In the ever-evolving financial landscape, option spread trading has emerged as a powerful tool for investors seeking to amplify their returns while managing risks. At the forefront of this innovative realm, option spread trading services offer a gateway to harnessing the full potential of this niche yet lucrative strategy.

Image: www.incomementorbox.com

By providing the necessary framework, these services empower traders of all experience levels to navigate the complexities of option spreads, enabling them to craft tailored strategies that align with their financial aspirations. From educational resources and analytical tools to real-time market data and personalized guidance, these services offer a comprehensive solution for aspiring traders eager to capitalize on the opportunities inherent in option spread trading.

Unveiling the Dynamics of Option Spread Trading

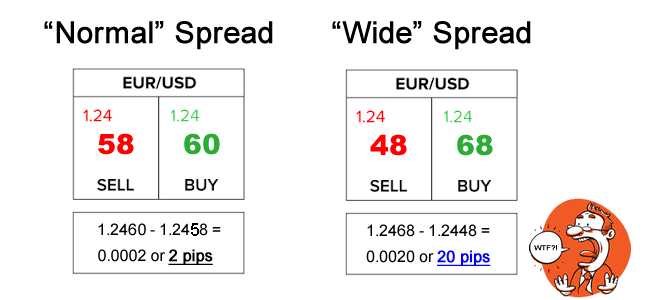

At its core, option spread trading involves the simultaneous purchase and sale of two or more options with different strike prices and expiration dates on the same underlying asset. This nuanced strategy allows traders to define the potential profit and loss boundaries within which their investment will operate.

For instance, a trader may purchase a call option at a higher strike price while simultaneously selling a call option at an even higher strike price. By establishing this vertical spread, the trader creates a defined risk-reward profile with limited profit potential but also capped potential losses.

Navigating the Tangled Web of Spread Types

The world of option spread trading is a diverse tapestry of strategies, each catering to specific investment objectives and risk tolerances. From bullish bullish spreads, which seek to profit from rising asset prices, to bearish bear spreads that thrive in falling markets, there’s an option spread configuration for every market outlook.

Butterfly spreads offer a balanced approach, seeking moderate gains in both directions while limiting potential losses. Iron condors, on the other hand, excel in sideways markets, generating income from time decay as long as the underlying asset remains within a predetermined range.

Empowering Traders with Comprehensive Services

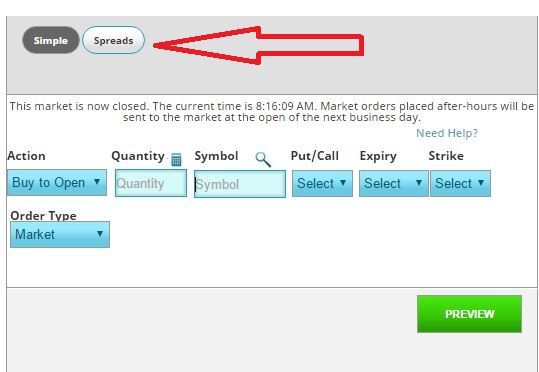

Recognizing the multifaceted nature of option spread trading, leading service providers offer a range of tools and resources to empower traders at every stage of their investment journey. Cutting-edge platforms provide real-time market data, detailed charts, and sophisticated analytical tools, allowing traders to make informed decisions backed by data-driven insights.

Educational resources, including webinars, online courses, and personalized coaching, equip traders with the knowledge and skills necessary to navigate the complexities of option spread trading with confidence. Expert advisors are always on hand to provide personalized guidance, helping traders refine their strategies and fine-tune their risk management techniques.

Image: www.pinterest.com

Option Spread Trading Services

Image: personalfinancelab.com

Igniting Profitable Possibilities

By partnering with reputable option spread trading services, traders can unlock a world of financial opportunities and harness the power of this versatile strategy. Through tailored guidance, comprehensive resources, and cutting-edge platforms, these services provide the necessary foundation for success, empowering traders to make well-informed decisions and maximize their potential returns.

Whether you’re a seasoned investor seeking to expand your trading repertoire or a novice eager to explore the world of options, option spread trading services offer a valuable gateway to financial empowerment. Embrace the guidance of experts, leverage advanced tools, and embark on a journey of financial growth and prosperity.