Introduction

Embarking on the realm of options trading can be exhilarating yet daunting for those seeking academic insight. As a budding financial enthusiast, my journey began with a modest comprehension of options trading fundamentals, a foundation that propelled me to explore the complexities within this dynamic market. Today, I am eager to impart upon you the knowledge acquired through my academic pursuits, offering a comprehensive guide to options trading basics.

Image: optionalpha.com

Understanding Options Trading: A Definition

In the tapestry of financial instruments, options serve as contracts granting the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility empowers traders to speculate on future price movements or hedge against potential risks, making options an integral part of modern financial markets.

History and Significance

The origins of options trading can be traced back to ancient Greece, where merchants used forward contracts to mitigate price fluctuations in grain. Fast forward to the 17th century, Amsterdam became the epicenter of options trading, with markets dedicated to the trading of tulips and other commodities. Over the years, options evolved into standardized contracts traded on exchanges, providing a regulated framework for market participants. Today, options trading is a global phenomenon, encompassing a vast array of underlying assets, from stocks and indices to currencies and commodities.

Delving into Options Types

The options universe comprises two primary types: calls and puts. Call options grant the holder the right to buy the underlying asset, while put options confer the right to sell. Each option contract specifies the following key components:

- Strike Price: The predetermined price at which the holder can buy or sell the underlying asset.

- Expiration Date: The date upon which the option contract expires, rendering it worthless.

- Premium: The price paid by the option buyer to the option seller for the right to exercise the contract.

Image: ar.inspiredpencil.com

Intrinsic and Extrinsic Value

Options possess both intrinsic and extrinsic value. Intrinsic value represents the difference between the strike price and the current market price of the underlying asset. Extrinsic value, on the other hand, encapsulates all other factors influencing the option’s price, including time remaining until expiration, volatility, and market sentiment.

Options Trading Basics Courses Academic

Image: stoxbox.in

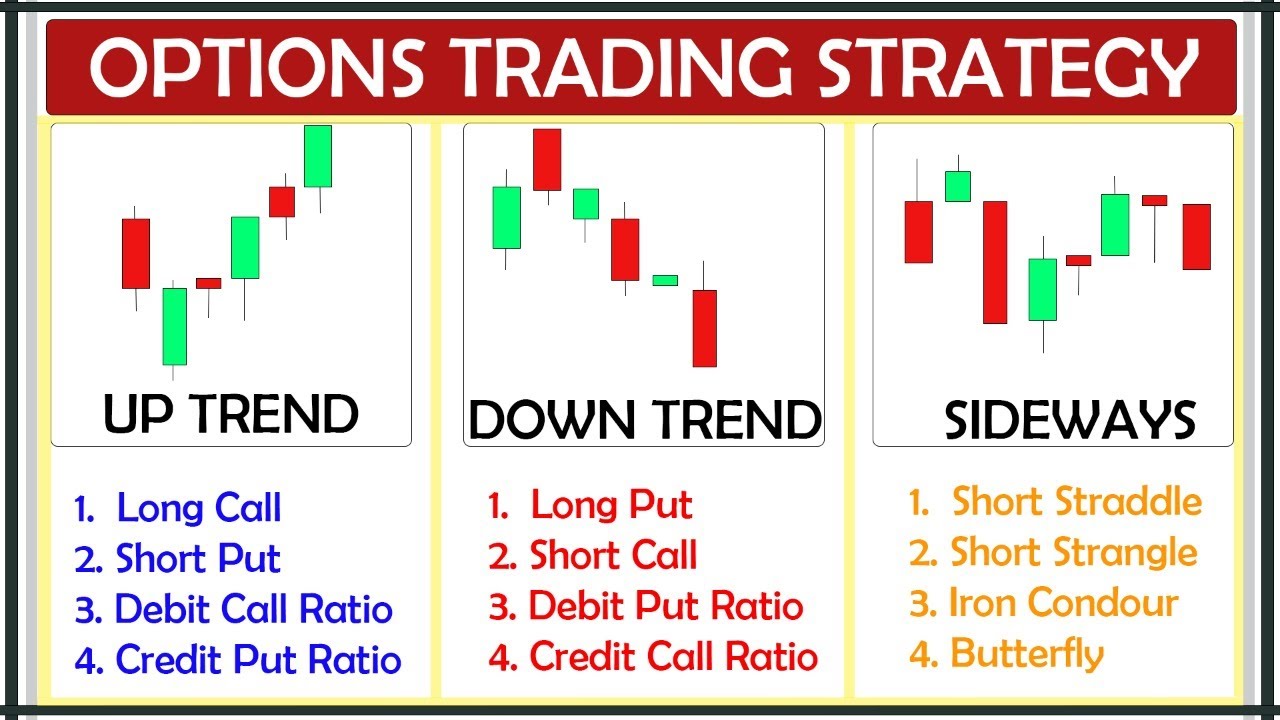

Strategies and Techniques

The versatility of options trading offers a wide array of strategies, each tailored to specific market conditions and investor goals. Some of the most prevalent strategies include:

- Bullish Strategies: Seeking to profit from a rise in the underlying asset’s price, including buying call options or selling put options.

- Bearish Strategies: Aiming to capitalize on a decline in the underlying asset’s price, such as selling call options or buying put options.

- Neutral Strategies: Employing a combination of bull