As the world grapples with volatile energy markets, understanding the intricate nuances of oil trading becomes crucial. Sally Clubley, a renowned expert in commodities, offers a comprehensive strategy to navigate the complex world of oil futures and options. Join us as we delve into Sally Clubley’s crude strategy, empowering you with the knowledge to make informed decisions in the dynamic oil market.

Image: pmnewsnigeria.com

Understanding Oil Futures and Options

Futures and options are financial instruments that allow investors to trade oil contracts for future delivery at a predetermined price. Futures contracts are standardized agreements to buy or sell a fixed amount of oil on a specific future date, while options grant the holder the right but not the obligation to buy or sell oil at a set price. These instruments provide investors with flexibility and risk management tools in the often-unpredictable oil market.

The Sally Clubley Crude Strategy

Sally Clubley’s crude strategy revolves around a deep understanding of supply and demand fundamentals, combined with technical analysis and risk management techniques. She emphasizes the importance of thoroughly researching market conditions, including global economic indicators, geopolitical events, and inventory data. By analyzing market supply and demand dynamics, investors can identify potential trading opportunities and make informed decisions.

Technical analysis plays a significant role in Sally Clubley’s strategy. She utilizes chart patterns, moving averages, and other technical indicators to predict price movements and identify potential entry and exit points for trades. By recognizing historical trends and market behavior, investors can enhance their trading accuracy.

Risk management lies at the heart of Sally Clubley’s approach. She employs strict risk-reward parameters, setting stop-loss and take-profit orders to limit potential losses and lock in gains. Understanding one’s risk appetite and implementing effective risk management strategies is paramount in successful oil trading.

Expert Insights and Actionable Tips

“Timing is everything in commodities trading,” says Sally Clubley. “Traders should constantly monitor market conditions and be prepared to adjust their positions accordingly.”

“Don’t overtrade,” she cautions. “It’s essential to avoid the temptation of excessive trading, which can lead to emotional decision-making and potentially costly mistakes.”

“Stay updated on global events,” she advises. “Geopolitical events can significantly impact oil prices. Keep abreast of international news and potential disruptions to supply chains.”

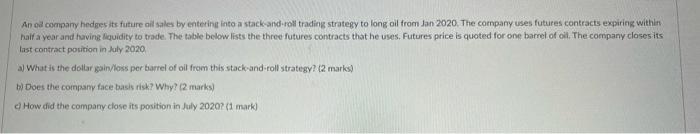

Image: www.chegg.com

Trading In Oil Futures And Options Sally Clubley Crude Strategy

Image: tickertape.tdameritrade.com

Conclusion

Trading in oil futures and options requires a comprehensive understanding of market dynamics, technical analysis, and risk management. By embracing Sally Clubley’s crude strategy, investors can gain invaluable insights and make informed decisions. Remember to trade with discipline, manage risks judiciously, and seek knowledge continuously to navigate the complexities of the oil market effectively.