Options trading is a great way to increase your income potential, but it can also be daunting if you’re new to the game. Don’t worry, this article will give you everything you need to know to get started trading options for $1,000.

Image: marketbusinessnews.com

In this article, we’ll cover the basics of options trading, including what they are, how they work, and the different types of options available. We’ll also provide you with some tips on how to choose the right options for your trading strategy. So whether you’re a complete beginner or you’re just looking to brush up on your knowledge, this article is for you.

What Are Options?

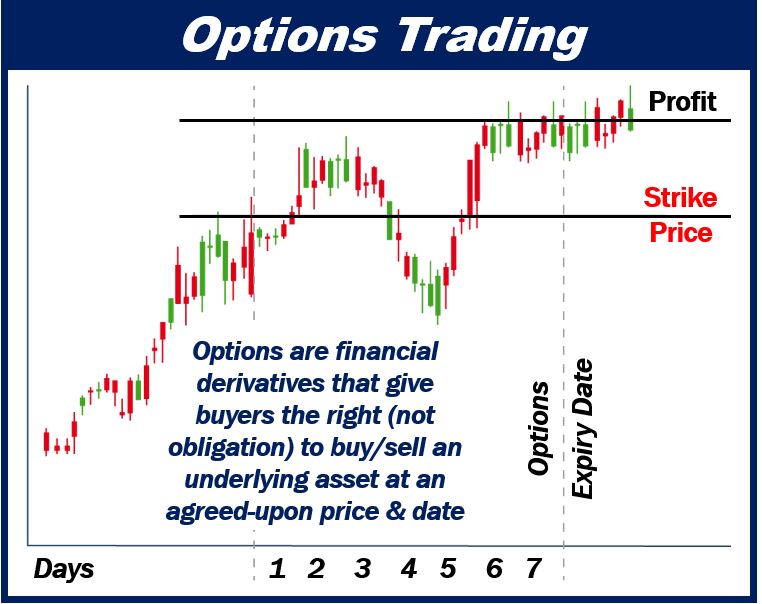

Options are financial contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a certain price on or before a certain date. This gives you the flexibility to profit from price movements in the underlying asset without having to buy or sell it outright.

There are two main types of options: calls and puts. Call options give you the right to buy the underlying asset, while put options give you the right to sell it. Each type of option has its own set of risks and rewards, so it’s important to understand how they work before you start trading.

How Do Options Work?

When you buy an option, you’re paying for the right to buy or sell the underlying asset at a certain price on or before a certain date. The price you pay for the option is called the premium.

If the price of the underlying asset moves in your favor, you can profit from your option. However, if the price moves against you, you can lose the premium you paid for the option.

The Different Types of Options

There are a variety of different types of options available to investors. Some of the most common include:

- Calls: Call options give you the right to buy the underlying asset at a certain price on or before a certain date.

- Puts: Put options give you the right to sell the underlying asset at a certain price on or before a certain date.

- American options: American options can be exercised at any time up until their expiration date.

- European options: European options can only be exercised on their expiration date.

Image: www.youtube.com

How to Choose the Right Options for Your Trading Strategy

When choosing options, there are a few things you need to consider.

- The underlying asset: What underlying asset do you want to trade options on? The most popular underlying assets for options traders include stocks, indices, commodities, and currencies.

- The strike price: The strike price is the price at which you can buy or sell the underlying asset. When choosing a strike price, you need to consider the current price of the underlying asset and how you expect the price to move.

- The expiration date: The expiration date is the date on which your option expires. When choosing an expiration date, you need to consider how long you want to have the option to buy or sell the underlying asset.

Tips on How to Get Started Trading Options

If you’re new to options trading, there are a few things you can do to get started.

- Learn the basics: Before you start trading options, it’s important to learn the basics of how they work. There are a number of resources available online and from your brokerage firm.

- Start with a small account: It’s a good idea to start trading options with a small account so that you can learn the ropes without risking too much money.

- Use a practice account: Many brokerages offer practice accounts that you can use to test your trading strategies before you start trading with real money.

- Don’t trade options on margin: Trading options on margin can magnify your potential profits, but it can also magnify your losses. It’s best to avoid trading options on margin until you have some experience.

Expert Advice for Options Traders

Here are a few expert tips for options traders.

- Focus on the right things: When trading options, it’s important to focus on the right things. This includes things like the underlying asset, the strike price, and the expiration date.

- Be patient: Options trading can be a profitable way to invest, but it’s important to be patient. It takes time to learn how to trade options successfully.

- Don’t get discouraged: Even the most experienced options traders lose money from time to time. Don’t get discouraged if you lose money on a trade. Learn from your mistakes and move on.

- Consult with a financial advisor: If you’re not sure how to get started trading options, you can consult with a financial advisor. A financial advisor can help you create a trading plan and choose the right options for your investment goals.

FAQs on Options Trading

Here are some of the most frequently asked questions about options trading.

- What is the difference between a call option and a put option?

A call option gives you the right to buy the underlying asset at a certain price on or before a certain date. A put option gives you the right to sell the underlying asset at a certain price on or before a certain date. - What is a strike price?

The strike price is the price at which you can buy or sell the underlying asset. - What is an expiration date?

The expiration date is the date on which your option expires. - How do I profit from options trading?

You can profit from options trading by buying options that increase in value or by selling options that decrease in value. - What are the risks of options trading?

The risks of options trading include losing the premium you paid for the option or losing more money than you invested.

Get Started Trading Options For 1000

Image: www.redfox-trading.com

Conclusion

Options trading can be a great way to increase your income potential, but it’s important to understand the risks involved. Before you start trading options, it’s important to learn the basics and develop a trading plan. You can also consult with a financial advisor to help you get started.

If you’re already trading options, I encourage you to share your tips and advice in the comments below. And be sure to check out our other articles on options trading for more information.

Are you interested in learning more about options trading? Let me know in the comments below!