Introduction

Options trading, a sophisticated investment strategy, involves purchasing contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Understanding the tax implications of options trading is crucial to navigate market dynamics effectively. This article delves into the complexities of options taxation, providing a comprehensive overview to empower informed decision-making.

Image: www.personalfinanceclub.com

Taxation of Options Premiums

When you purchase an option contract, you pay a premium to the seller. This premium represents the price you are willing to pay for the right to buy or sell the underlying asset. The premium amount is subject to taxation as ordinary income in the year it is paid. For example, if you purchase an option contract with a premium of $1,000, you will owe taxes on that $1,000 as ordinary income.

Taxation of Options Gains

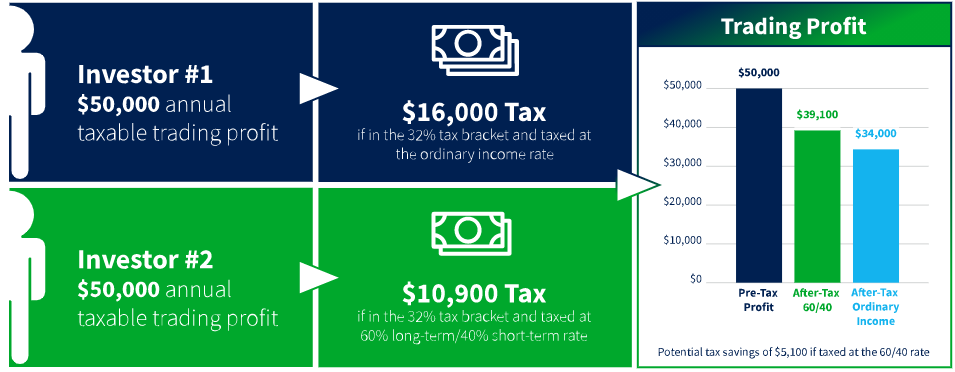

When you exercise an option and purchase or sell the underlying asset, any profit you make is subject to capital gains tax. The tax rate you pay on options gains depends on how long you held the option contract before exercising it.

- Short-term capital gains: If you hold the option contract for less than one year before exercising it, the profit is taxed as short-term capital gains. Short-term capital gains are taxed at the same rate as your ordinary income.

- Long-term capital gains: If you hold the option contract for more than one year before exercising it, the profit is taxed as long-term capital gains. Long-term capital gains are taxed at a lower rate than ordinary income.

Taxation of Options Losses

If you exercise an option and incur a loss, you can deduct the loss from your taxable income. Option losses are treated as capital losses. Short-term capital losses can be deducted from short-term capital gains, while long-term capital losses can be deducted from long-term capital gains.

Image: c1.bats.com

Wash Sale Rules

The wash sale rule prevents you from claiming a tax loss on an option contract if you purchase substantially identical options within 30 days before or after the sale. If you violate the wash sale rule, your loss on the original sale will be disallowed.

Specific Identification

When selling option contracts, you can choose which contracts to sell through a process called specific identification. This allows you to control the tax consequences of your sales. For example, you may want to sell option contracts that will generate long-term capital gains rather than short-term capital gains.

Tax Reporting

Option traders are required to report their gains and losses on Schedule D of their tax return. Form 6781, Gains and Losses from Section 1256 Contracts and Straddles, is also used to report certain types of option transactions.

Do You Get Taxed On Options Trading

Image: www.youtube.com

Conclusion

Understanding the tax implications of options trading is essential for minimizing your tax burden and maximizing your investment returns. By considering the various tax treatments of options premiums, gains, losses, and specific identification, you can navigate the complexities of options taxation and make informed decisions that align with your financial goals. Remember to consult with a tax professional for personalized guidance and to stay up-to-date on the latest tax laws and regulations.