Introduction

Navigating the dynamic world of oil trading can be a complex endeavor. As a seasoned market expert, I have witnessed the nuances of oil futures and options trading firsthand. In this comprehensive guide, I aim to unravel the intricacies of these instrumental financial products, sharing my insights and distilling the latest market trends.

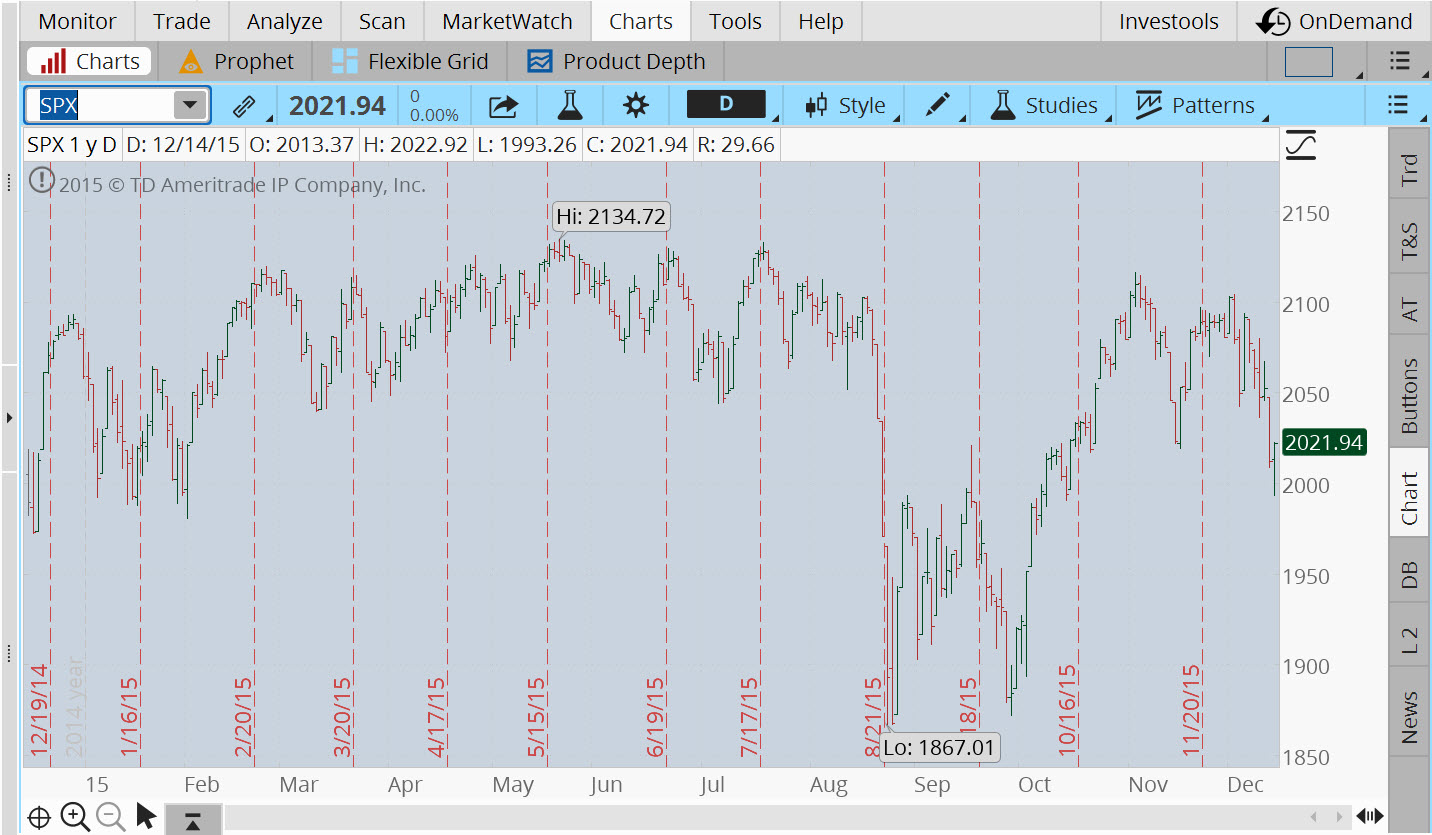

Image: www.sidewaysmarkets.com

As the world’s primary energy source, oil prices have a profound impact on global economies. Futures and options contracts emerge as vital tools for managing risk and profiting from price fluctuations in this volatile market.

Understanding Oil Futures and Options

Futures Contracts

Oil futures contracts are standardized agreements to buy or sell a predetermined quantity of oil at a set price on a future date. They allow traders to lock in a price today, mitigating the uncertainties associated with future price movements.

Options Contracts

Oil options contracts, on the other hand, provide traders with the right, but not the obligation, to buy or sell a specific amount of oil at a specific price on or before a particular date. This flexibility offers traders the potential to capitalize on market moves while limiting their financial risk.

Image: uqyhadet.web.fc2.com

Trading Strategies and Market Analysis

Successfully navigating the oil futures and options market demands a multifaceted approach. Market analysis plays a pivotal role, as it enables traders to identify trends, anticipate price movements, and develop informed trading strategies.

Technical analysis, involving the study of price charts and patterns, can unveil potential trading opportunities. Fundamental analysis, examining supply and demand dynamics, economic indicators, and geopolitical events, provides a broader perspective on market fundamentals.

Latest Trends and Developments

The oil futures and options market is in a state of constant evolution, influenced by technological advancements, environmental concerns, and geopolitical shifts. The proliferation of alternative energy sources and the growing emphasis on sustainability are shaping the industry.

Furthermore, the advent of algorithmic trading and automated execution platforms is transforming trading methodologies, enhancing efficiency, and facilitating faster decision-making. By staying abreast of these trends, traders can adapt their strategies and remain competitive.

Tips and Expert Advice

Based on my experience in the industry, I offer these valuable tips for traders embarking on the oil futures and options market:

- Thoroughly understand the underlying concepts and risks associated with futures and options trading.

- Conduct meticulous market research and technical analysis to identify profitable trading opportunities.

- Implement a disciplined risk management strategy to mitigate potential losses.

- Stay informed about market news and global events that may impact oil prices.

- Consider seeking guidance from experienced traders or industry experts.

By adhering to these principles and continuously honing your knowledge, you can enhance your trading skills and navigate the intricacies of the oil futures and options market with greater confidence.

Frequently Asked Questions

Q: How do I get started with oil futures and options trading?

A: It is essential to open an account with a reputable broker and gain a thorough understanding of the market and trading practices.

Q: What is the difference between a bull market and a bear market in oil?

A: A bull market is characterized by rising oil prices, while a bear market is characterized by falling oil prices.

Q: How can I minimize my risk when trading oil futures and options?

A: Implementing a sound risk management strategy, including position sizing, stop-loss orders, and hedging techniques, is crucial.

Trading In Oil Futures And Options Sally Clubley

Image: www.amazon.com

Conclusion

The world of oil futures and options trading presents both opportunities and challenges to traders. By understanding the fundamental concepts, staying abreast of market trends, and implementing sound trading strategies, you can leverage these financial instruments to navigate market volatility and potentially generate profits.

Whether you are a seasoned trader or just starting out, I encourage you to further explore the depths of oil futures and options trading. Remember, the pursuit of financial success in this dynamic market requires continuous learning, adaptability, and unwavering determination. Are you ready to delve into the exciting world of oil futures and options?