Introduction:

Image: www.happiestpost.com

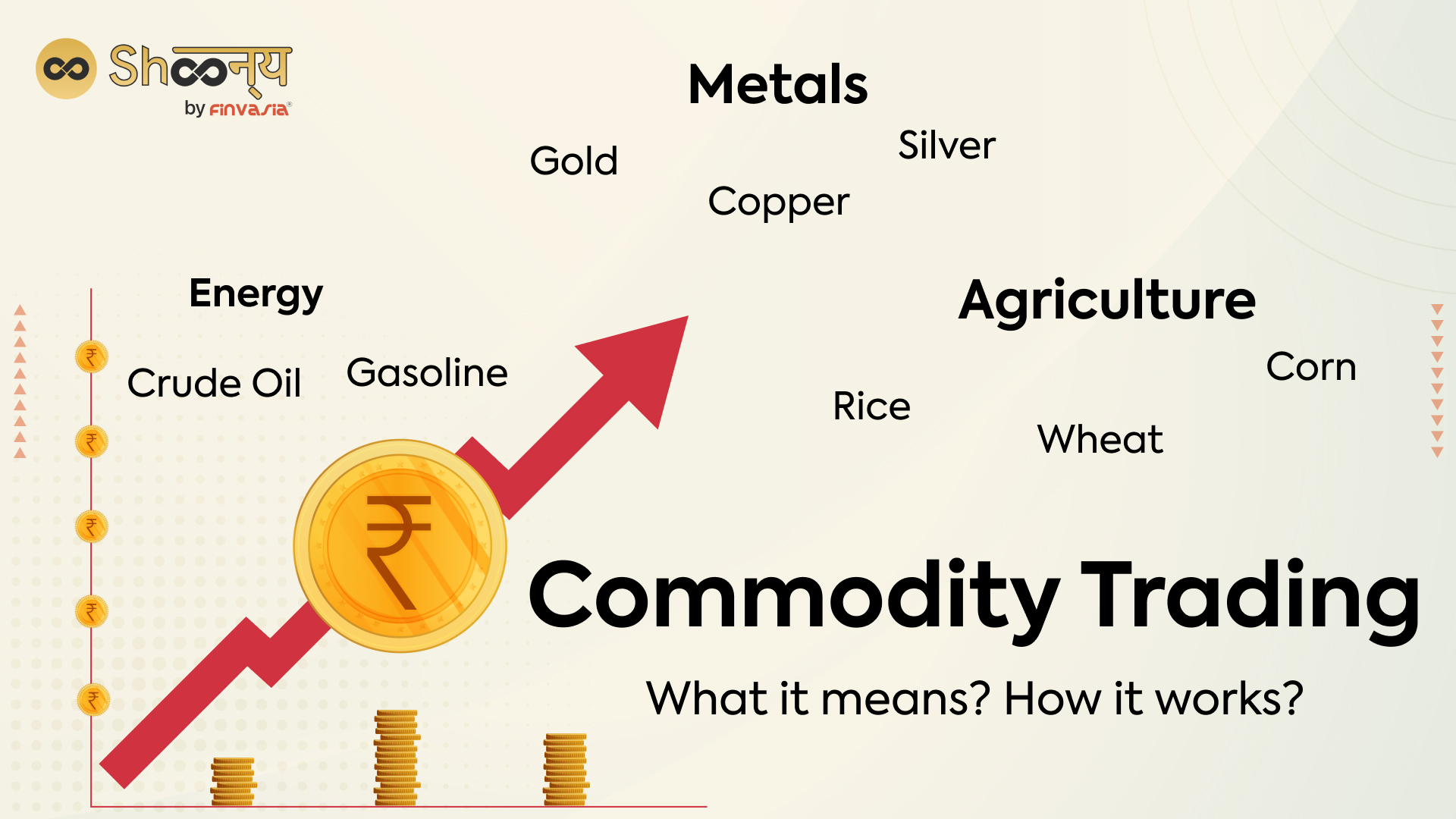

The Indian commodity market has witnessed a surge in activity over the past decade, offering traders diverse investment avenues. Commodity option trading has emerged as a popular way to mitigate risk and speculate on the price movements of underlying commodities. This comprehensive guide will elucidate the intricacies of commodity option trading in India, empowering you with the knowledge to make informed decisions in this dynamic market.

Understanding Commodity Options:

Commodity options are derivative contracts that grant the holder the right, but not the obligation, to buy or sell a specific quantity of an underlying commodity at a predetermined price (strike price) on or before a fixed date (expiration date). These contracts allow traders to participate in the commodity market without the need for physical delivery, offering a more flexible and effective way to manage risk.

Types of Commodity Options:

In India, there are two main types of commodity options: call options and put options. Call options give the holder the right to buy the underlying commodity, while put options provide the right to sell. The price premium, a payment made by the option buyer to the option seller, represents the cost of purchasing the option contract.

Benefits of Commodity Option Trading:

-

Risk Management: Options provide a valuable tool for hedging against price fluctuations in the underlying commodity. Traders can utilize call options to lock in a favorable price for buying the commodity in the future, while put options offer protection against potential losses in case of a price decline.

-

Speculation: Commodity options enable traders to speculate on the price movements of the underlying commodity without the need for physical possession of the asset. By predicting future price trends, traders can profit from favorable price changes.

-

Leverage: Options offer leverage, allowing traders to control a larger position with a relatively small amount of capital compared to buying or selling the underlying commodity directly.

Procedure for Commodity Option Trading:

Trading in commodity options in India is regulated by the Multi Commodity Exchange of India Limited (MCX). To participate in this market, you require a trading account with a registered broker and a demat account to hold the purchased option contracts.

The process involves:

-

Selecting the Underlying Commodity: Choose the commodity you wish to trade options on, based on market research and understanding.

-

Determining the Strike Price: Select a strike price that aligns with your expectations of future price movements.

-

Choosing the Expiration Date: Determine the expiration date that corresponds to your trading strategy.

-

Placing the Order: Submit a buy or sell order, specifying the quantity of options contracts you want to trade.

Strategies for Commodity Option Trading:

-

Covered Call: This strategy involves selling a call option while simultaneously holding a corresponding position in the underlying commodity. It is typically employed to generate additional income or reduce the initial investment.

-

Protective Put: Traders can purchase a put option to protect their long position in a commodity from potential price declines. The premium paid for the put option acts as an insurance premium.

-

Bull Call Spread: This strategy involves buying a higher-priced call option and simultaneously selling a lower-priced call option with the same expiration date. It is designed to benefit from a moderate rise in the underlying commodity price.

-

Bear Put Spread: In this strategy, a trader sells a higher-priced put option and buys a lower-priced put option with the same expiration date. This strategy anticipates a decline in the underlying commodity price.

Conclusion:

Commodity option trading in India provides a flexible and powerful tool for risk management and speculative investment. By understanding the basics, types, and strategies involved, traders can harness the potential of this market to enhance their financial

Image: blog.shoonya.com

Commodity Option Trading In India

Image: www.thehindubusinessline.com