Introduction

In the realm of financial markets, where opportunities and risks intertwine, call options emerge as a powerful tool for astute investors. Whether you’re a seasoned trader or a curious novice, understanding call options and their dynamics is crucial for unlocking their profit-making potential. This comprehensive guide will delve into the intricacies of call option trading, empowering you with the knowledge and skills to navigate the market with confidence.

Image: www.call-options.com

Call options, as opposed to their counterpart, put options, grant the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This unique characteristic empowers traders with the potential to profit from an anticipated appreciation in the asset’s value. As the saying goes, “with great power comes great opportunity,” and call option trading is no exception. However, before diving headfirst into the turbulent waters of the options market, let’s equip you with the necessary foundations.

Understanding the Dynamics of Call Options

At the heart of call option trading lies the concept of the underlying asset. This could be a stock, bond, commodity, or even a currency. The buyer of a call option is essentially betting on a rise in the price of the underlying asset. If their prediction holds true, they can exercise their right to purchase the asset at the strike price, irrespective of the prevailing market price. This mechanism enables traders to potentially reap substantial profits without having to purchase the underlying asset outright, saving both capital and potential headaches.

Intrinsic and Time Value: Valuing Call Options

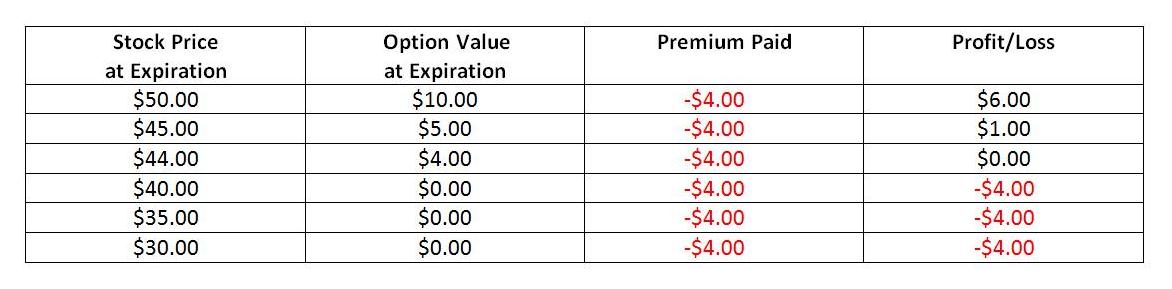

Every call option possesses two distinct components that determine its value: intrinsic value and time value. Intrinsic value, like a sturdy foundation, represents the difference between the current market price of the underlying asset and the strike price. On the other hand, time value reflects the remaining time until the option’s expiration date. The closer the expiration date, the less time value remains, and hence, the lower the option’s value. Understanding the interplay between these two elements is essential for savvy option traders.

Trading Strategies: Navigating the Options Market

The options market offers a rich tapestry of trading strategies, each with its own risk and reward profile. Covered calls, for instance, involve selling a call option against a corresponding number of shares that the trader already owns. This strategy generates premium income and limits downside risk, making it suitable for investors with a bullish outlook. Uncovered calls, on the other hand, involve selling call options without owning the underlying shares. While offering the potential for higher returns, this strategy also exposes the trader to unlimited loss and is recommended only for experienced traders with a clearly defined risk management strategy.

Image: www.onlinefinancialmarkets.com

Hedging: Shielding Against Market Volatility

In the capricious world of financial markets, hedging emerges as a valuable tool for mitigating risk. By constructing carefully orchestrated hedges, traders can offset potential losses from adverse price movements. Combining call options with other financial instruments, such as put options or futures contracts, enables investors to neutralize unwanted exposure, allowing them to preserve capital and protect their hard-earned gains.

Call Option Trading Basics

![[WIP] Enrollment – Options Trading Program | Beyond Insights](https://www.beyondinsights.net/wp-content/uploads/Call-vs-Put-Options-1024x553.png)

Image: www.beyondinsights.net

Conclusion

Call option trading presents a potent arsenal for investors seeking to exploit the potential for profit and mitigate risk in the stock market. Grasping the intricacies of call option dynamics, valuation techniques, and trading strategies provides a solid foundation for successful navigation of this complex landscape. Remember, the financial markets are an arena where both opportunity and risk abound, demanding a disciplined approach, diligent risk management, and an unyielding pursuit of knowledge. Embrace the power of call options, but always proceed with caution, prudence, and a deep understanding of the potential rewards and perils involved.