Unlocking the Potential of Exchange-Traded Funds

In a rapidly evolving financial landscape, Charles Schwab emerges as a leading force, offering a comprehensive suite of options trading solutions tailored to meet the diverse needs of investors. Exchange-traded funds (ETFs), a cornerstone of modern portfolio management, have gained immense popularity due to their inherent advantages, including diversification, cost-effectiveness, and transparency. When combined with the flexibility and leverage of options contracts, ETFs present a compelling opportunity for savvy investors to enhance their returns and mitigate risks.

Image: t3technologyhub.com

Understanding ETFs and Options Contracts

Exchange-traded funds are hybrid investment vehicles that track a specific asset, index, or basket of assets. They combine the diversification of mutual funds with the liquidity and tradability of stocks, providing investors with a convenient and efficient way to access a broad range of markets and sectors. Options contracts, on the other hand, confer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specified expiration date. By incorporating options into their ETF investment strategies, investors can potentially enhance returns, manage volatility, and implement sophisticated trading strategies.

The ETFS Universe at Charles Schwab

Charles Schwab’s ETF platform boasts a vast selection of ETFs covering a wide spectrum of asset classes and investment objectives. From broad-based index funds tracking major market benchmarks to niche-specific funds tailored to specific industries or sectors, investors can find ETFs that align seamlessly with their investment goals. Schwab’s ETF offering encompasses both traditional ETFs and actively managed strategies, providing investors with the flexibility to choose between passive and active investment approaches.

Options Trading with Charles Schwab

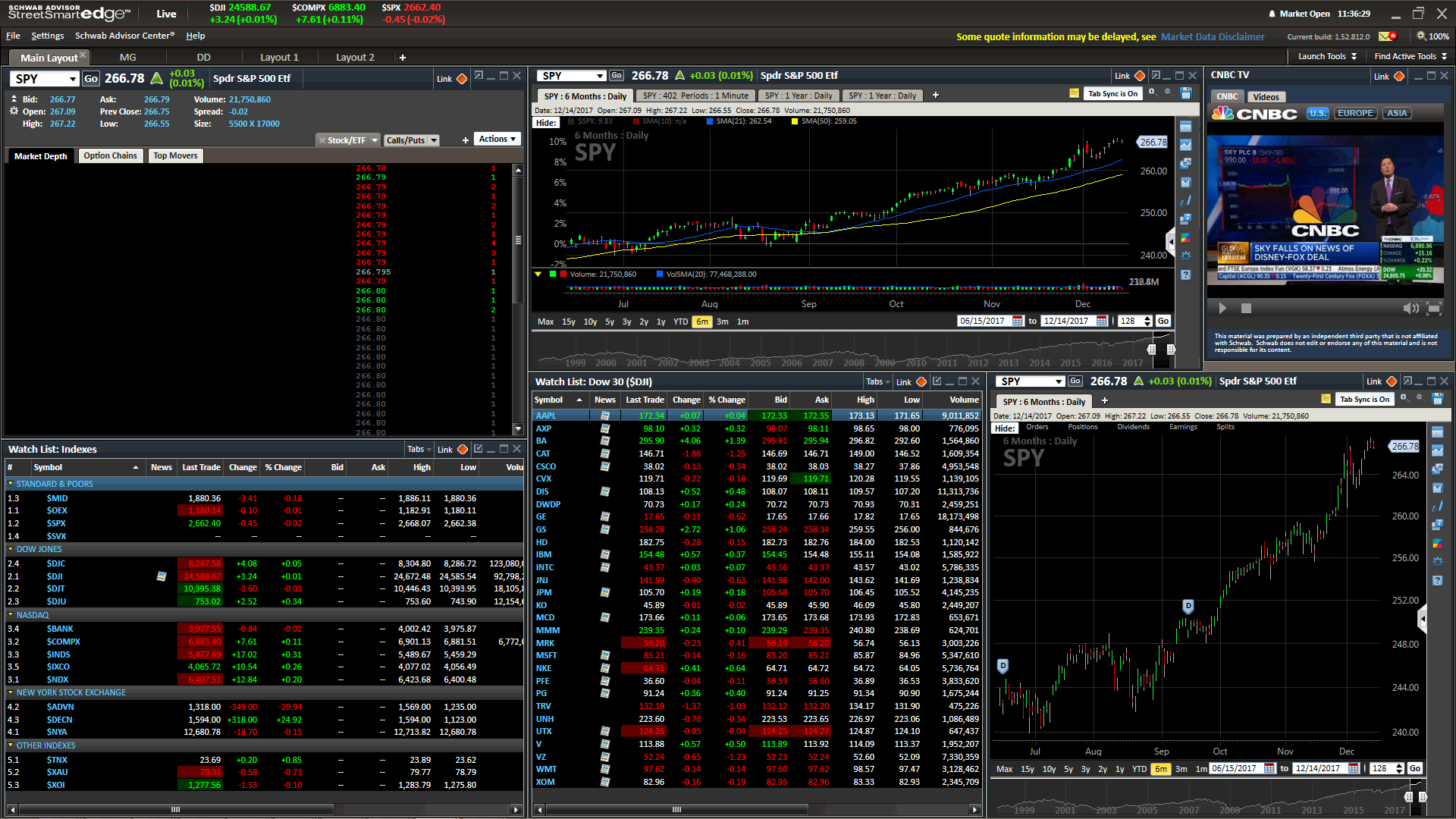

Schwab’s options trading platform is designed to cater to the needs of both novice and experienced traders. It features an intuitive interface, real-time market data, and advanced tools that empower traders to make informed decisions. Schwab also offers a comprehensive suite of educational resources and dedicated support to help investors navigate the complexities of options trading and develop their skills.

Image: www.schwab.com

Case Study: Enhancing Returns with ETF Options

Consider an investor seeking to enhance the return potential of a core holding in the S&P 500 ETF (SPY). By selling a cash-secured put option on SPY, they can receive an immediate premium payment in exchange for the obligation to sell a specified number of shares of SPY at the strike price if the price falls below the strike before the expiration date. If the price holds above the strike, the investor retains the option premium as profit. This strategy generates incremental income and reduces portfolio volatility, making it an attractive option for risk-averse investors seeking to generate additional yield from their ETF holdings.

Charles Schwab Etfs Options Trading

Image: www.youtube.com

Conclusion

Charles Schwab’s comprehensive ETF and options trading platform empowers investors with the tools and resources they need to navigate the dynamic financial landscape. By leveraging the power of ETFs and options, investors can customize their investment strategies, enhance returns, and manage risks more effectively. Whether you are a passive investor seeking diversification or an experienced trader looking to implement advanced trading strategies, Schwab provides a tailored solution to meet your unique needs. Embrace the opportunities presented by ETF options trading with Charles Schwab and unlock the potential for a brighter financial future.