Are you interested in learning about option trading charges in Sharekhan? If so, you’re in the right place. In this article, I’ll provide a comprehensive overview of the topic, including the latest trends, tips, and expert advice.

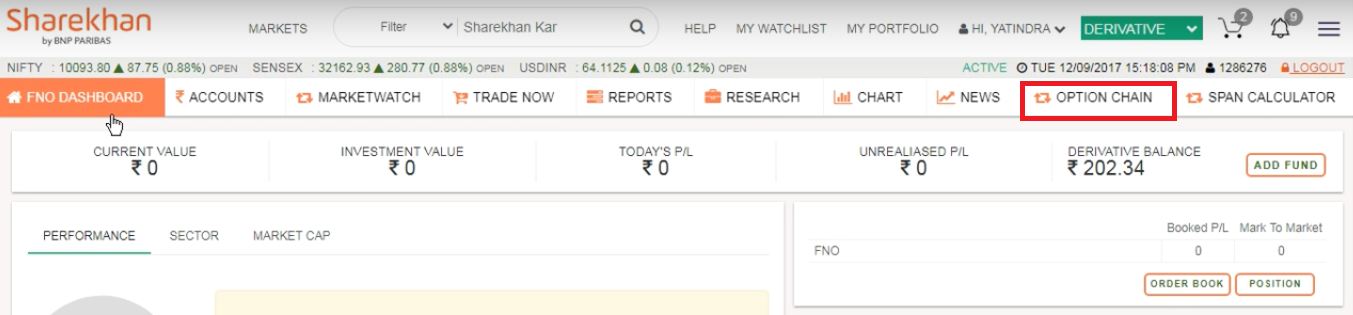

Image: www.chittorgarh.com

As a former option trader at Sharekhan, I have firsthand experience with the ins and outs of the platform. I’ll share my insights and knowledge to help you better understand the costs associated with option trading and make informed decisions about your trading strategy.

Understanding Option Trading Charges

Before we delve into the specific charges in Sharekhan, let’s start with a basic understanding of option trading charges.

When you trade options, you pay several types of fees, including:

- Brokerage fees

- Exchange fees

- SEBI fees

- STT fees

The specific charges you pay will vary depending on the type of option you trade, the exchange you use, and the broker you choose.

Sharekhan Option Trading Charges

Sharekhan offers a competitive fee structure for option trading. The brokerage fees for option trading in Sharekhan are as follows:

| Option Type | Brokerage Charges |

|---|---|

| Index Options | Flat ₹20 per lot |

| Stock Options | 0.05% of the contract value, subject to a minimum of ₹20 per lot |

In addition to brokerage charges, Sharekhan also charges exchange fees, SEBI fees, and STT fees. These fees are standard across all brokers and are not specific to Sharekhan.

Tips for Minimizing Option Trading Charges

Here are a few tips to help you minimize your option trading charges in Sharekhan:

- Trade only when you have a high probability of success.

- Use limit orders to control the price you pay for options.

- Avoid overtrading.

- Consider using a discount broker.

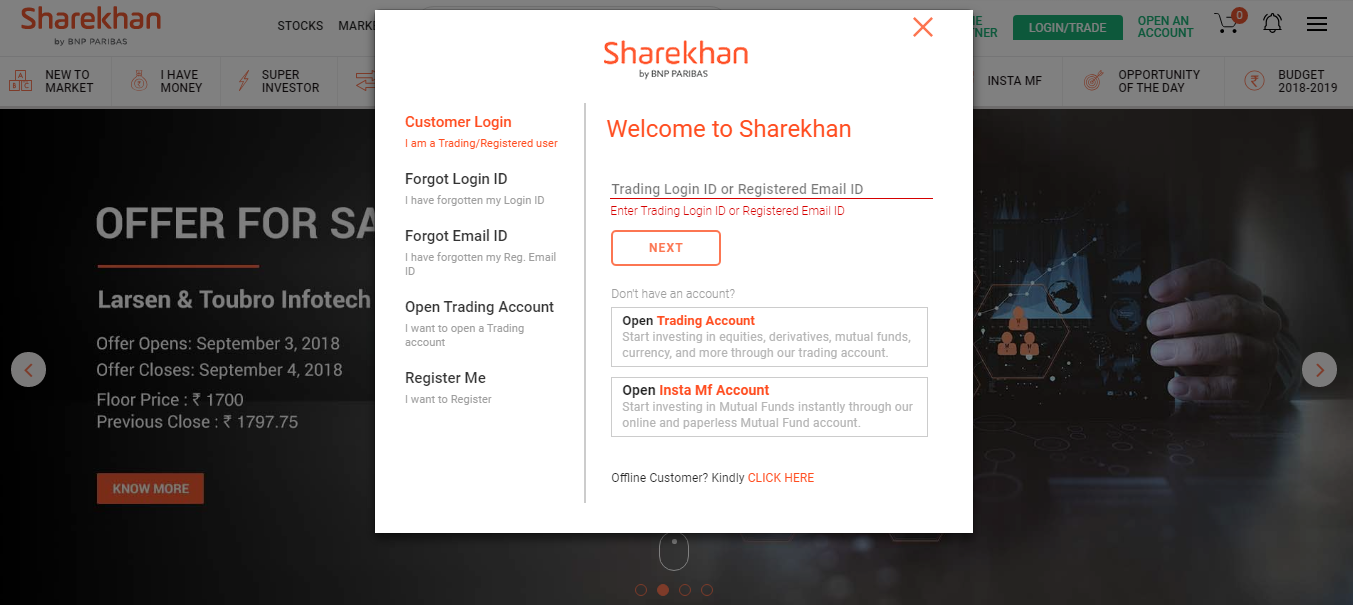

Image: forexeaforum.blogspot.com

Expert Advice on Option Trading Charges

Here is some expert advice on option trading charges that you can use to enhance your trading strategy:

-

Don’t let fees deter you from trading options.

Option trading can be a lucrative way to generate income, even if you have to pay fees. -

Shop around for the best broker.

Not all brokers charge the same fees. Compare the fees of several brokers before you decide who to use. -

Be aware of the hidden costs of option trading.

In addition to the fees you pay to your broker, there are also exchange fees, SEBI fees, and STT fees. Be sure to factor these costs into your trading strategy.

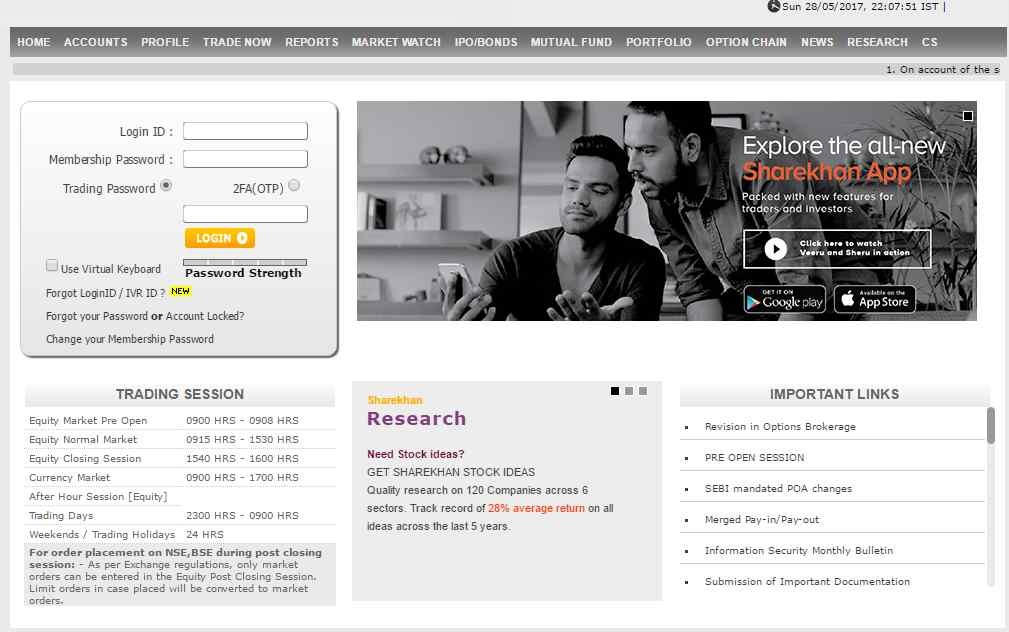

Option Trading Charges In Sharekhan

Image: www.adigitalblogger.com

Frequently Asked Questions (FAQs) About Option Trading Charges

Q: What are the different types of option trading charges?

A: The different types of option trading charges include brokerage fees, exchange fees, SEBI fees, and STT fees.

Q: How can I minimize my option trading charges?

A: You can minimize your option trading charges by trading only when you have a high probability of success, using limit orders to control the price you pay for options, avoiding overtrading, and considering using a discount broker.

Q: What is the best broker for option trading?

A: The best broker for option trading depends on your individual needs. However, some of the most popular brokers for option trading include Sharekhan, Zerodha, and Upstox.