Deciphering the Language of Options Contracts

In the labyrinthine world of options trading, “call” and “put” are terms that hold immense significance for investors seeking to navigate the treacherous waters of financial markets. These versatile instruments empower traders to wager on the future direction of an underlying asset, such as stocks, bonds, or commodities. So, buckle up and prepare to unravel the enigmas of options trading as we dissect the meanings and applications of “call” and “put” options.

Image: eafx.monster

1. Call Options: The Right to Acquire

Imagine yourself at the wheel of a car, cruising down the highway with confidence. A call option grants you the exclusive prerogative to seize control of an underlying asset at an agreed-upon price on a predefined date. It’s as if you possess the golden ticket, entitling you to purchase that alluring stock or commodity at a discounted rate, regardless of market fluctuations. Call options are potent tools for traders who anticipate a rise in the underlying asset’s value.

2. Put Options: The Power to Sell

Now, let’s shift gears and envision a scenario where you possess a rare gem that you wish to divest. A put option bestows upon you the authority to sell an underlying asset at a predetermined price on a chosen date. Think of it as an insurance policy, safeguarding you against unfavorable market swings. Put options are indispensable for investors who foresee a decline in the value of the underlying asset.

3. The Mechanics of Call and Put Options

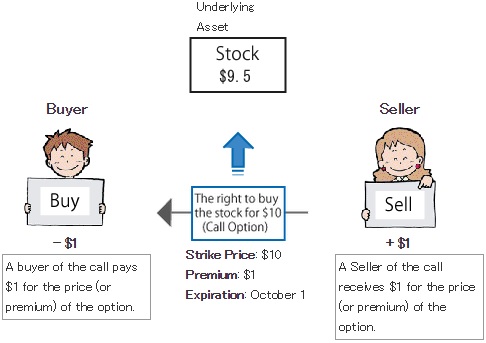

To fully grasp the essence of call and put options, let’s delve into their inner workings. An option contract comprises three fundamental components: the underlying asset, the strike price, and the expiration date. The underlying asset represents the financial instrument upon which the option is based, such as a stock, ETF, or currency pair. The strike price is the price at which you have the right to buy (call option) or sell (put option) the underlying asset. The expiration date marks the final day on which you can exercise your option.

Image: upstox.com

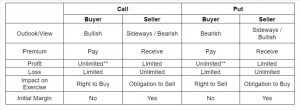

4. Buy vs. Sell: The Options Trading Dance

The options market is a bustling dance floor where two distinct roles emerge: the buyer and the seller. The buyer of an option pays a premium to acquire the right to exercise the contract at the agreed-upon strike price. Conversely, the seller of an option receives the premium and assumes the obligation to fulfill the contract if the buyer chooses to exercise it.

What Does Call And Put Mean In Options Trading

Image: www.option-dojo.com

Conclusion

Understanding the intricacies of call and put options unlocks a gateway to a world of financial opportunities. These versatile instruments empower traders to harness market movements to their advantage, potentially generating substantial returns. However, it’s crucial to approach options trading with caution, meticulously assessing risks and deploying sound investment strategies. The journey into the realm of options trading may be fraught with challenges, but with knowledge as your compass, you can navigate its complexities and emerge victorious.