Are you interested in learning about FX options trading basics? If so, you’re in the right place, as this article will begin by providing a comprehensive overview of FX options trading, including its definition, history, and significance. Afterward, we’ll delve into the specifics of FX options trading, explaining various types of FX options and their uses. Finally, we’ll wrap up with some expert advice to help you get started with FX options trading.

Image: planbtutor.com

What is FX Options Trading?

FX options trading involves the buying and selling of options contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of foreign currency (currencies not native to the country where the trade is being executed) at a predetermined exchange rate on or before a certain date. These contracts are typically traded over-the-counter (OTC) between two parties, known as the buyer and seller of the option. Unlike futures contracts, FX options offer traders flexibility and the potential for profit, making them an attractive choice for many investors.

Understanding FX Options Basics

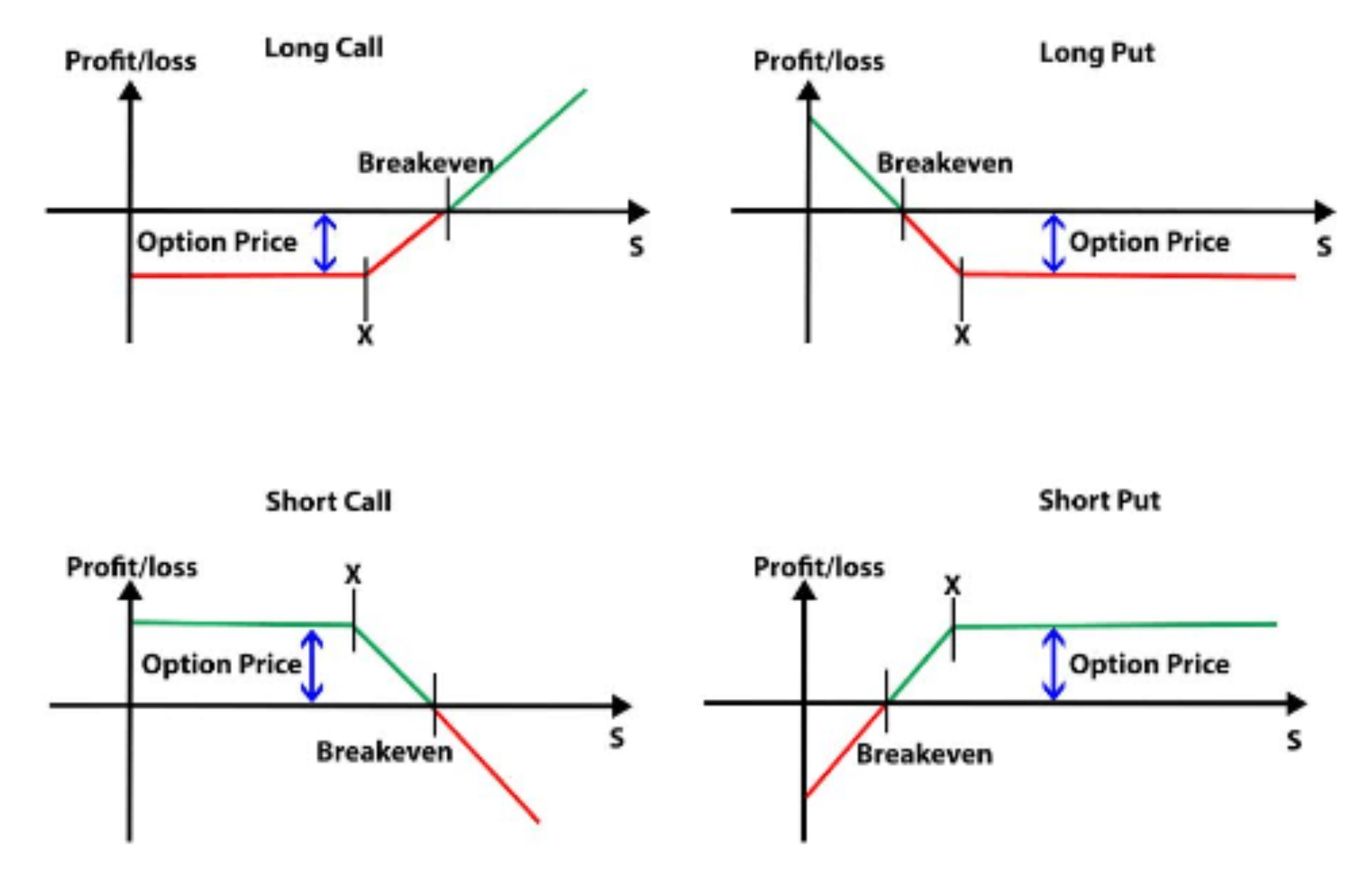

In FX options trading, the buyer of an option pays a premium to the seller of the option in exchange for the right to buy or sell the specified amount of foreign currency at a predetermined exchange rate and on or before a certain date. There are two main types of FX options:

- Call options:

- Put options:

Give the buyer the right to buy a specified amount of foreign currency at the predetermined exchange rate on or before the specified date.

Give the buyer the right to sell a specified amount of foreign currency at the predetermined exchange rate on or before the specified date.

The buyer of the FX option has the right, but not the obligation, to exercise their option. If the option is not exercised, the premium paid by the buyer to the seller is forfeited. However, the option seller is obligated to buy (in the case of a call option) or sell (in the case of a put option) the foreign currency if the buyer exercises their option.

Benefits of FX Options Trading

There are several benefits to FX options trading, including:

- Flexibility: The significant advantage FX options offer is flexibility. Traders gain the flexibility to execute trades at the right time for them. Because of the non-obligatory nature of FX options, traders can take advantage of market conditions without forcing a position on themselves.

- Capital efficiency: When compared to outright forwards, FX options allow for more efficient capital usage. This results from only requiring a small amount of capital, the option premium, to control a more significant underlying value.

- Potential for profit: FX options have the potential to generate significant profits. If a trader predicts correctly, they can profit from favorable movements in the underlying currency pair. The profit potential is arguably what entices most people to take part in FX options trading.

Image: tme.net

Fx Options Trading Basics

Image: getbinaryoptionsaccount.logdown.com

Conclusion

FX options trading can be a complex but rewarding endeavor. By understanding the basics of FX options trading and using expert advice, you can increase your chances of success in this dynamic market. If you are interested in learning more about FX options trading, you should conduct further research and consult with a financial professional.