Captivating Introduction

Imagine the exhilaration of unlocking the boundless potential of financial markets, where savvy investors leverage the power of options to enhance their returns. Sharekhan, a leading brokerage house in India, offers a robust platform for options trading, empowering individuals to participate in this dynamic arena. However, understanding the associated charges is crucial for prudent financial decision-making. This comprehensive guide delves deep into the nuances of Sharekhan option trading charges, equipping you with the knowledge to navigate this complex landscape with confidence.

Image: www.chittorgarh.com

Sharekhan’s option trading platform provides a gateway to a world of financial possibilities, offering investors the flexibility to capitalize on market movements. Options, financial instruments derived from underlying assets, allow traders to speculate on price fluctuations and tailor their investment strategies to suit their risk appetite. Before embarking on this exciting journey, it is essential to have a clear understanding of the charges involved to optimize your trading experience.

Sharekhan Option Trading Charges: A Detailed Breakdown

Sharekhan’s option trading charges encompass a range of fees that vary depending on the type of option contract and the trading strategy employed. By grasping the intricacies of these charges, you can make informed choices that align with your financial goals.

-

Brokerage Fees: Sharekhan charges a fixed brokerage fee for each option contract traded, regardless of its strike price or expiry period. This fee is typically a percentage of the transaction value, and it can range from 0.05% to 0.25% for different types of options.

-

Transaction Charges: In addition to brokerage fees, Sharekhan levies transaction charges for each trade executed on its platform. These charges are calculated based on the volume of shares underlying the option contract and can vary from ₹0.50 to ₹2 per contract.

-

Exchange Fees: The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), where Sharekhan’s option trading platform operates, impose exchange fees on all executed trades. These fees are standardized and independent of Sharekhan’s charges, ensuring transparency and market fairness.

-

Government Taxes: Option trading in India is subject to various government taxes, including the Securities Transaction Tax (STT) and the Goods and Services Tax (GST). The STT is levied on both the premium paid while buying an option and the premium received upon its sale or exercise. The GST is applicable on brokerage fees and other associated charges.

-

Demat Account Annual Maintenance Charges (AMC): Sharekhan, like other brokerages, charges an annual maintenance fee for holding a Demat account where your traded shares are stored. This fee is typically levied on a yearly basis and varies depending on the plan chosen.

-

Option Premium: The premium paid while buying an option contract is a crucial charge that directly impacts your trading strategy. The premium is determined by factors such as the underlying asset price, strike price, time to expiration, and volatility.

Understanding these charges and their impact on your trading P&L is essential to maximizing your returns. By carefully considering each component, you can optimize your trading approach and minimize unnecessary expenses.

Navigating the Nuances of Sharekhan Option Trading Charges

The intricacies of option trading charges can be daunting, but with the right insights, you can transform them from obstacles into opportunities. Here are expert tips to help you navigate the landscape:

-

Choose the Right Brokerage Plan: Sharekhan offers various brokerage plans tailored to different trading styles and account balances. Carefully evaluate these plans to select the one that best suits your trading volume and risk profile. Lower brokerage plans may have higher transaction charges, while higher brokerage plans often offer lower transaction fees.

-

Consider Market Conditions: Market volatility significantly influences option premiums. During volatile market conditions, premiums tend to be higher, leading to increased trading charges. Understanding market dynamics can help you make informed decisions about the timing of your trades.

-

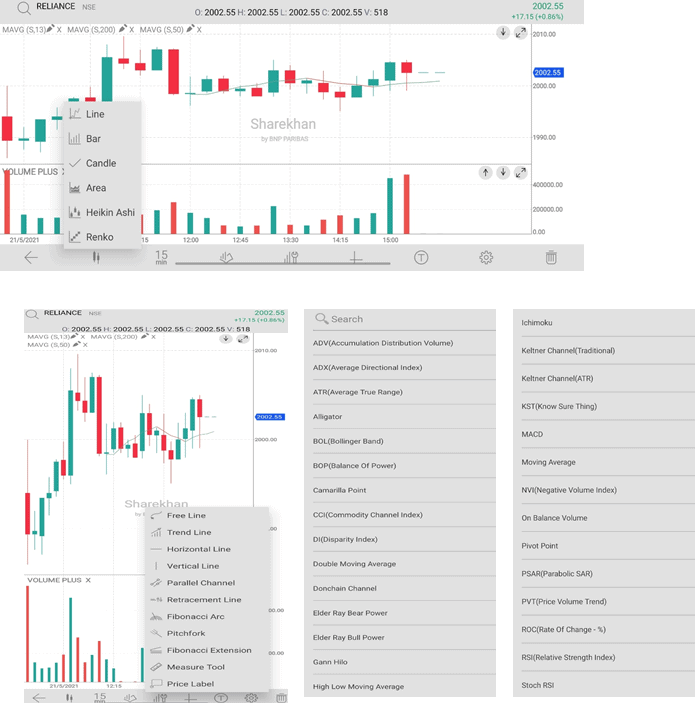

Leverage Technology: Sharekhan’s trading platform provides advanced tools and analytics to help you optimize your trading strategy. Utilize these tools to monitor market trends, identify trading opportunities, and manage your risk exposure.

-

Seek Professional Guidance: If you are new to option trading or need expert insights, consider consulting a financial advisor. They can guide you on complex trading strategies, risk management techniques, and charge optimization.

Empowering Investors with Knowledge and Expertise

By understanding the complexities of Sharekhan option trading charges, you gain a powerful advantage in the financial markets. Informed decision-making empowers you to tailor your trading strategies, maximize returns, and minimize unnecessary expenses.

Sharekhan’s commitment to transparency and customer satisfaction shines through in its comprehensive disclosure of trading charges. By dissecting each component and providing valuable tips, this guide seeks to equip you with the knowledge and expertise to navigate the dynamic world of option trading with confidence and success.

Image: coincodecap.com

Sharekhan Option Trading Charges

Embark on Your Trading Journey with Confidence

Unlock the boundless potential of financial markets with Sharekhan’s option trading platform. Embrace the power of informed decision-making, stay abreast of market trends, leverage expert guidance, and optimize your trading strategy by meticulously considering the associated charges.

Remember, the path to financial success lies in continuous learning and a commitment to understanding the intricate details of the markets. As you embark on your trading journey, remember that the key to unlocking consistent returns lies in knowledge, expertise, and the ability to adapt to evolving market conditions.