Gain Mastery of GBTC Options Trading: A Comprehensive Guide for Success

Image: www.tradingview.com

Unveiling the World of GBTC Options Trading

In the dynamic realm of digital assets, Grayscale Bitcoin Trust (GBTC) has emerged as a pioneering vehicle for regulated bitcoin exposure. As GBTC’s prominence soars, savvy investors are delving into a sophisticated trading strategy: GBTC options trading. This comprehensive guide empowers you to navigate this exciting arena, unlocking the potential for both risk management and profit generation. Dive into the depths of GBTC options trading, mastering its intricacies and unlocking its transformative power.

A Deep Dive into GBTC Options Trading

GBTC options provide investors with the flexibility to make informed bets on the future price of GBTC shares without committing to an outright purchase. This empowers traders to capitalize on potential price movements and strategically manage risk. Understanding the foundational concepts of options trading is paramount to unlocking the full spectrum of opportunities it presents.

Deciphering Options Terminology

At the heart of options trading lies a lexicon of specialized terms that can initially appear daunting. However, with a clear understanding of their meanings, the path to mastery becomes more accessible.

-

Option: A contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date.

-

Call Option: Grants the holder the right to buy the underlying asset at a set price (strike price) on or before a specific date (expiration date).

-

Put Option: Grants the holder the right to sell the underlying asset at the strike price on or before the expiration date.

-

Premium: The price paid to acquire an option, representing the cost of the right it provides.

Grasping the Mechanics of GBTC Options Trading

Effectively navigating GBTC options trading hinges on comprehending its mechanics. These include:

-

Option Price: Determined by factors such as the underlying asset’s price, time to expiration, strike price, and volatility.

-

Delta: Measures the sensitivity of the option’s price to changes in the underlying asset’s price.

-

Theta: Captures the value decay of an option as time passes.

Unlocking Expert Insights and Actionable Tips

To further enhance your GBTC options trading prowess, harness the insights of seasoned professionals. Experts recommend:

-

Understanding the Greeks: Delving into the intricacies of option Greeks (e.g., Delta, Theta) provides valuable insights into option behavior and risk assessment.

-

Hedging Strategies: Utilizing options to mitigate portfolio risk by offsetting potential losses in another asset.

-

Trading Discipline: Maintaining a clear trading strategy, managing emotions, and adhering to risk management principles are crucial for sustained success.

Embark on Your GBTC Trading Odyssey

The world of GBTC options trading is a vast and ever-evolving landscape. With the guidance provided in this comprehensive article, you possess the knowledge and understanding to navigate its complexities effectively. Take your trading journey to new heights, harnessing the power of GBTC options to maximize potential returns and mitigate risk.

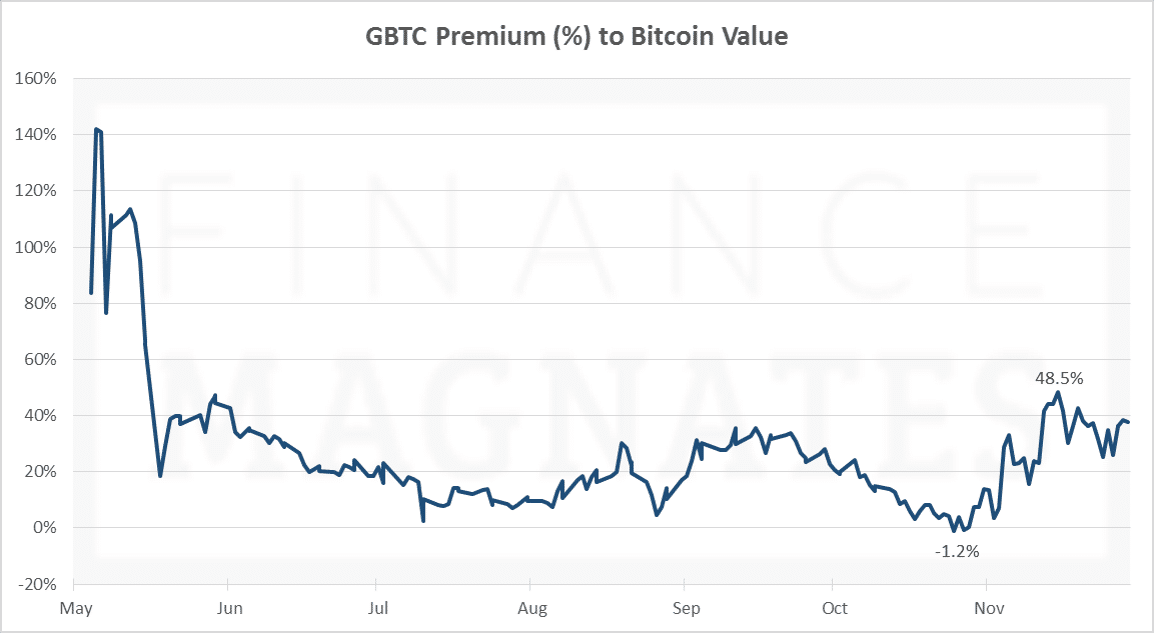

Image: www.financemagnates.com

Gbtc Options Trading

Image: tokenist.com