Introduction

As an options trader, I’ve seen the highs and lows of the market, but nothing quite compares to the adrenaline rush of trading options on Fridays. It’s a day of heightened volatility, where fortunes can be made or lost in a matter of minutes. In this article, we’ll explore the ins and outs of trading options on Fridays, uncovering the risks and rewards that come with it.

Image: www.focusedtrades.com

Fridays are known to be a time of increased volatility in the options market. This is due to a number of factors, including the expiration of weekly options contracts and the squaring of positions ahead of the weekend. As a result, option prices can fluctuate wildly on Fridays, making it a potentially lucrative – but also risky – day to trade.

Trading Options on Friday: Key Considerations

If you’re considering trading options on Fridays, there are a few key things to keep in mind:

- Volatility: Fridays are known for their volatility, so it’s important to be prepared for large swings in option prices. This can be both a blessing and a curse, as it can lead to both big profits and big losses.

- Liquidity: Liquidity can be lower on Fridays, especially towards the end of the trading day. This means that it may be more difficult to get in and out of positions quickly, which can be a problem if the market is moving quickly.

- Time decay: Time decay works against you on Fridays, as options contracts lose value every day. This means that you need to be mindful of your holding period and make sure to close out your positions before they expire worthless.

Tips and Expert Advice for Trading Options on Fridays

If you’re looking to increase your chances of success when trading options on Fridays, here are a few tips to keep in mind:

- Be aware of the risks: Before you start trading options on Fridays, it’s important to be aware of the risks involved. The market can be very volatile, and you could lose money quickly.

- Trade with a plan: Don’t just jump into the market without a plan. Take some time to develop a strategy and stick to it.

- Use limit orders: Limit orders can help you to control your risk when trading options on Fridays. By setting a limit price, you can prevent yourself from getting filled at a price that you’re not comfortable with.

- Don’t get greedy: It’s easy to get caught up in the excitement of trading options on Fridays, but it’s important to remember that greed can lead to losses.

- Take profits: When you’re trading options on Fridays, it’s important to take profits when you can. Don’t let your profits turn into losses.

FAQs About Trading Options on Fridays

Q: What are the risks of trading options on Fridays?

A: The risks of trading options on Fridays include volatility, liquidity, and time decay.

Q: What are some tips for trading options on Fridays?

A: Some tips for trading options on Fridays include being aware of the risks, trading with a plan, using limit orders, and not getting greedy.

Q: What is the best way to learn how to trade options on Fridays?

A: The best way to learn how to trade options on Fridays is to practice. You can open a paper trading account to practice trading without risking any real money.

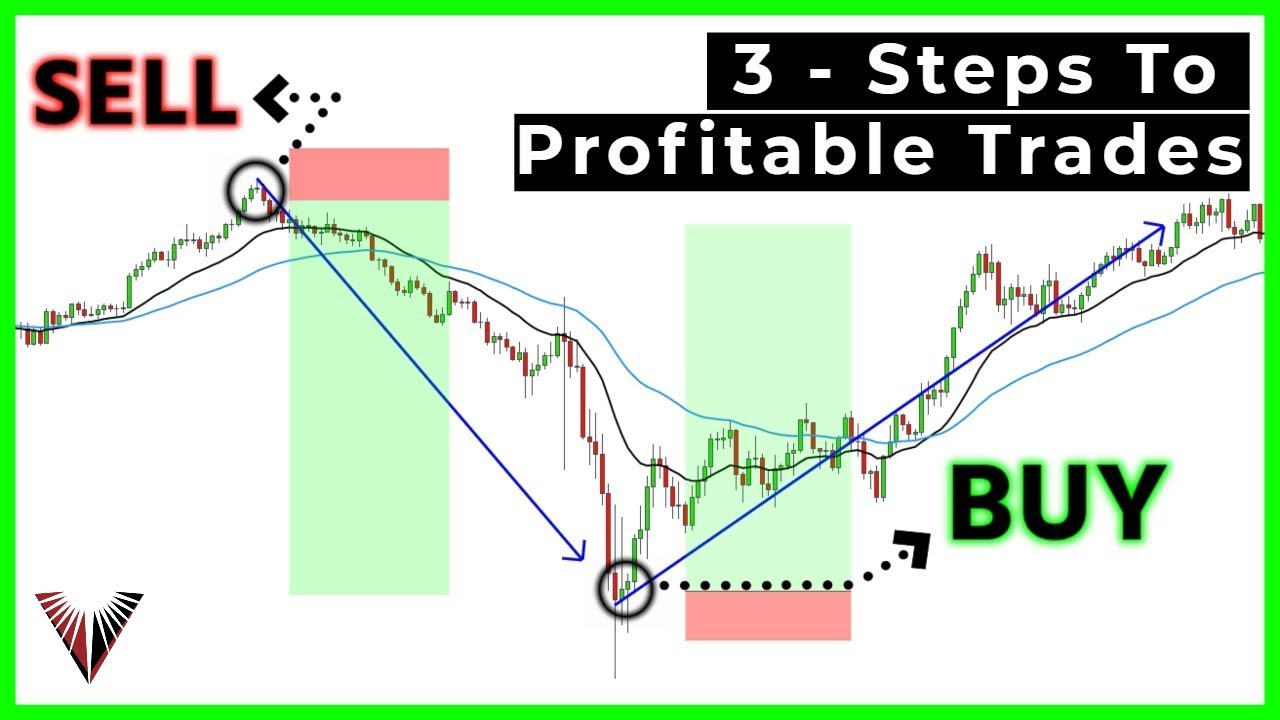

Image: www.youtube.com

Trading Options On Fridays

Image: www.youtube.com

Conclusion

Trading options on Fridays can be a high-risk, high-reward endeavor. If you’re looking to trade options on Fridays, it’s important to be aware of the risks and to have a solid trading plan in place.

Are you interested in learning more about trading options on Fridays? If so, I encourage you to do some research and to practice trading in a paper trading account before you risk any real money.