Introduction: Navigator through the Nifty Options Labyrinth

In the bustling landscape of the Indian stock market, Nifty options have emerged as a powerful tool for astute traders seeking to amplify their profits. My fascination with these financial instruments began when I stumbled upon an extraordinary story of transformation: an unassuming employee, leveraging the nuances of Nifty options trading, metamorphosed into a financial wizard. Intrigued, I embarked on a quest to unravel the intricacies of this sophisticated trading strategy, eager to empower others with the same path to financial success.

Image: optionstradingiq.com

Navigating the Enigma of Nifty Options Trading

Nifty options, deeply intertwined with the Nifty 50 index, provide traders with immense flexibility to capitalize on market oscillations. These derivative contracts confer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on a specific date (expiry date). Mastering this terrain requires an adept understanding of market trends, volatility, and risk management principles.

Fundamentals of Nifty Options Trading: Unraveling the Basics

Understanding the Anatomy of an Options Contract

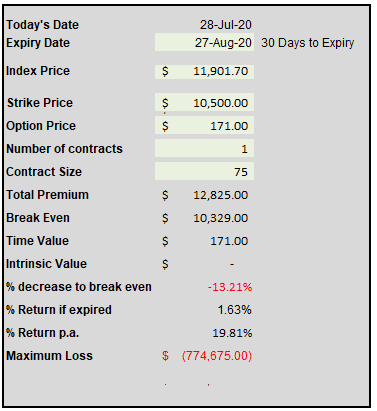

Each Nifty options contract represents 75 shares of the underlying Nifty 50 index. When a trader initiates a call option, they anticipate an upsurge in the index value, granting them the right to purchase the specified quantity of shares at the strike price on or before the contract’s expiration. Conversely, a put option conveys the right to sell the shares at the strike price should the index value decline.

Factors Impacting Option Premiums: Deciphering the Price Signal

The premium associated with an options contract, indicating its cost, serves as a crucial indicator of market sentiment. Several factors influence premium pricing, including time to expiration, volatility, interest rates, and market supply and demand. Traders must carefully evaluate these dynamics to make informed trading decisions.

Charting the Market Landscape: A Comprehensive Overview

Historical Evolution and Significance: Tracing the Nifty Options Journey

Nifty options trading has undergone a remarkable evolution since its inception in 2000. Initially reserved for institutional investors, the advent of online trading platforms has democratized access to these powerful instruments. Today, individual traders can harness the immense potential of Nifty options to amplify their investment returns.

Market Volatility: Embracing the Dance of Risk and Reward

Market volatility, a measure of price fluctuations, plays a pivotal role in options trading. Increased volatility translates into higher option premiums, as traders are willing to pay more for the potential to protect against or capitalize on price movements. Understanding and managing volatility is key to successful options trading.

Empowering Traders: Tips and Expert Insights

Mastering the Art of Trading Nifty Options: Essential Tips

– **Diligent Research and Market Analysis:** Thoroughly research market trends, volatility patterns, and underlying index performance before making any trades.

– **Smart Strike Price Selection:** Carefully choose strike prices that align with your market outlook and risk tolerance.

– **Expiration Date Strategy:** Select appropriate expiration dates that provide sufficient time for your trading objectives to materialize while minimizing the impact of time decay.

Professional Insights from Seasoned Traders: Unlocking the Secrets

– **Embrace Risk Management:** Implement robust risk management strategies to mitigate potential losses.

– **Leverage Technical Analysis:** Study technical indicators and chart patterns to identify trading opportunities.

– **Monitor Portfolio Performance:** Regularly review your trading activity and make adjustments to optimize profitability and manage risk.

Image: www.angelone.in

FAQs: Empowering Traders with Clarity

Q: What is the difference between a call and a put option?

A: A call option grants the right to buy the underlying asset, while a put option confers the right to sell.

Q: How do I determine the profitability of an options trade?

A: Subtract the premium paid from the profit or loss on the underlying asset.

Q: What are the key risks associated with options trading?

A: Unlimited loss potential, time decay, and volatility risk.

Trading Nifty Options

Conclusion: Unveiling the Path to Success

Nifty options trading presents a fertile ground for investors seeking augmented returns in the Indian stock market. By embracing a comprehensive understanding of market dynamics, implementing sound trading strategies, and adopting a disciplined approach to risk management, traders can harness the immense potential of Nifty options. Whether you’re a seasoned pro or a novice entering the arena, the world of options trading beckons you to embark on an enriching journey towards financial empowerment.

Are You Ready to Conquer the Nifty Options Market?