Introduction

The world of options trading can be a daunting place for beginners, but it can also be a lucrative one. Options are a powerful tool that can help you make money in the stock market, but they can also be risky. That’s why it’s important to understand the basics of options trading before you get started.

Image: www.fool.com

In this article, we’ll give you a comprehensive overview of options trading. We’ll start with the basics, including what options are and how they work. Then, we’ll discuss the different types of options and the strategies you can use to trade them. Finally, we’ll provide you with some tips and expert advice to help you get started in options trading.

What are options?

An option is a contract that gives you the right to buy or sell an underlying asset at a specified price on a specified date. The underlying asset can be a stock, a bond, a commodity, or an index. The price at which you can buy or sell the asset is called the strike price. The date on which you can exercise the option is called the expiration date.

There are two types of options: calls and puts.

- Calls give you the right to buy the underlying asset at the strike price.

- Puts give you the right to sell the underlying asset at the strike price.

How to use options trading?

There are many different ways to use options trading to make money. Some of the most common strategies include:

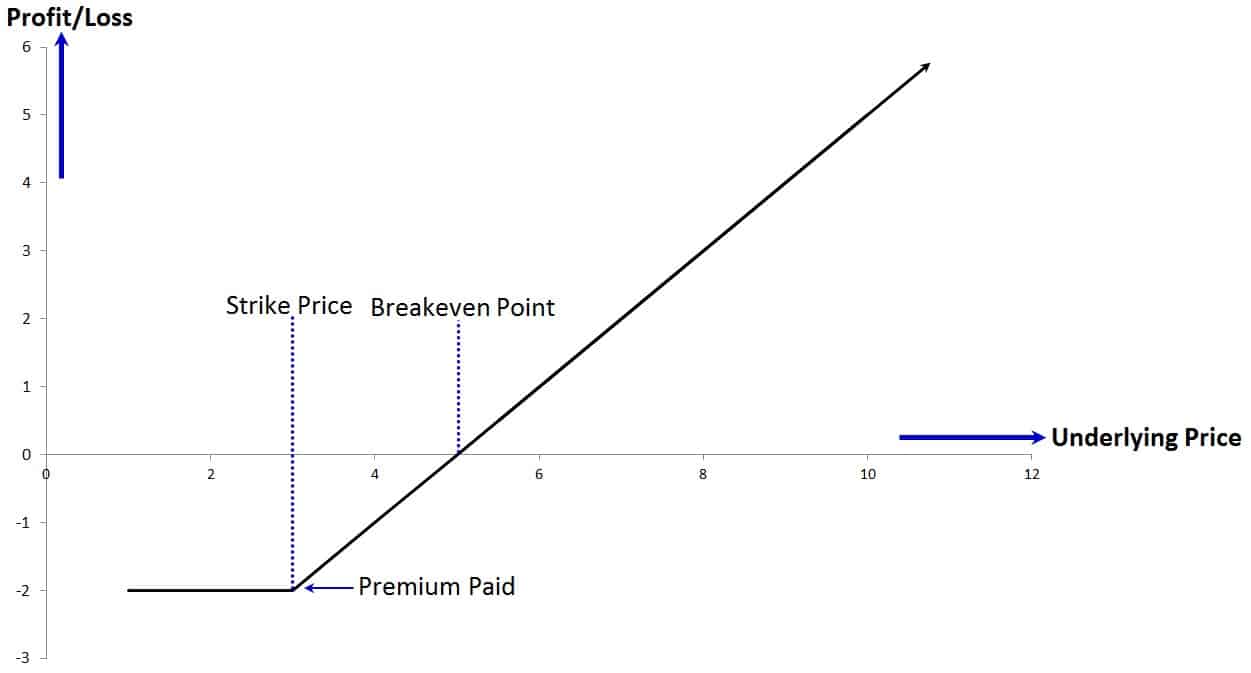

- Buying calls: Buying a call option gives you the right to buy the underlying asset at the strike price. If the price of the asset increases above the strike price, you can profit by selling the option.

- Selling calls: Selling a call option gives you the obligation to sell the underlying asset at the strike price if the buyer exercises the option. If the price of the asset decreases below the strike price, you can profit by keeping the premium you received from selling the option.

- Buying puts: Buying a put option gives you the right to sell the underlying asset at the strike price. If the price of the asset decreases below the strike price, you can profit by selling the option.

- Selling puts: Selling a put option gives you the obligation to buy the underlying asset at the strike price if the buyer exercises the option. If the price of the asset increases above the strike price, you can profit by keeping the premium you received from selling the option.

Conclusion

Options trading can be a powerful tool for making money in the stock market, but it’s important to understand the risks involved before you get started. By following the tips and advice in this article, you can increase your chances of success in options trading. Are you interested in learning more about options trading?

Image: www.netpicks.com

Options Trading Pics

Image: tradingtuitions.com

FAQ

Q: What are the risks of options trading?

A: The risks of options trading include the possibility of losing your entire investment. The value of options can fluctuate rapidly, and it’s possible for the value of an option to become worthless.

Q: How do I get started with options trading?

A: To get started with options trading, you’ll need to open an account with a broker that offers options trading. Once you have an account, you can start trading options by following the steps outlined in this article.

Q: What are some tips for successful options trading?

A: Some tips for successful options trading include understanding the risks involved, trading with a plan, and managing your risk. It’s also important to stay up-to-date on market news and trends, and to be patient and disciplined in your trading.