Introduction

In the labyrinthine world of financial markets, where every second counts, understanding the intricacies of trading hours is paramount. Crude oil futures options, a financial instrument that grants the buyer the right (but not the obligation) to buy or sell a specified quantity of crude oil at a predetermined price on a future date, is no exception. This article delves into the nuances of crude oil futures options trading hours, empowering traders with the knowledge to navigate these time-sensitive markets effectively.

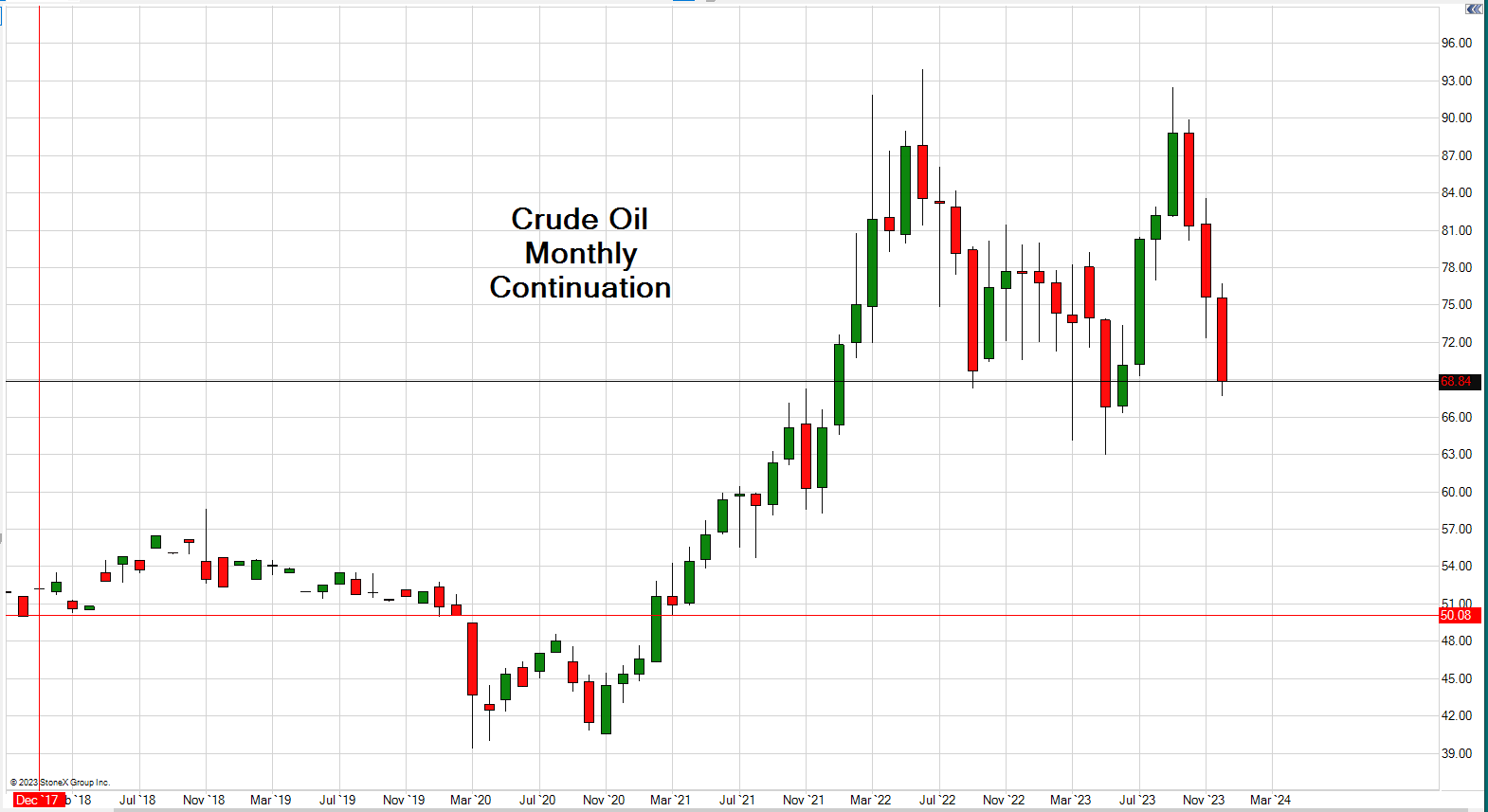

Image: s3.amazonaws.com

Understanding Crude Oil Futures Options

Crude oil futures options are financial derivatives that provide a way for market participants to manage the price risk associated with crude oil purchases or sales. They are traded on futures exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE). The contracts specify the grade of crude oil to be bought or sold, the quantity, the delivery month, and the strike price (the price at which the buyer can exercise the option).

Trading Hours

Crude oil futures options trading hours vary depending on the exchange and the specific contract being traded. However, they generally follow a consistent schedule to facilitate efficient trading. The NYMEX, for example, offers trading hours for crude oil futures options from Sunday evening to Friday afternoon, with specific times allocated for pre-opening and post-closing trading sessions.

Regular Trading Hours

The primary trading hours for crude oil futures options typically fall within the following timeframes:

- Sunday: 6:00 PM ET to 5:00 PM ET (pre-opening)

- Monday-Friday: 7:00 AM ET to 1:00 PM ET (regular trading)

- Monday-Friday: 2:00 PM ET to 5:00 PM ET (post-closing)

Image: www.sidewaysmarkets.com

Pre-Opening and Post-Closing Sessions

The pre-opening and post-closing trading sessions offer traders additional flexibility to adjust their positions outside the regular trading hours. These sessions allow for order entry and execution, but trading volume and liquidity may be lower compared to regular trading hours.

Trading Halts

In rare circumstances, trading in crude oil futures options may be halted due to unforeseen events, such as natural disasters or market volatility. These halts are typically brief and serve to protect market participants from extreme price movements.

Impact of Trading Hours

The trading hours of crude oil futures options have several implications for traders:

- Market volatility: Trading hours coincide with periods of heightened market activity, such as during the release of economic data or political events. This can lead to increased volatility and price fluctuations.

- Spread risk: The limited trading hours make it crucial for traders to manage their spread risk (the difference between the bid and ask prices) effectively.

- Order execution: Traders need to place their orders within the available trading hours to ensure timely execution.

Crude Oil Futures Options Trading Hours

Image: www.youtube.com

Conclusion

Mastering the trading hours of crude oil futures options is essential for successful navigation of these time-sensitive markets. By understanding the regular trading hours, pre-opening and post-closing sessions, and potential trading halts, traders can optimize their strategies, manage risk, and capture opportunities in this dynamic and influential sector of the financial markets. Remember to consult the relevant exchange websites for the most up-to-date trading hour information and to always conduct thorough research before making any investment decisions.