In the labyrinth of financial markets, the allure of crude oil futures and options has captured the imagination of traders seeking both profit and portfolio diversification. These instruments offer a unique opportunity to capitalize on the fluctuations of the global energy landscape. This comprehensive guide will delve into the intricacies of trading in oil futures and options, empowering you with a crude strategy for optimizing your investments.

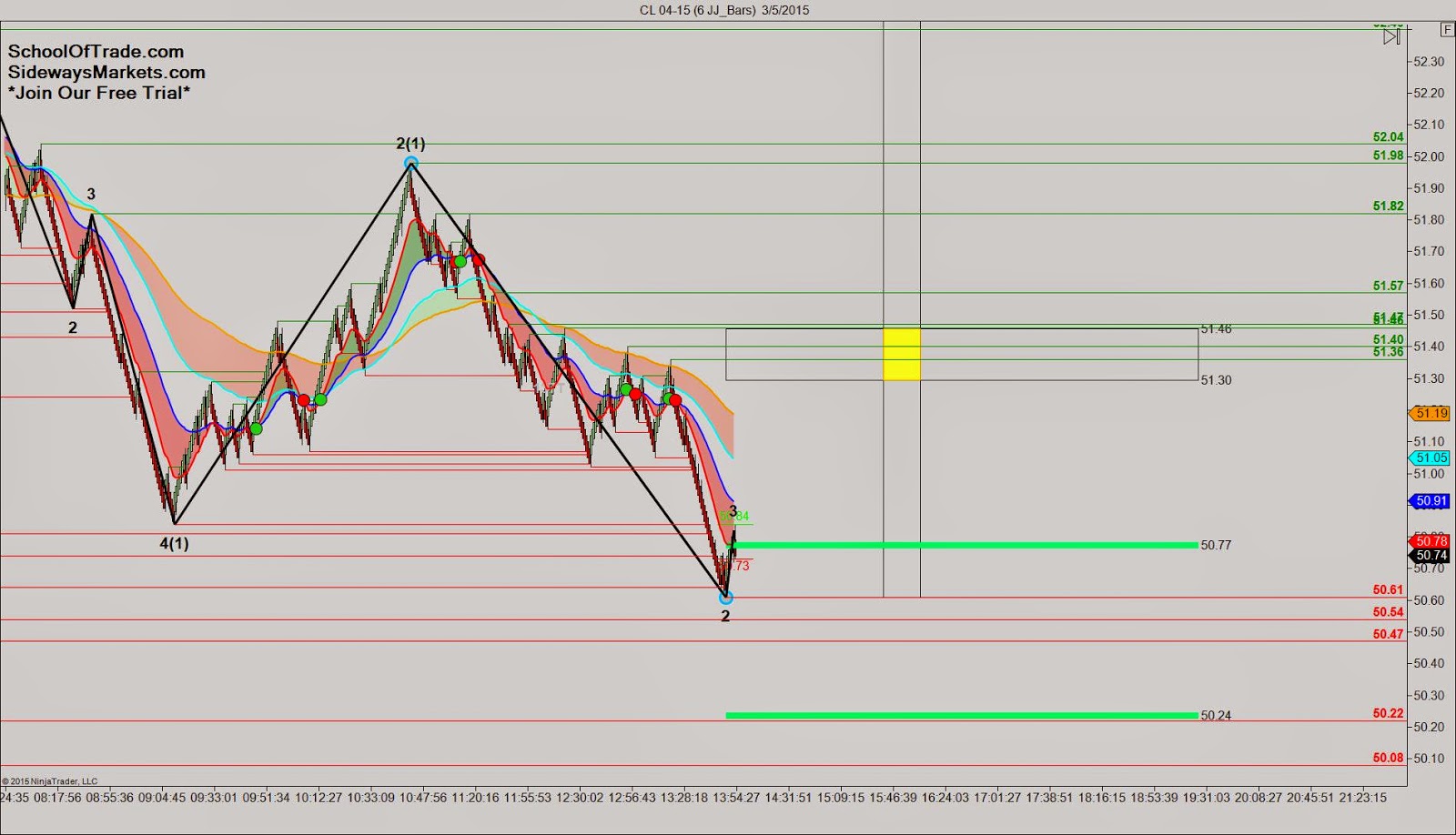

Image: www.sidewaysmarkets.com

Futures and Options: The Foundation of Oil Trading

Oil futures contracts are agreements to buy or sell a specified quantity of crude oil at a predetermined price and date in the future. By trading futures, investors can hedge against price risk or speculate on future price movements. Options, on the other hand, grant the holder the right, but not the obligation, to buy or sell oil at a specific price on or before a certain date. This versatility makes options a valuable tool for managing risk and capturing opportunities in the volatile oil market.

Understanding the Forces that Drive Oil Prices

The price of oil is influenced by a complex interplay of global economic factors, geopolitical events, and supply and demand dynamics. Key factors to consider include:

- Economic Growth: Growing economies typically increase demand for oil, pushing prices higher.

- Political Instability: Disruptions in oil production or supply routes due to geopolitical tensions can also drive price increases.

- Supply and Demand: Fluctuations in oil production and consumption can significantly impact prices, making supply and demand management crucial.

Trading Strategies for Oil Futures and Options

Traders employ a range of strategies to maximize returns in oil futures and options trading. Some common approaches include:

- Hedging: Using futures or options to reduce exposure to price volatility.

- Trading Trends: Identifying and capitalizing on long-term price trends in oil.

- Scalping: Trading on short-term price movements within a single day.

- Spread Trading: Buying and selling assets simultaneously to reduce risk and enhance returns.

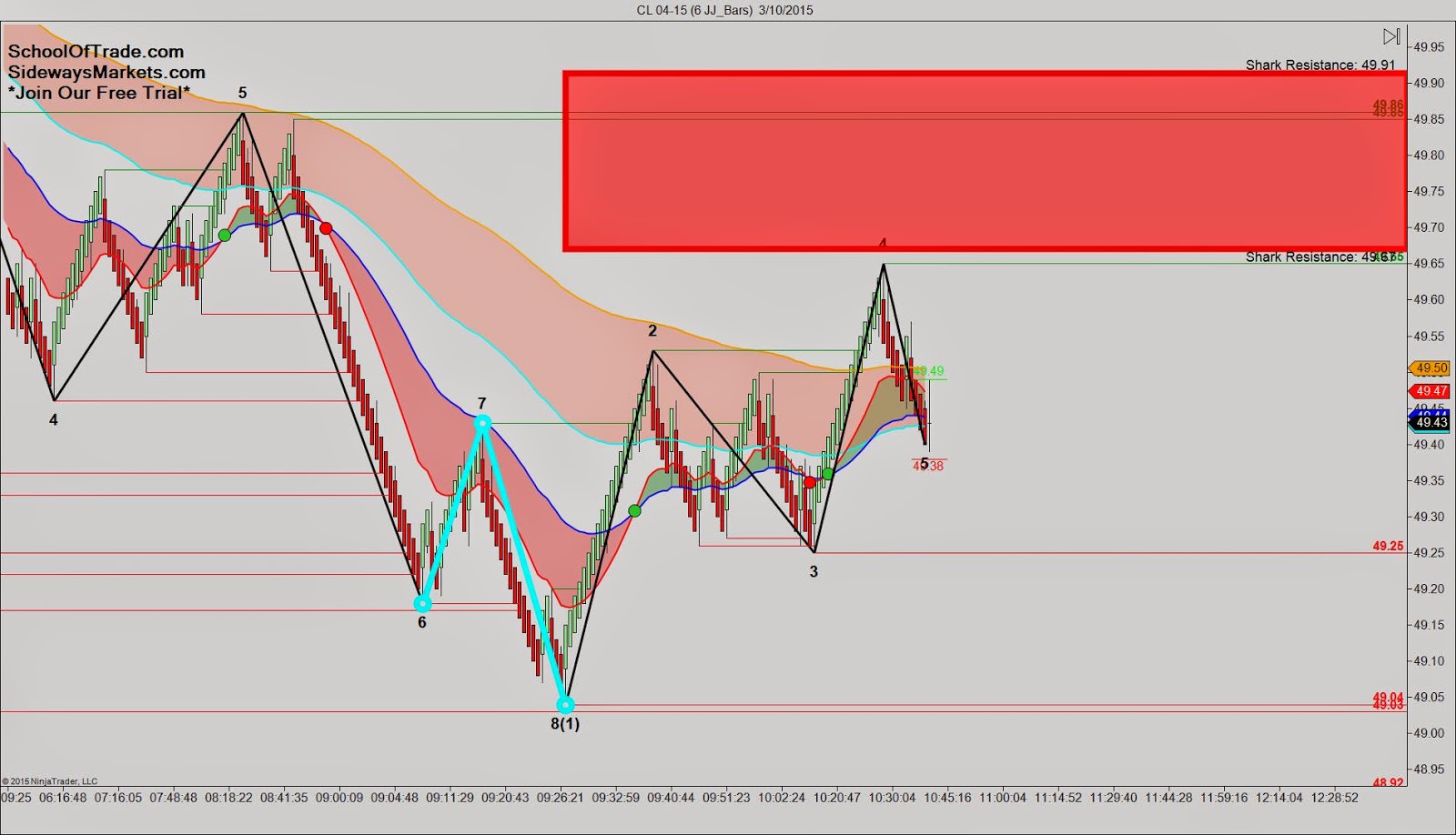

Image: www.sidewaysmarkets.com

Risk Management in Oil Futures and Options

Effective risk management is paramount in oil futures and options trading. Considerations include:

- Margin Requirements: Traders must maintain sufficient funds to cover potential losses.

- Position Sizing: Limiting the size of trades relative to available capital.

- Hedging Strategies: Employing strategies to reduce exposure to unfavorable price movements.

- Monitoring Market Conditions: Continuously assessing market conditions and adjusting trading strategies accordingly.

Leveraging the Power of Brokers

Choosing the right broker is essential for successful oil futures and options trading. Factors to consider include:

- Reputation: Selecting a reputable and well-established broker with a proven track record.

- Fees and Commissions: Comparing trading costs to minimize expenses.

- Trading Platform: Ensuring the platform offers advanced features and intuitive functionality.

- Customer Support: Seeking prompt and knowledgeable customer support when needed.

Trading In Oil Futures And Options Crude Strategy

Image: xelenew.web.fc2.com

Conclusion

Trading in oil futures and options offers a unique path to capitalize on the energy market while mitigating risks. By understanding the underlying principles, employing effective trading strategies, and leveraging the power of brokers, investors can harness the allure of crude oil for financial success. Remember to approach trading with a disciplined and informed mindset, and seek professional guidance if necessary. The journey to mastery in the realm of oil investments begins with this exploration of trading in oil futures and options.