Introduction

Options trading, a financial instrument that allows investors to speculate on the price movements of underlying assets, has gained immense popularity in recent years. However, understanding the tax implications of such transactions is crucial for maximizing returns and avoiding penalties. This article delves into the intricacies of options taxation, providing a comprehensive guide for informed decision-making. We will explore the tax rates applicable to different types of options, as well as the strategies used to minimize tax liability.

Image: platformaxxi.org

Options Basics

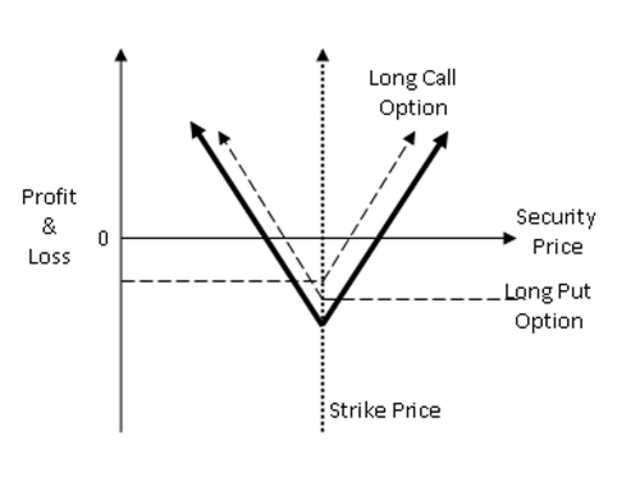

Options contracts represent a buyer’s option to buy (call option) or sell (put option) an underlying asset at a specified price within a certain period. These contracts involve two parties: the buyer, who pays a premium to the seller, and the seller, who is obligated to fulfill the contract if the buyer exercises their option.

Taxation of Options Premiums

When the buyer purchases an options contract, the premium paid is generally considered a capital expense and is subject to capital gains tax upon the sale of the contract. Short-term capital gains tax rates apply to premiums held for less than one year, while long-term capital gains tax rates apply to premiums held for one year or longer.

Taxation of Options Gains

The treatment of options gains depends on whether the contract was exercised or not. If the contract is exercised, the resulting gain or loss is treated as a capital gain or loss and is taxed accordingly. However, if the contract is sold before exercise, the gain or loss is treated as a premium gain or loss and is subject to capital gains tax rates.

Image: libraryoftrader.net

Section 1256 Contracts

Certain types of options contracts, known as Section 1256 contracts, receive special tax treatment. These contracts include equity options, index options, and options on futures. Gains and losses from Section 1256 contracts are taxed at a maximum rate of 60% long-term capital gains tax and 40% short-term capital gains tax.

Wash Sale Rule

The wash sale rule prohibits taxpayers from selling a security at a loss and purchasing the same security within 30 days. If the wash sale rule applies, any losses realized on the sale are disallowed and added to the cost basis of the newly acquired security. This rule also applies to options contracts.

Tax Strategies for Options Traders

Minimizing tax liability is essential for maximizing returns. Several strategies can be employed, including:

- Holding Options Long-Term: Long-term capital gains tax rates are generally lower than short-term rates. Holding options for at least one year can save on taxes.

- Utilizing Section 1256 Contracts: Trading Section 1256 contracts provides more favorable tax treatment compared to non-Section 1256 contracts.

- Selling Covered Calls: Selling covered calls involves selling call options on stocks you already own. The premiums you receive can offset any potential losses from the underlying stock.

- Tax-Loss Harvesting: Selling losing options contracts before the end of the tax year can generate capital losses, which can be used to offset capital gains from other investments.

How Much Tax Do You Pay On Options Trading

Image: www.livemint.com

Conclusion

Understanding the tax implications of options trading is crucial for making wise investment decisions. This article has provided a comprehensive overview of the tax rates and strategies applicable to options transactions. By carefully considering these factors, traders can minimize tax liability, maximize returns, and achieve their financial goals. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.