Introduction

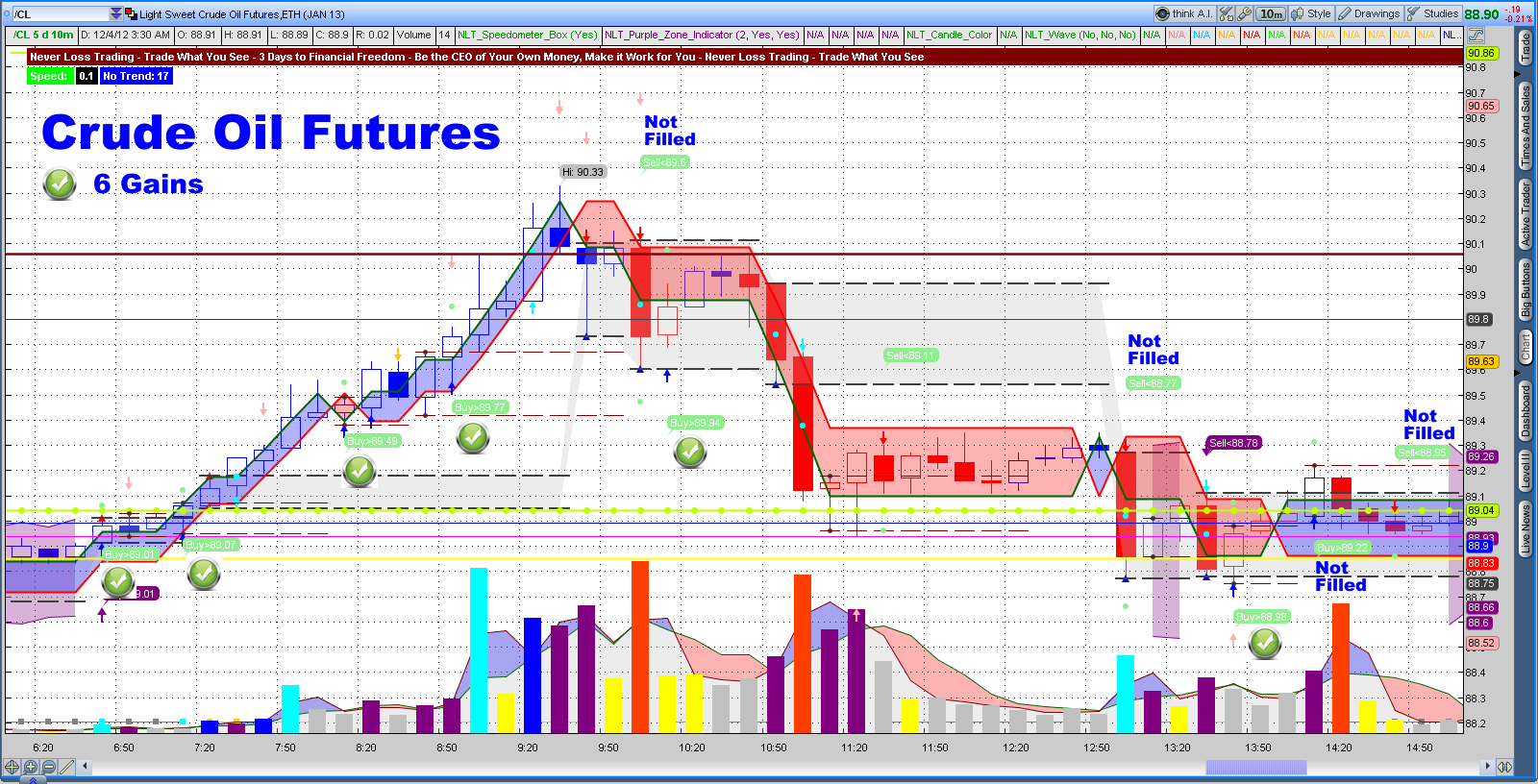

Image: seboxinero.web.fc2.com

In the ever-volatile energy market, the dance of crude oil holds immense financial sway. As investors seek to navigate the complexities of this dynamic landscape, trading crude oil futures options has emerged as a powerful tool. This intricate form of investing offers a unique blend of risk and reward, providing opportunities for savvy traders to harness market knowledge and maximize gains.

Delve into this comprehensive article, where we unveil the intricate world of trading crude oil futures options. We’ll equip you with a profound understanding of foundational concepts, empower you with expert insights, and guide you towards maximizing your trading potential.

Delving into the Realm of Crude Oil Futures Options

Crude oil futures options, rooted in the futures market, are financial contracts that grant traders the right, but not the obligation, to buy or sell a specified quantity of crude oil at a predetermined price on a future date. These contracts play a pivotal role in mitigating risk, speculating on price fluctuations, and reaping potential profits.

Grasping the Fundamentals

To navigate the realm of crude oil futures options, a firm understanding of core concepts is paramount. The contract size, typically 1,000 barrels for crude oil, determines the scale of the underlying transaction. The expiration date designates the day on which the contract expires, influencing its value and strategic implications.

Premiums, the price paid to acquire an option contract, embody the potential profit or loss. Call options grant the buyer the right to purchase at a predetermined price, and their premium reflects the market’s expectations of future price increases. Conversely, put options bestow the right to sell, with their premium mirroring anticipated price declines.

Mastering the Mechanics of Futures Options Trading

Trading crude oil futures options demands an intimate understanding of market dynamics and strategic execution. Buying a futures option grants the trader the flexibility to exercise it on the expiration date, or prior to it, to secure profit or mitigate losses. Alternatively, options can be sold to generate income or hedge against existing positions.

Unearthing Expert Insights

Navigating the complexities of crude oil futures options trading can be enhanced by tapping into the wisdom of seasoned experts. They emphasize the significance of thorough research, risk management, and a nuanced understanding of market sentiment.

Furthermore, recognizing the impact of geopolitical events, economic indicators, and supply-demand dynamics is essential for informed trading decisions. By embracing these expert insights, you’ll elevate your trading prowess and increase the probability of successful outcomes.

Harnessing Actionable Trading Strategies

Empower yourself with these practical trading strategies that have proven their mettle in the crude oil futures options market:

-

Trend following: Capitalize on market momentum by aligning trades with prevailing price trends.

-

Range trading: Profit from price fluctuations within defined ranges, buying at support levels and selling at resistance levels.

-

Volatility trading: Exploit periods of market volatility by purchasing options that benefit from price swings.

Conclusion

The realm of trading crude oil futures options offers a fertile ground for astute investors seeking financial growth. By delving into the intricacies of this instrument, understanding market dynamics, and harnessing expert insights, you’ll equip yourself with the knowledge and strategies to navigate market complexities with confidence.

Remember, successful trading demands a disciplined approach, constant learning, and the ability to adapt to the ever-evolving market landscape. Embrace the power of crude oil futures options, and unlock your potential as a discerning and profitable investor.

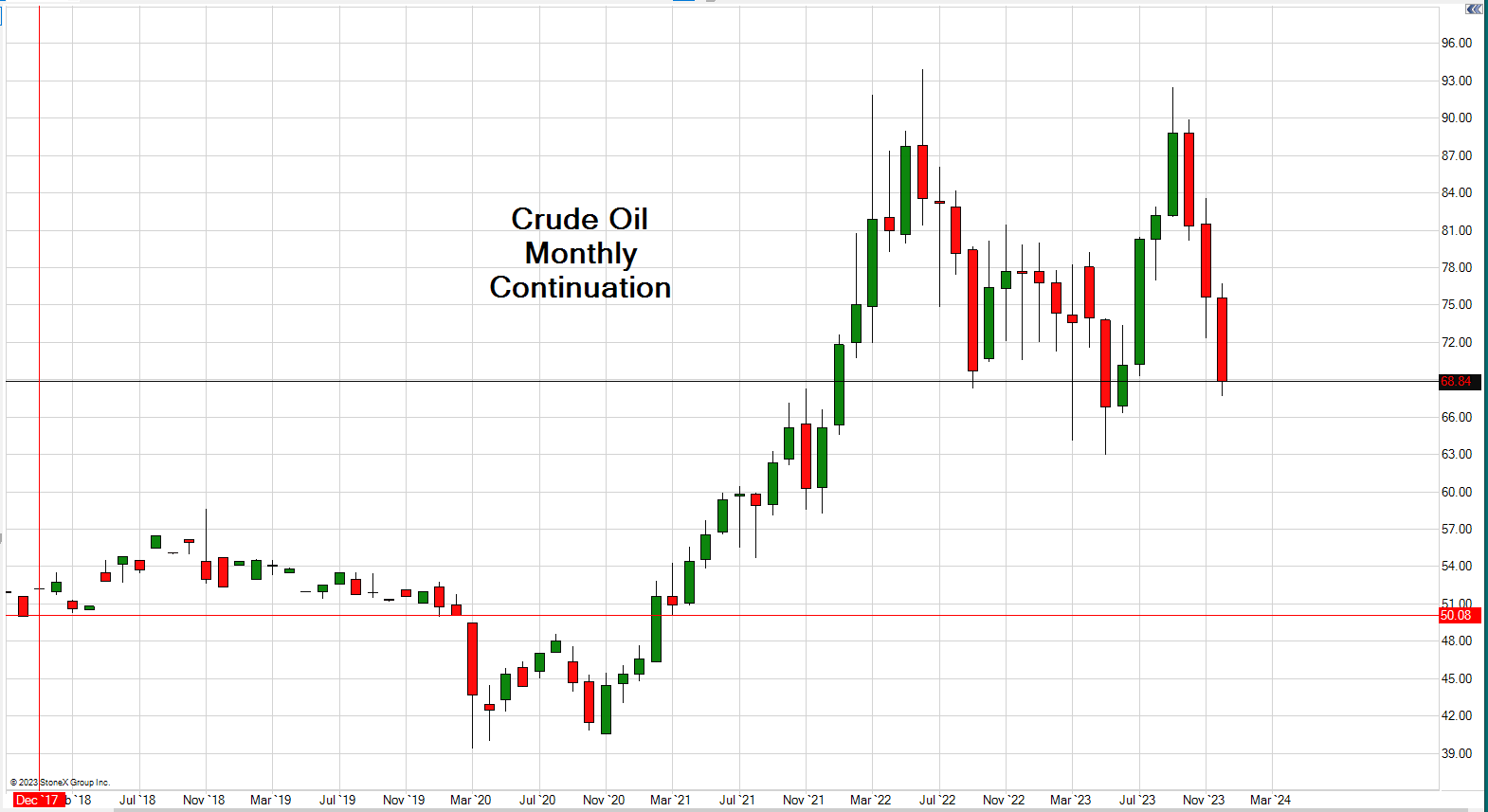

Image: www.sidewaysmarkets.com

Trading Crude Oil Futures Options

Image: s3.amazonaws.com