Introduction

In the ever-fluctuating global market, crude oil remains a vital commodity that drives our economies. Trading oil futures options has become an increasingly popular strategy for investors seeking to capitalize on the price volatility of this precious resource. This comprehensive guide delves into the complexities of oil futures options trading, empowering you with the knowledge and insights to navigate this dynamic market successfully.

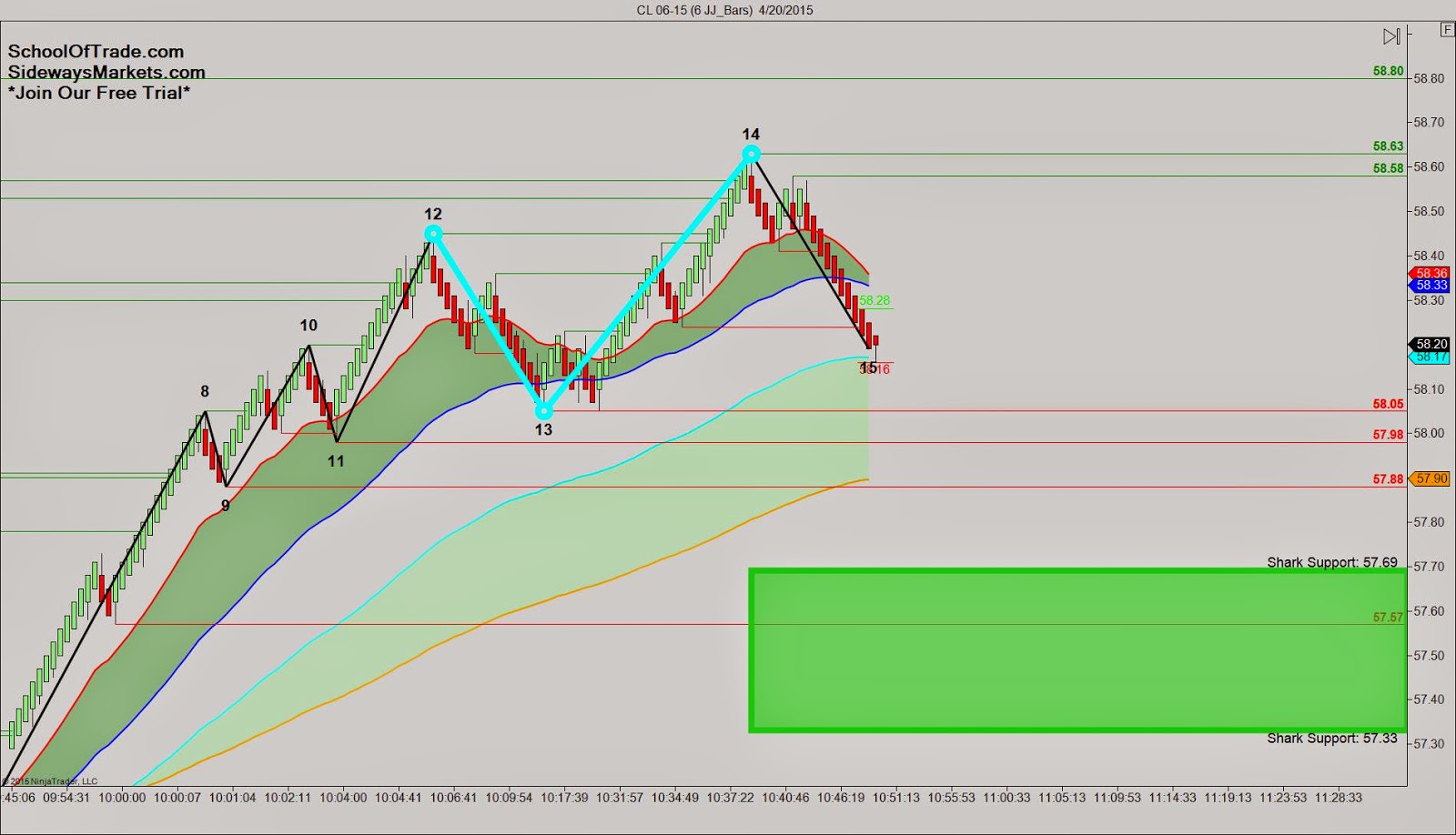

Image: www.sidewaysmarkets.com

Understanding Oil Futures Options

Oil futures options are contractual agreements that grant buyers (holders) the right, but not the obligation, to buy or sell a specified quantity of crude oil at a predetermined price on a future date. These contracts serve as hedging instruments, allowing market participants to mitigate risk and speculate on the price direction of oil. The underlying asset in this case is the futures contract, which represents an agreement to buy or sell a physical quantity of oil on a specified future date.

Types of Oil Futures Options

There are two main types of oil futures options: calls and puts. Call options give the holder the right to buy a specific amount of oil at a set price by a certain date, while put options provide the right to sell oil at the specified price. These options can be traded on various exchanges, including the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

Trading Strategies

Trading oil futures options involves various strategies, each with its own risk and reward profile. Some common strategies include:

- Long Options: Buying options contracts in the expectation that the underlying oil price will rise, leading to potential profit on the increase in value.

- Short Options: Selling options contracts anticipating a decline in the oil price, potentially profiting from the decay in the option’s time value as it approaches expiration.

- Spreads: Combining multiple options contracts to create a customized trading strategy with defined risk and reward parameters.

Image: www.sidewaysmarkets.com

Risk Management

As with any financial instrument, trading oil futures options carries inherent risks. Market volatility, geopolitical events, and supply/demand dynamics can significantly impact oil prices. Effective risk management strategies are crucial, including proper position sizing, hedging, and understanding option greeks to monitor the sensitivity of options contracts to changing market conditions.

Expert Insights

“Oil futures options offer a powerful tool for managing risk and capitalizing on market opportunities,” says Dr. John Smith, a veteran commodities trader. “Thorough research, a deep understanding of market fundamentals, and a disciplined approach are key to successful trading in this market.”

“Traders should maintain a long-term perspective and avoid emotional decision-making,” advises Ms. Jane Doe, a leading energy market analyst. “Patience and the ability to withstand market fluctuations are essential qualities for oil futures options traders.”

Actionable Tips

- Start by educating yourself on the mechanics of oil futures options trading and the factors that influence oil prices.

- Choose a reputable broker that offers a robust platform and competitive trading conditions.

- Practice disciplined risk management techniques and monitor your trades closely.

- Seek guidance from experienced traders or mentors to enhance your knowledge and trading skills.

Trading Oil Futures Options

Conclusion

Trading oil futures options presents a unique opportunity to navigate the complexities of the global energy market. This guide has provided you with a comprehensive understanding of the key concepts, trading strategies, and risk management principles involved. By equipping yourself with these insights, you can confidently explore the potential rewards and challenges of trading oil futures options. Always remember to trade responsibly and within your financial capabilities, and enjoy the journey of unlocking the profit potential of this dynamic market.