Options trading offers investors the opportunity to speculate on the future price movements of underlying assets while limiting their risk exposure. A key consideration for any options trader is the brokerage charges they will incur, as these can significantly impact their profitability. The type of brokerage firm, the trading platform used, and the specific options strategies employed all play a role in determining the costs involved.

Image: www.adigitalblogger.com

Understanding Options Trading Brokerage Charges

Brokerages typically charge a combination of two main types of fees: commissions and spread markups. Commissions are flat fees charged per contract traded, irrespective of the option’s value or underlying asset. Spread markups represent the difference between the bid and ask prices quoted by the brokerage. Traders should be aware of how these fees are applied by their chosen broker to ensure they are making informed trading decisions.

Factors Affecting Brokerage Charges

The following factors can influence the brokerage charges associated with options trading:

- Brokerage type: Full-service brokers tend to offer more comprehensive services and support but may charge higher fees than discount brokers. Discount brokers typically provide a more streamlined trading experience at lower costs.

- Trading platform: Different trading platforms may come with varying fee structures, including tiered pricing models or reduced fees for specific options strategies.

- Option strategy: The complexity and risk involved in the chosen options strategy can impact the brokerage charges applied. Strategies involving multiple legs or exotic options often incur higher fees.

- Trading frequency and volume: Brokers may offer volume discounts or tiered pricing for frequent and large volume traders.

Types of Brokerage Charges

- Option Contract Commissions: The most common type of commission charged per contract traded, regardless of the option’s value.

- Per-Leg Commissions: Some brokers charge a commission per leg of an option strategy, which can accumulate for complex strategies.

- Exercise and Assignment Fees: Fees charged when exercising or assigning option contracts.

- Spread Markups: The difference between the bid and ask prices, which brokers typically capture as part of their fee structure.

- Platform Fees: Some trading platforms charge additional fees for access to advanced features or real-time data.

Image: tradinghow.com

Comparing Brokerage Charges

Before selecting an options trading brokerage, it is essential to compare the brokerage charges they offer. Consider the following factors when comparing fees:

- Type of broker: Full-service vs. discount

- Commission structure: Flat fees, per-leg commissions

- Spread markups: Typical spread markups for commonly traded options

- Hidden fees: Any additional fees that may not be readily apparent

- Volume discounts: Discounts offered for high-volume traders

Minimizing Brokerage Charges

Traders can employ several strategies to minimize the brokerage charges they pay:

- Negotiate with the broker: High-volume traders may be able to negotiate reduced commission rates with their brokerage.

- Choose a broker with low fees: Discount brokers typically offer competitive fee structures, including low commissions and narrow spread markups.

- Optimize trading strategy: Selecting less complex and lower-risk options strategies can help reduce brokerage charges.

- Trade during off-peak hours: Spread markups tend to be wider during peak trading hours, so trading outside these times can potentially reduce costs.

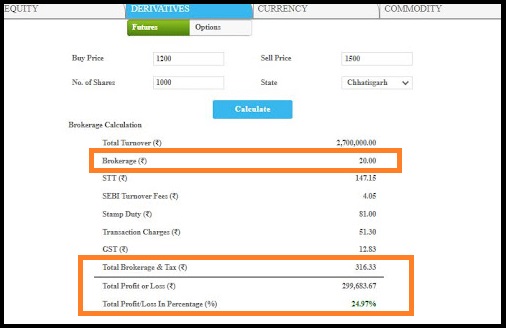

Options Trading Brokerage Charges

Image: finsavee.com

Conclusion

Options trading brokerage charges are a crucial factor to consider for any trader looking to maximize their profitability. By understanding the different types of fees involved and comparing the offerings of various brokers, traders can select a brokerage that meets their needs and minimizes their trading costs. By carefully considering these charges and implementing strategies to reduce them, traders can enhance their trading experience and potentially improve their financial outcomes.