For seasoned traders and ambitious beginners alike, navigating the intricate world of day trading options can be a lucrative endeavor. However, understanding the intricacies of taxation is paramount to maximizing your returns and minimizing your financial burden.

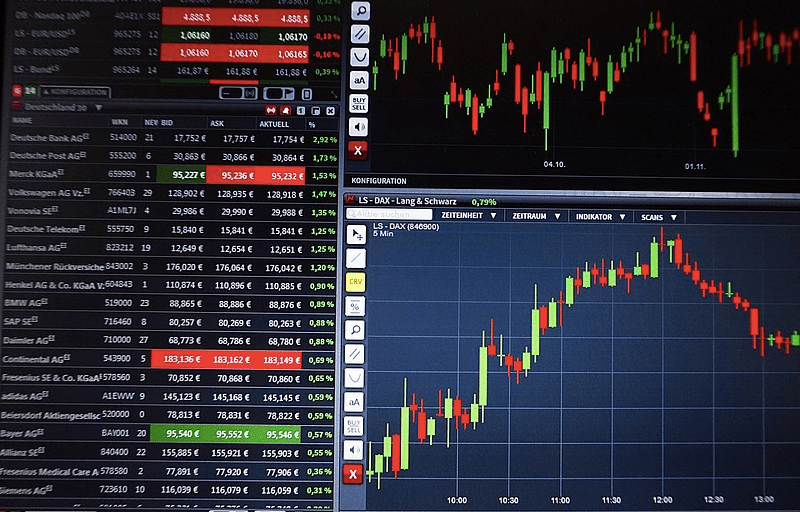

Image: www.daytrading.com

In this comprehensive guide, we delve into the intricacies of day trading options taxation, offering a comprehensive overview and practical tips to help you navigate the complexities successfully.

Understanding Day Trading and Option Taxation

Day trading involves buying and selling options contracts within the same trading day, seeking to capitalize on short-term price movements. Options contracts represent the right, but not the obligation, to buy (call options) or sell (put options) an underlying instrument at a specified price (strike price) on or before a certain date (expiration date).

Options taxation differs significantly from that of other financial instruments. Short-term gains or losses, classified as those held for less than a year, are taxed at ordinary income rates. Conversely, long-term gains or losses, resulting from options held for a year or more, are taxed at the more favorable capital gains rate.

The Wash Sale Rule

The wash sale rule applies to options trades as well. If you sell an option at a loss and acquire a substantially identical option within 30 days, the loss will be disallowed for tax purposes. This rule helps prevent artificial loss generation and provides a more accurate reflection of actual trading activity.

Latest Trends and Developments in Day Trading Options Taxation

The regulatory landscape surrounding day trading options taxation is ever-evolving. Recent updates include:

- Increased Enforcement: Tax authorities are ramping up efforts to enforce existing tax laws and regulations, targeting day traders who underreport or misclassify their trading activities.

- New Reporting Requirements: Advanced trading platforms now provide sophisticated reporting tools that can assist traders in accurately tracking their gains and losses for tax purposes.

- Social Media Scrutiny: Tax authorities are increasingly monitoring social media platforms to identify potential tax avoidance strategies and uncover undeclared income.

Image: daytradesafe.com

Tips and Expert Advice for Successful Taxation Management

Effective day trading options taxation management requires a combination of knowledge and strategy. Consider these tips from industry experts:

- Keep Accurate Records: Maintain detailed records of all your trades, including purchase and sale dates, strike prices, and expiration dates. This documentation will be invaluable when filing your taxes.

- Use Tax-Advantaged Accounts: Consider utilizing tax-advantaged accounts such as IRAs and 401(k)s to minimize capital gains taxes on long-term trades.

- Consult a Tax Professional: Engage the services of a qualified tax professional who specializes in options taxation. They can provide tailored advice and guidance to help you navigate the complexities.

Frequently Asked Questions on Day Trading Options Taxation

Q:** What are the tax implications of day trading options?

A: Day trading options generates both short-term and long-term gains or losses. Short-term gains are taxed at ordinary income rates, while long-term gains are taxed at more favorable capital gains rates.

Q:** Can I claim losses from day trading options on my tax return?

A: Yes, you can claim losses from day trading options as long as you follow the wash sale rule and maintain accurate documentation.

Day Trading Options And Taxes

Image: www.amazon.com

Conclusion

Mastering day trading options taxation is essential for maximizing returns and minimizing financial burden. By embracing the principles outlined in this guide and adhering to the latest trends and developments, you can navigate the complexities of options taxation confidently. Remember, the key to success lies in maintaining accurate records, utilizing tax-advantaged accounts, and seeking guidance from qualified tax professionals.

If you’re ready to delve deeper into the world of day trading options and conquer the nuances of taxation, reach out to our team of experts for personalized guidance. We’re here to empower you on your journey to financial success.