Unveiling the Dynamics of Global Currency Markets

As the world becomes increasingly interconnected, the foreign exchange (forex) market has gained unprecedented significance. Over-the-counter (OTC) bank foreign currency options trading is a cornerstone of this market, facilitating the exchange of currencies between global financial institutions. This article delves into the fascinating realm of OTC bank foreign currency options trading, exploring its significance, mechanics, and recent trends.

Image: www.djrlandscape.com

The Importance of OTC Bank Foreign Currency Options Trading

OTC bank foreign currency options trading plays a pivotal role in facilitating international trade, investment, and hedging. It allows businesses and investors to mitigate currency risks, maximize profit opportunities, and manage their cash flow. By providing a customized and flexible platform for trading, OTC banks offer tailored solutions to meet the specific needs of their clients.

Understanding OTC Bank Foreign Currency Options Trading

OTC bank foreign currency options trading operates in a decentralized manner, away from regulated exchanges. It is primarily conducted between individual banks, their clients, and other financial intermediaries. Foreign currency options are financial derivatives that grant the holder the right, but not the obligation, to buy or sell a specified amount of foreign currency at a predetermined price (the strike price) on or before a predetermined date (the expiration date).

The Mechanics of OTC Foreign Currency Options Trading

In the OTC foreign currency options market, participants negotiate directly with counterparties to agree on the terms of the contracts. Options contracts can be tailored to suit specific requirements, offering flexibility in terms of strike prices, expiration dates, and other parameters. Options premiums, which represent the price paid for the option, are determined through negotiation between the parties.

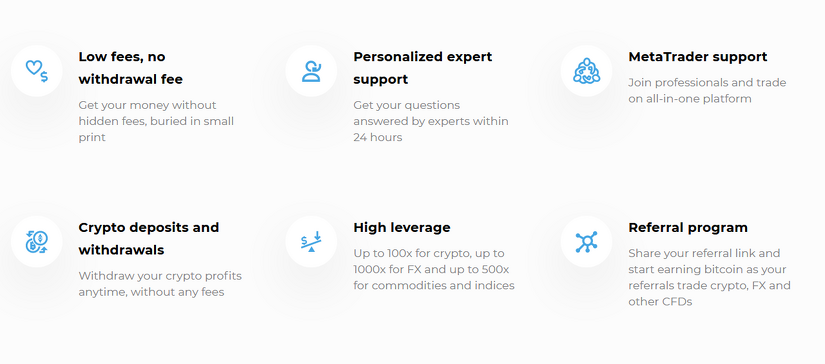

Image: www.fxpro.com

Market Dynamics and Latest Trends

The OTC bank foreign currency options market is highly dynamic, with fluctuations influenced by a wide range of economic, political, and financial factors. Global macroeconomic trends, geopolitical events, and changes in interest rates can significantly impact currency movements and, consequently, the pricing of options contracts.

Tips and Expert Advice for Successful Trading

Navigating the OTC bank foreign currency options market requires a comprehensive understanding of market fundamentals, risk management principles, and trading strategies. Here are some key tips and expert advice to help you succeed:

- Conduct thorough market research to identify potential trading opportunities.

- Understand the mechanics of option pricing and hedging strategies to minimize risks.

- Employ a disciplined risk management approach to protect your capital from significant losses.

- Leverage technology and market intelligence platforms to stay abreast of market trends.

Otc Bank Foreign Currency Options Trading Results

Image: stock.adobe.com

Frequently Asked Questions about OTC Bank Foreign Currency Options Trading

Q: What are the benefits of OTC bank foreign currency options trading?

A: OTC bank foreign currency options trading offers flexibility, customization, and the potential for profit generation and risk management.

Q: How do I get started with OTC foreign currency options trading?

A: To participate in OTC foreign currency options trading, it is essential to open an account with a reputable OTC bank that offers such services.

Conclusion

OTC bank foreign currency options trading is a complex but rewarding field that requires a deep understanding of the financial markets, the dynamics of currencies, and the art of risk management. By embracing industry best practices, staying informed about market trends, and seeking expert advice, you can unlock the potential of this dynamic and ever-evolving market.

Do you find the topic of OTC bank foreign currency options trading intriguing? Share your thoughts and questions in the comments section below.