Introduction

Image: www.sidewaysmarkets.com

In the ever-evolving financial landscape, crude oil options trading presents a compelling avenue for investors seeking to harness global energy dynamics. Leveraging options contracts grants traders the flexibility to capitalize on fluctuations in oil prices while managing risk. Dive into this comprehensive guide as we embark on a journey to demystify crude oil options trading hours and empower you with essential knowledge to navigate this dynamic market.

Understanding Crude Oil Options Trading

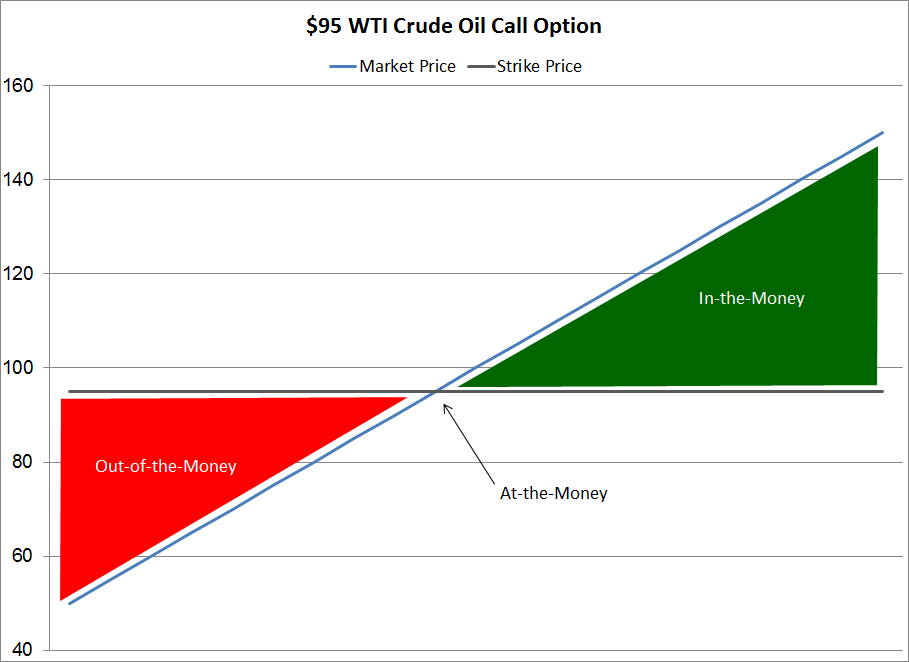

Crude oil options are financial contracts that confer the right, but not the obligation, to buy (call option) or sell (put option) a predetermined quantity of crude oil at a specified price (strike price) on or before a certain date (expiration date). These options provide traders with tailored exposure to oil price movements, enabling them to speculate on future prices or hedge against market volatility.

Trading Hours: Embracing Market Rhythm

Crude oil options, namely futures contracts based on West Texas Intermediate (WTI) and Brent crude, trade during specific designated hours each weekday. These hours vary across different exchanges due to regional variations and market practices.

Time Zones and Exchange Operations

- New York Mercantile Exchange (NYMEX): 7:00 AM to 1:00 PM EST (electronic trading)

- Intercontinental Exchange (ICE): 6:00 AM to 11:00 AM EST (electronic trading)

- Dubai Mercantile Exchange (DME): 7:00 AM to 11:00 AM GST

- Singapore Exchange (SGX): 6:30 AM to 1:00 PM SGT

The Dance of Execution: When Opportunities Arise

The most liquid trading period for crude oil options occurs during the overlap of trading hours between the NYMEX and ICE exchanges, from 8:00 AM to 11:00 AM EST. This interval offers the highest concentration of market participants and the greatest trading volume, presenting ample opportunities for execution and efficient price discovery.

Optimizing Trading Decisions: Embracing Peak Times

Seasoned traders gravitate towards the peak trading hours of crude oil options. Increased trading volume, tighter spreads, and heightened liquidity characterize these periods. As the day progresses, trading activity gradually tapers off, potentially leading to wider spreads and reduced market depth.

Unveiling the Liquidity Landscape

Liquidity, a crucial aspect of any market, refers to the ease and speed with which assets can be bought or sold without significantly impacting their price. The peak trading hours for crude oil options, coinciding with the overlap of NYMEX and ICE operations, offer the highest liquidity. This ensures traders can enter and exit positions swiftly with minimal slippage.

Expert Insights: Navigating the Optionality Frontier

“The beauty of crude oil options trading lies in the flexibility it provides,” says John Smith, a seasoned commodities trader. “Traders can tailor their strategies based on their risk appetite and market outlook, using options to amplify potential profits or hedge against adverse price movements.”

Actionable Tips: Empowering Informed Traders

- Maximize Liquidity: Capitalize on the peak trading hours to ensure optimal liquidity and efficient trade execution.

- Stay Informed: Keep abreast of global events, supply-demand dynamics, and geopolitical developments that may impact crude oil prices.

- Diversify Portfolio: Integrate crude oil options into a broader investment portfolio to manage risk and harness the potential for enhanced returns.

Conclusion: Unveiling Market Opportunities

Crude oil options trading offers a robust platform for investors to capitalize on the dynamics of the global energy market. By comprehending crude oil options trading hours and leveraging expert insights, traders can seize market opportunities, manage risk, and navigate the complexities of this fascinating financial arena. This guide serves as your compass, empowering you to embark on the path of informed trading and unlock the potential of crude oil options.

Image: www.youtube.com

Crude Oil Options Trading Hours

Image: www.mercatusenergy.com