Introduction:

Imagine trading options like a thrilling game of chess, where every move matters and strategy is paramount. Enter the trailing stop, an indispensable tool that can transform your game by safeguarding profits and minimizing potential losses. In this comprehensive guide, we’ll delve into the world of options trading trailing stops, empowering you with the knowledge to navigate the market’s turbulent waters with confidence.

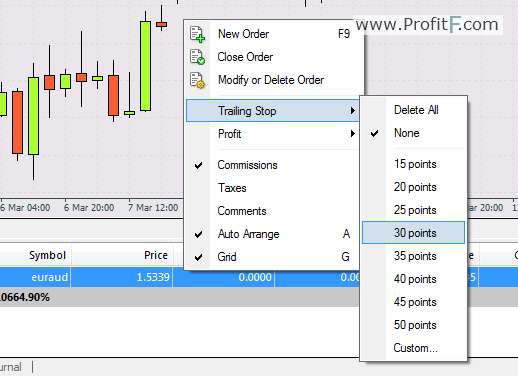

Image: www.profitf.com

Understanding Trailing Stops for Options Trading

A trailing stop is a type of stop order that moves with the underlying asset’s price, adjusting dynamically to protect your position. When the stock price rises, the trailing stop moves upward, preserving your profits. Conversely, when the price falls, the stop moves downward, preventing excessive losses.

History and Evolution:

Traders have relied on the concept of trailing stops for decades, with the advent of automated trading platforms making them even more accessible. Modern trading tools offer sophisticated algorithms that enable precise and timely execution of trailing stop orders, giving traders an edge in the fast-paced options market.

Benefits of Using Trailing Stops for Options Trading

-

Image: www.binarytribune.comProfit Preservation:

The primary benefit of using a trailing stop for options trading is to maximize profits. By adjusting with the underlying asset’s price, trailing stops ensure that you capture gains as the price rises. This mitigates the risk of giving back profits if the market sentiment suddenly shifts downward.

-

Loss Mitigation:

Equally important is the ability of trailing stops to minimize losses. When the market reverses and the underlying asset’s price falls, trailing stops move down, limiting your exposure to potential losses. This is particularly valuable in volatile markets, where sharp price movements can erode profits rapidly.

-

Automated Trading:

Trailing stops automate the process of managing your risk, freeing you from the need to monitor markets continuously. This allows you to allocate your attention to other aspects of trading, maximize your time, and avoid emotional interference in trade decisions.

-

Customization:

Trailing stops offer traders a high level of customization, empowering them to set the parameters that align with their trading style and risk tolerance. You can define the percentage or fixed dollar amount by which the stop moves with the underlying asset’s price, adapting it to your specific needs.

-

Flexibility:

Trailing stops provide flexibility in trading strategies. Traders can use them as part of a larger trading plan or combine them with other orders, such as limit orders or stop-loss orders, to create more sophisticated trading scenarios.

Expert Insights: Harnessing Trailing Stops for Success

“Options trading is a game of probabilities, and trailing stops allow traders to manage risk and enhance their chances of success,” says seasoned options trader Robert Black. “By implementing a well-defined trailing stop strategy, traders can preserve their hard-earned profits and navigate market volatility with confidence.”

According to respected trading expert Tracy Lee, “Trailing stops are a powerful tool for options traders. They enable disciplined profit-taking and loss-limiting, which are essential ingredients for long-term trading success.”

Actionable Tips: Implementing Trailing Stops in Your Options Trading

-

Determine Optimal Trailing Percentage:

The choice of a trailing stop percentage depends on your risk tolerance and trading strategy. Higher percentages offer more protection but may limit profits, while lower percentages expose you to increased risk in exchange for higher potential gains.

-

Utilize Volatility Analysis:

Evaluate the historical volatility of the underlying asset before setting the trailing stop percentage. Adjust the percentage accordingly, using a wider stop for more volatile assets and a tighter stop for less volatile assets.

-

Define a Start Point:

Identify a sensible starting point for your trailing stop. This could be a predefined market support or resistance level, or simply a technical indicator that signals trend reversals.

-

Adjust Dynamically:

Don’t set and forget your trailing stop orders. Monitor market trends and adjust the stop price accordingly, based on changes in volatility, news events, or technical indicators.

-

Test and Optimize:

Just like any other trading strategy, trailing stop orders require testing and refinement. Use a trading simulator or paper-trade your strategies to optimize the parameters of your trailing stop, assessing performance in both uptrending and downtrending markets.

Options Trading Trailing Stop

Image: tradingstrategyguides.com

Conclusion: Embracing Trailing Stops for Options Trading Success

In the high-stakes world of options trading, the adoption of trailing stops can significantly improve your chances of success. By preserving profits, minimizing losses, automating risk management, and providing customization, trailing stops empower traders to navigate market volatility with confidence.

Harnessing the insights of experts and applying actionable tips, you can leverage trailing stops to optimize your options trading strategy, maximize returns, and minimize losses. Remember, every successful trader has a system in place to manage risk, and trailing stops are a powerful tool in that arsenal. So, embrace the use of trailing stops in your options trading, and unlock a world of possibilities in the financial markets.