In the competitive world of options trading, effective risk management strategies are paramount for long-term success. One such strategy that has gained popularity among traders is the trailing stop strategy. This innovative approach dynamically adjusts stop-loss orders as the market moves in a favorable direction, allowing traders to lock in profits while limiting potential losses.

Image: mediodiablodigital.com

Understanding Trailing Stops: A Flexible Risk Mitigation Tool

Trailing stops are not static stop-loss orders but rather dynamic ones that move with the price of the underlying asset. They are typically set a certain percentage or dollar amount away from the current market price, ensuring that a position is liquidated only when the price moves unfavorably beyond a tolerable threshold.

Advantages of Trailing Stops: Enhanced Risk Management and Profit Potential

Traders employ trailing stops for several compelling reasons. Firstly, they help mitigate losses by automatically exiting a position when the price falls below a predefined level. This prevents traders from holding losing positions indefinitely and incurring excessive losses. Secondly, trailing stops enhance profit potential by allowing traders to ride out positive price movements and capture additional gains. As the underlying asset appreciates, the trailing stop moves upward, preserving profits and minimizing the risk of profit erosion.

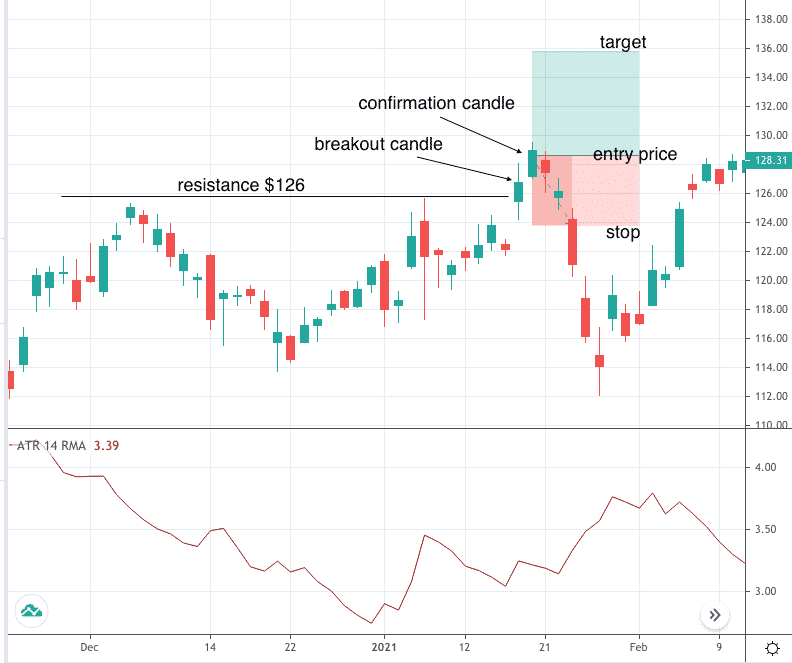

Implementing Trailing Stops: Setting Parameters and Considerations

Implementing a trailing stop strategy involves establishing clear parameters. Traders must determine the percentage or dollar amount by which the trailing stop will adjust, known as the “trailing percentage” or “trailing amount.” This choice depends on individual risk tolerance and the volatility of the underlying asset. Additionally, traders need to consider the type of order to use for the trailing stop, such as a stop-loss or stop-limit order, each with its own advantages and disadvantages.

Image: www.youtube.com

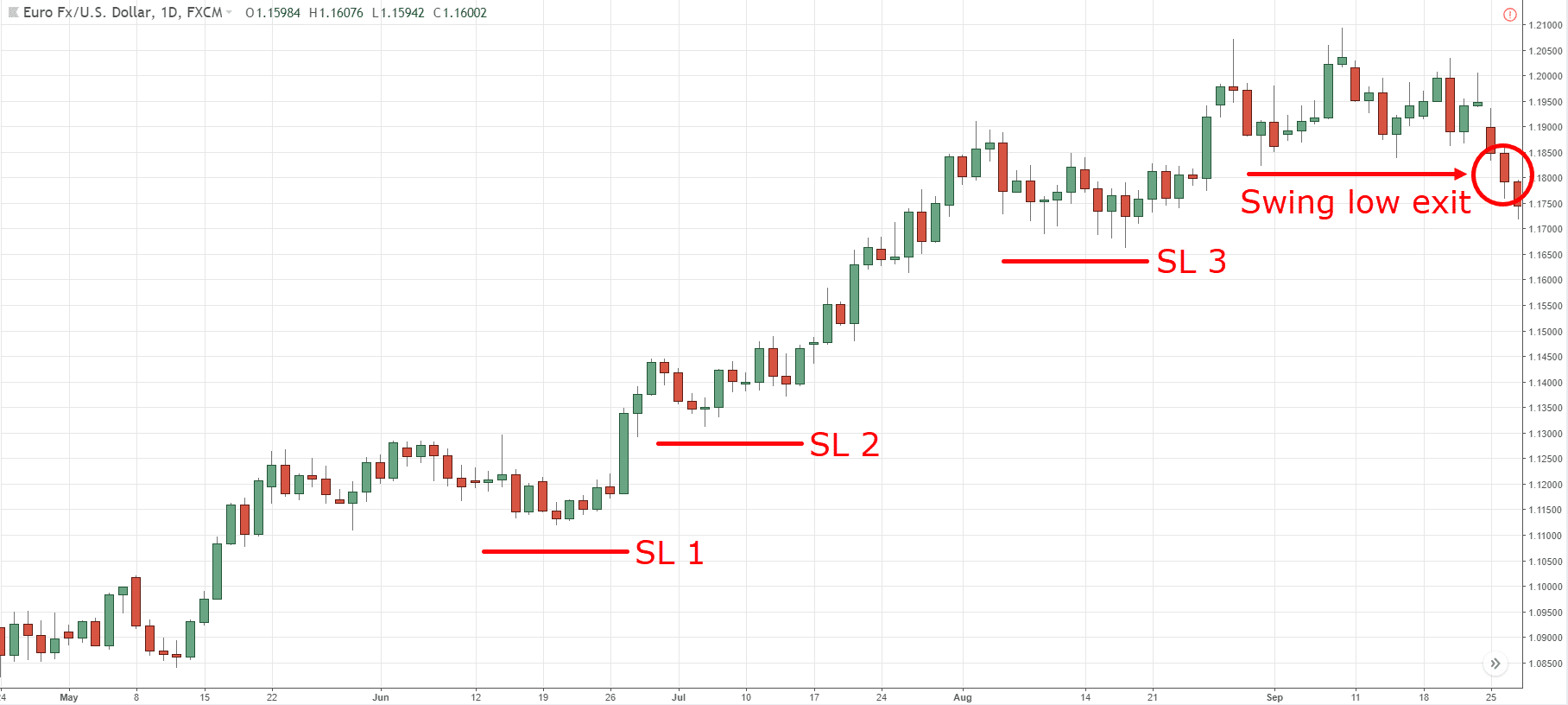

Trailing Stops in Practice: Enhancing Performance in Real-Time Trading

In real-time trading, trailing stops play a crucial role in assisting traders in managing risk and maximizing profits. When the price of an underlying asset rises, the trailing stop follows suit, allowing traders to capture incremental gains. In the event of a sudden downturn, the trailing stop triggers an exit from the position, mitigating the potential for substantial losses.

Historical Success and Empirical Evidence Supporting the Trailing Stop Strategy

Empirical studies have provided evidence to support the effectiveness of trailing stop strategies. Backtesting and simulation results have shown that, under certain market conditions, trailing stops can enhance overall trading performance by managing risk more effectively and capturing more profit than traditional static stop-loss orders.

Options Trading Trailing Stop Strategy

Image: optionstradingiq.com

Conclusion

The options trading trailing stop strategy offers a dynamic approach to risk management, empowering traders to navigate market volatility while maximizing profit potential. By setting a trailing stop at a predefined offset from the market price, traders can mitigate losses, enhance profitability, and optimize their overall trading performance. While no trading strategy can guarantee consistent success, the trailing stop strategy has proven to be a valuable tool for options traders seeking to improve their risk-reward profile and achieve long-term success.