Are you curious about the world of day trading and eager to explore the intricacies of call options? In this comprehensive guide, we will delve into the depths of this exciting financial instrument, empowering you with the knowledge and understanding to navigate the volatile waters of day trading with confidence.

Image: eafx.monster

Understanding Call Options: A Primer

In the realm of day trading, an option grants you the right, but not the obligation, to buy or sell an underlying asset at a specific price within a specified time frame. A call option, specifically, provides you with the privilege of purchasing an asset at a predetermined strike price before the option’s expiration date.

Imagine you’re optimistic about the future performance of Apple stock. You have the option to buy 100 shares of Apple at a strike price of $150 within the next two weeks. If the stock price surpasses $150 during that period, you can exercise your right to purchase the shares at the lower strike price, potentially profiting from the stock’s appreciation.

The Mechanics of Call Options

Every call option contract represents 100 shares of the underlying asset. When you purchase a call option, you pay a premium, which is the price of the option. This premium reflects factors such as:

- The current market price of the underlying asset

- The strike price

- The time to expiration

If the market price of the underlying asset rises above the strike price, you can exercise your call option and buy the asset at the lower strike price, potentially generating a profit. However, if the stock price falls below the strike price, the option will expire worthless, and you will lose the premium you initially paid.

Strategic Use of Call Options

In the hands of skilled traders, call options offer a versatile tool for profiting from rising stock prices. Here are some common strategies:

- Bullish Call Spread: In anticipation of a stock’s appreciation, you can buy a call option with a lower strike price and simultaneously sell a call option with a higher strike price at the same expiration date.

- Covered Call: If you already own the underlying asset, you can sell a call option with a strike price above the current market price. This strategy generates income from the premium but limits your potential upside.

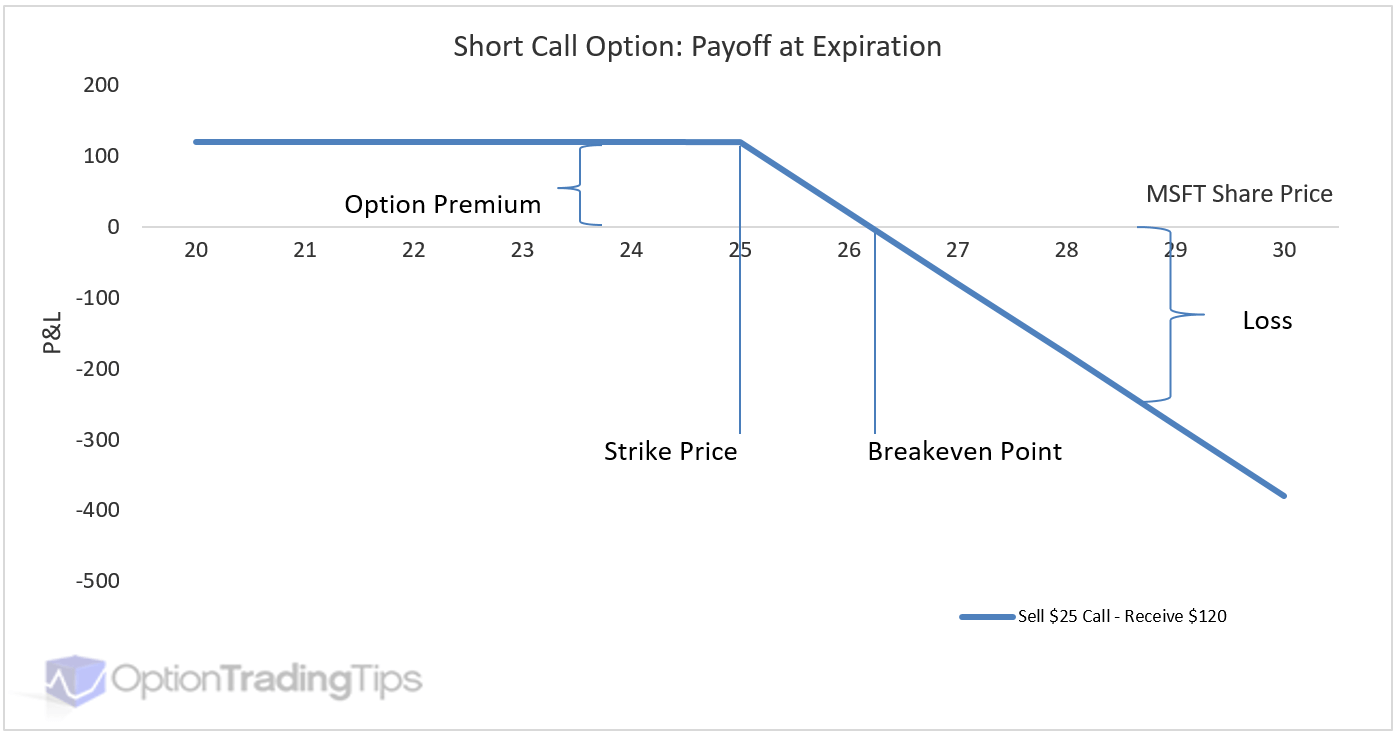

- Naked Call: Selling a call option without owning the underlying asset is a more speculative and riskier strategy. If the stock price rises significantly, you may be obligated to buy the asset at the strike price, potentially leading to significant losses.

Image: www.optiontradingtips.com

Expert Insights and Actionable Tips

“Call options can be a powerful tool for day traders, but understanding the risks and limitations is crucial,” advises John Carter, a veteran day trader and renowned options expert. “Always conduct thorough research on the underlying asset and carefully evaluate the option’s premium before making a trade.”

To enhance your call option trading, follow these actionable tips:

- Consider the Greeks: The Greeks, such as Delta and Gamma, provide insights into the sensitivity of the option’s price to changes in various factors.

- Manage Risk: Determine your risk tolerance and never invest more than you can afford to lose.

- Use Option Chains: Option chains offer a visual representation of available options for a particular underlying asset.

- Stay Informed: Monitor market news and company announcements to stay up-to-date on factors that may affect the underlying asset’s price.

What Are Call Options In Day Trading

Image: globaltradingsoftware.com

Conclusion

Unlocking the potential of call options in day trading requires a thorough understanding of their mechanics, strategic applications, and inherent risks. By leveraging the insights and guidance provided in this comprehensive guide, you are well-equipped to embark on your day trading journey with confidence. Remember, education is key to success, and continuous learning will serve you well in the ever-evolving world of financial markets.