Introduction:

Image: unygeduc.web.fc2.com

Delving into the world of commodity futures and options can be a thrilling yet daunting experience. One of the most prominent platforms in India for trading commodity derivatives is Multi Commodity Exchange (MCX). If you’re eager to embark on this journey, understanding MCX commodity options trading is crucial. In this comprehensive guide, we will delve into the basics, mechanics, benefits, and strategies involved in navigating this dynamic market. Get ready to expand your knowledge and seize the opportunities presented by MCX commodity options trading.

Understanding Commodity Options

Commodity options are financial contracts that grant the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific quantity of an underlying commodity at a predetermined price on or before a specified date. Unlike futures contracts, the buyer of an options contract is not obligated to exercise their right to buy or sell the commodity. This flexibility offers traders the opportunity to speculate on price movements without the commitment of holding a physical position.

Trading Mechanism on MCX

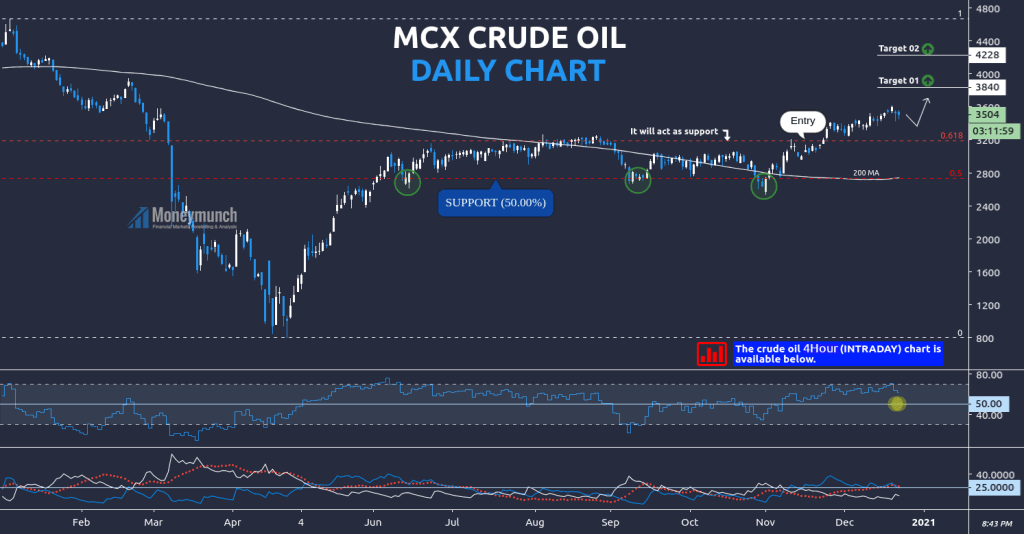

MCX, India’s largest commodity exchange, provides a transparent and standardized platform for trading commodity options. The process involves matching buyers and sellers who are willing to trade at specific prices. The exchange acts as an intermediary, ensuring that trades are executed fairly and efficiently. MCX offers options contracts for various commodities, including bullion (gold and silver), base metals (copper, zinc, and aluminum), energy (crude oil and natural gas), and agricultural products (soybean, corn, and wheat).

Benefits of MCX Commodity Options Trading

– Leverage: Options trading allows traders to gain exposure to underlying commodities with a relatively small investment compared to buying or selling the actual asset. This leverage enables traders to amplify potential returns while also limiting their risk.

– Flexibility: Options contracts provide traders with great flexibility. They can choose from a range of strike prices and expiration dates, enabling them to tailor their strategies to suit their specific market views and risk tolerance.

– Speculation and Hedging: Options trading provides opportunities for speculation, where traders can capitalize on price fluctuations to earn profits. Additionally, it can be used for hedging purposes, allowing market participants to manage risk and protect against potential losses.

Strategies for MCX Commodity Options Trading

– Bull Call Spread: Involves buying an at-the-money (ATM) call option and simultaneously selling an out-of-the-money (OTM) call option with a higher strike price, expecting the underlying commodity’s price to rise.

– Bear Put Spread: Similar to a bull call spread, but instead involves selling an ATM put option and buying an OTM put option with a lower strike price, anticipating a decline in the commodity’s price.

– Long Straddle: Consists of buying both an ATM call and put option with the same strike price and expiration date. This strategy is suitable for traders who predict a significant price move, regardless of direction.

– Short Strangle: The opposite of a long straddle, involving selling both an ATM call and put option with the same strike price and expiration date. This strategy benefits from a sideways or range-bound market movement.

Conclusion:

MCX commodity options trading offers a plethora of opportunities for traders to speculate on price movements and manage risk in the Indian commodity markets. By leveraging its benefits, understanding the trading mechanism, and employing appropriate strategies, traders can enhance their chances of success.

Image: moneymunch.com

Mcx Commodity Options Trading

Image: uk.tradingview.com