The realm of options trading holds immense potential for savvy investors, and when it comes to finding a reliable platform, thinkorswim reigns supreme. Known for its robust features and advanced trading tools, thinkorswim has emerged as the industry leader, empowering both experienced traders and beginners alike. However, understanding the intricacies of options trading fees is paramount for maximizing returns and minimizing potential losses. In this article, we delve into the depths of thinkorswim options trading fees, providing a comprehensive guide to help you navigate these charges with confidence.

Image: app.warga.co.id

Options Trading: A Gateway to Enhanced Returns

Options Trading Fees: Understanding the Basic Structure

Options contracts, by their design, involve two distinct fees: the option premium and the transaction fee. The option premium is the price paid by the buyer to the seller of the option contract, granting the buyer the right but not the obligation to exercise the option at a specified strike price on or before a particular expiration date. On the other hand, the transaction fee is a commission charged by the broker for facilitating the trade, typically a flat fee irrespective of the value of the underlying security.

thinkorswim’s options trading fee structure is transparent and competitive, designed to cater to diverse trading strategies. The platform charges a competitive flat-rate transaction fee per contract, with additional charges based on the value of the underlying security for premium-priced contracts. This fee structure empowers investors to execute trades effectively, while ensuring transparency throughout the trading process.

Navigating Premium-Priced Contracts and Exercise Fees

Understanding premium-priced contracts and exercise fees is crucial for seasoned traders aiming to maximize their returns. thinkorswim charges an additional fee for premium-priced contracts, which are contracts with an option premium exceeding $1.00 per share. This fee is calculated as a percentage of the option premium and varies based on the number of contracts traded. It’s important to factor in these additional charges when evaluating the overall trading costs.

When it comes to exercising options, thinkorswim charges an exercise fee for each exercised contract. This fee is typically a flat rate and applies to both closing and opening trades. The exercise fee can be a significant cost consideration, particularly for traders who actively exercise options contracts. Therefore, traders should carefully weigh the potential benefits and costs associated with exercising options before making a decision.

Leveraging Advanced Trading Tools and Research

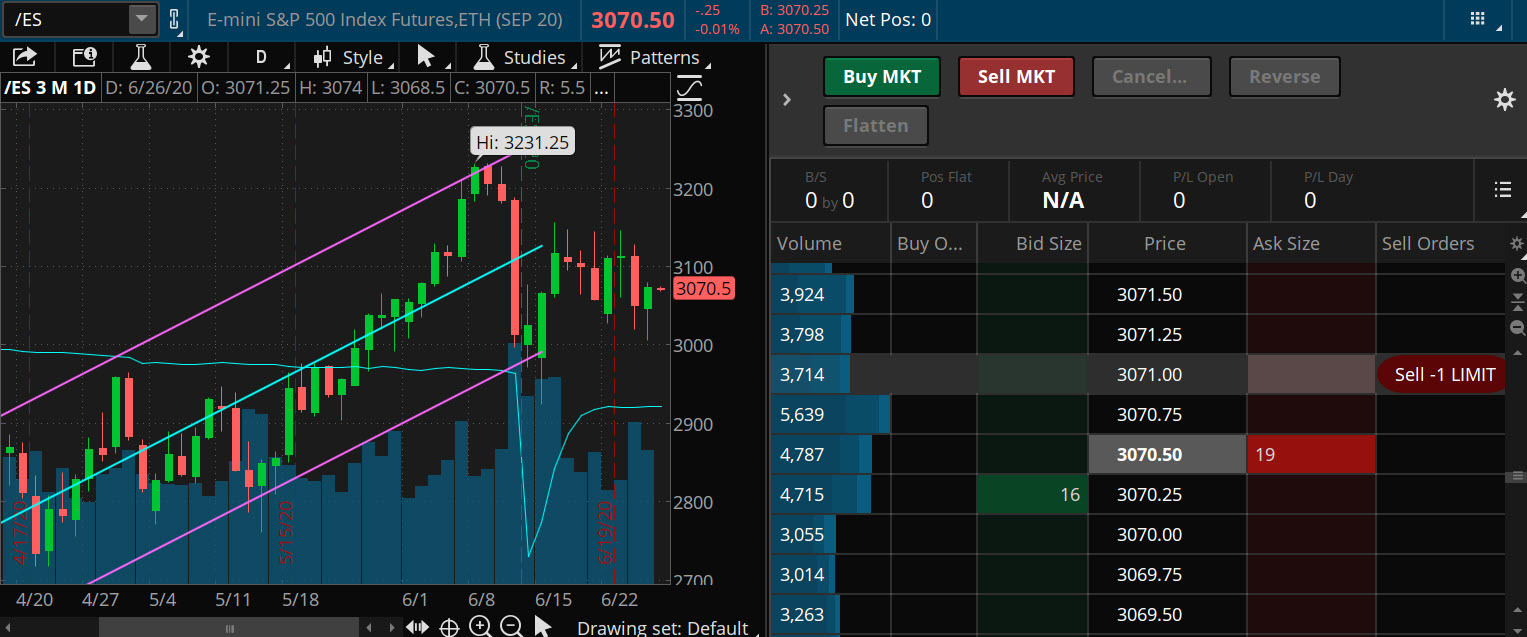

While trading fees are a necessary part of options trading, thinkorswim’s commitment to empowering traders extends beyond fee structures. The platform provides a comprehensive suite of advanced trading tools and research capabilities, designed to enhance decision-making and optimize trading strategies. These tools include real-time market data, technical analysis indicators, and comprehensive charting capabilities, empowering traders with the insights they need to capitalize on market opportunities.

thinkorswim’s dedication to trader education is evident in its extensive library of articles, videos, and webinars, covering a wide range of trading topics, including options trading strategies. These educational resources empower traders to continuously enhance their knowledge and skills, enabling them to make informed trading decisions.

Image: amelaho.weebly.com

Tips for Minimizing Trading Fees

Strategic trading practices can mitigate the impact of trading fees on overall profitability. Here are a few tips to help minimize fees:

- Utilize limit orders: Limit orders allow traders to specify the desired price for trade execution. This strategy ensures that trades are executed at or better than the specified price, reducing the potential for slippage, which can lead to higher transaction fees.

- Trade during extended-hours sessions: Extended-hours trading sessions offer lower option premiums due to reduced liquidity. Taking advantage of these off-peak trading periods can result in significant savings on option premiums.

- Consider multi-leg option strategies: Multi-leg option strategies, such as spreads, can reduce the overall cost of trading by offsetting the premium of one option against another. This approach allows traders to achieve similar market exposure with potentially lower upfront costs.

- Monitor fee schedules regularly: Brokerage fees can change over time. Regularly reviewing thinkorswim’s fee schedule will ensure that you are aware of any adjustments, enabling you to plan your trading activities accordingly.

Frequently Asked Questions

What is the standard transaction fee for options trades on thinkorswim?

thinkorswim charges a flat-rate transaction fee of $0.65 per contract, with an additional volume discount for higher trade volumes.

Are there any additional fees for premium-priced contracts?

Yes, thinkorswim charges an additional fee for premium-priced contracts with an option premium exceeding $1.00 per share. This fee is calculated as a percentage of the option premium.

What are the exercise fees associated with options on thinkorswim?

thinkorswim charges a flat exercise fee per exercised contract, typically ranging from $0.15 to $0.50 per contract.

Does thinkorswim offer any educational resources for options trading?

Yes, thinkorswim provides a comprehensive library of articles, videos, and webinars, covering a wide range of trading topics, including options trading strategies.

How can I minimize the impact of trading fees on my overall profitability?

Strategic trading practices, such as utilizing limit orders, trading during extended-hours sessions, and implementing multi-leg option strategies, can help minimize the impact of trading fees.

Thinkorswim Options Trading Fees

Conclusion

Embarking on the journey of options trading requires a deep understanding of trading fees and a strategic approach to minimize their potential impact on profitability. thinkorswim’s transparent and competitive fee structure, coupled with its advanced trading tools and research capabilities, empowers traders to navigate the market with confidence. By leveraging the tips and expert advice presented in this article, investors can effectively optimize their trading strategies and maximize their returns.

If you seek to delve further into the intricacies of options trading fees and maximize your trading success, we encourage you to continue exploring reliable sources and engaging in discussions with experienced traders. The knowledge you acquire will prove invaluable in your pursuit of financial growth and prosperity.