movements in any single asset or sector.

Diversification can take various forms, such as:

- Underlying Asset Diversification: Invest in options based on different stocks, indices, or commodities to reduce exposure to specific industries or sectors.

- Expiration Date Diversification: Stagger the expiration dates of your options contracts to spread out risk over different time frames.

- Option Type Diversification: Include different option types, such as calls, puts, covered calls, and vertical spreads, in your portfolio to balance risk and potential returns.

Image: the5ers.com

Staying Informed and Managing Market Risk

Staying abreast of market news and events is crucial for managing risk in options trading. Economic data, earnings reports, political announcements, and other factors can significantly impact the value of options contracts.

Use news sources, financial publications, and charting tools to monitor market trends and identify potential risks. By staying informed, you can make timely adjustments to your portfolio as needed.

Risk Management For Options Trading

https://youtube.com/watch?v=HldO2EgghTo

Conclusion

Risk management is not an option but a necessity in options trading. By embracing the strategies outlined in this article, you can navigate the complexities of options markets with confidence and mitigate potential losses. Remember, risk management is an ongoing process that requires constant monitoring, adaptation, and adherence to sound principles. By managing risk effectively, you can unlock the full potential of options trading while preserving your financial well-being.