Unveiling the Enigma of Trade Grading

As you venture into the dynamic world of option trading, it’s crucial to understand the significance of trade grading. Trade grades, expressed as letters, offer a quick and informative assessment of an option’s performance. By interpreting these grades, you gain invaluable insights into the risk and profitability potential of a trade.

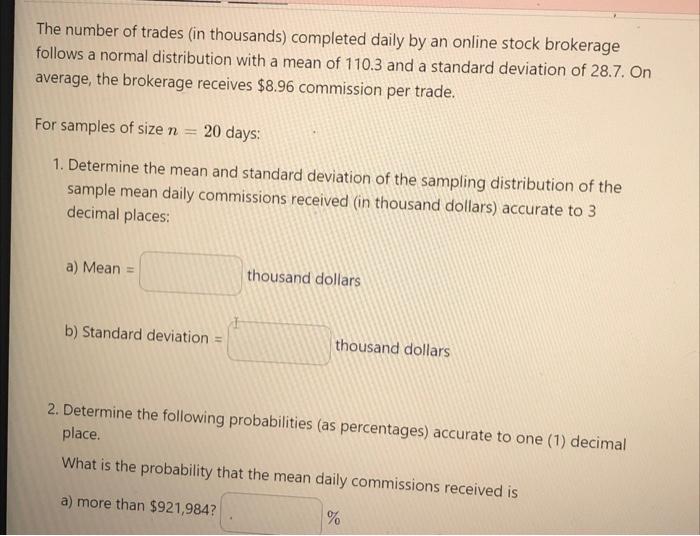

Image: www.chegg.com

Breaking Down Option Value

An option’s value is determined by a complex interplay of several factors, including the underlying asset’s price, time to expiration, volatility, and interest rates. Trade grades simplify this intricate equation by providing a snapshot of the option’s overall value proposition.

The ABCs of Trade Grading

The most common trade grades are A to F, with A representing the highest grade and F indicating the lowest. Each grade corresponds to a specific range of expected profits and losses.

- A and B grades: These grades signify that a trade has a high probability of profitability, indicating a strong likelihood of making a profit if executed according to plan.

- C grade: This neutral grade suggests that a trade’s potential for profit or loss is balanced, resulting in a moderate return.

- D and F grades: These grades indicate that a trade is likely to result in losses if executed. They serve as cautionary signals, prompting further analysis or reconsideration of the trade’s viability.

Expert Guidance for Enhanced Decisions

Seasoned traders often rely on trade grades to augment their decision-making process. Here are a few expert tips to maximize your use of trade grades:

- Understand the context: Trade grades should be evaluated in conjunction with other factors, such as the underlying asset’s historical performance and market conditions.

- Consider your risk tolerance: A trade grade that may be suitable for one trader may not be appropriate for another, depending on their individual risk appetite.

- Don’t rely solely on grades: While trade grades are valuable indicators, they should not be the sole basis for making investment decisions. Conduct thorough research and seek professional advice when necessary.

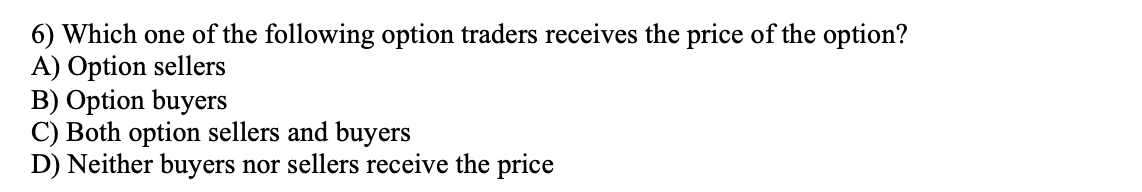

Image: www.chegg.com

FAQs for Enhanced Comprehension

Q: Why are trade grades only letter grades?

A: The use of letters instead of numbers or decimals simplifies their interpretation and allows traders to quickly grasp a trade’s overall quality.

Q: How can I interpret trade grades more effectively?

A: Refer to an option grading system or consult with a financial advisor to understand the specific criteria and thresholds associated with each grade.

Q: Should I always execute trades with higher trade grades?

A: While higher grades generally indicate a favorable risk-reward scenario, it’s essential to consider other factors, such as your personal financial situation and investment objectives.

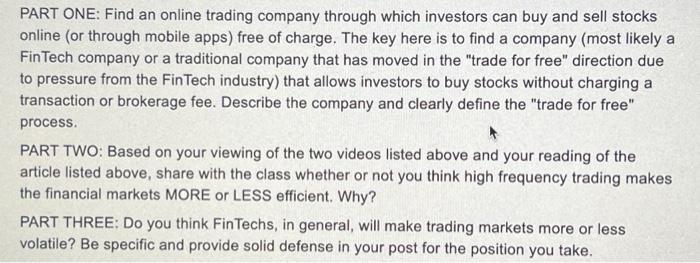

Option Trading What Does The Trade Grade Letter Mean

Image: www.chegg.com

Conclusion

Trade grades are an indispensable tool for option traders, offering valuable insights into a trade’s potential profitability. By understanding the nuances of trade grading and combining it with expert guidance and thorough research, you can make informed decisions and enhance your overall trading performance.

Are you curious to explore other aspects of option trading? Share your thoughts and questions in the comments section below, and let’s delve deeper into the fascinating world of options.