Do you ever wish you had a crystal ball, a glimpse into the future where you could see which stocks were destined to soar? While we can’t predict the future, trading call options gives you the power to leverage a potential stock price increase, amplifying your returns – and all without owning the underlying stock itself! It’s a powerful tool, but like any powerful tool, understanding the nuances is key to wielding it effectively.

Image: optionclue.com

But before we dive into the exhilarating world of call options, let’s define what they are. A call option is a financial contract that gives the buyer the right, but not the obligation, to purchase a stock at a specific price (the strike price) before a certain date (the expiration date). It’s essentially a bet on the stock going up, granting you the potential for huge profits if you’re right – but remember, options trading involves a great deal of risk.

Understanding the Basics

Imagine you believe Company X is about to release a game-changing product, sending its stock soaring. A call option allows you to invest in this belief without buying hundreds of shares of the stock.Instead, you purchase a call option, giving you the right to buy the stock at a specific price, say $50, even if the market price rises to $75! For a price, you’ve locked in the ability to purchase the stock at a discount, potentially making a handsome profit. This is the beauty of call options – they allow you to control a large number of shares without tying up a significant amount of capital.

Types of Call Options

Not all call options are created equal! Here’s a quick breakdown of the key categories:

-

American Call Options: These options can be exercised at any time before the expiration date.

-

European Call Options: These options can only be exercised on the expiration date.

-

Covered Call Options: Here, the buyer of the call option owns the underlying shares of stock. This strategy is often used by investors who want to generate income from their stock holdings.

-

Naked Call Options: The seller of the option doesn’t own the underlying shares of stock. This strategy is considered riskier because losses could be unlimited.

Understanding the Risks

While the potential for profits is tantalizing, understanding the risks is paramount. Call options are complex financial products, and it’s essential to tread carefully. Here are some of the key risks:

-

Time Decay: Options have a limited lifespan. As time passes, the value of the option decreases, even if the stock price stays flat.

-

Volatility: Options are highly sensitive to volatility in the stock market. If the stock price moves against you, you could lose a significant amount of money.

-

Unlimited Losses: While your profits are limited to the difference between the stock price and the strike price, your losses are potentially unlimited.

Image: www.pinterest.com

Strategies for Success

Navigating the world of call options requires a well-defined strategy. Here are some approaches that experienced traders use:

- Covered Calls: This strategy involves selling a call option on a stock you already own. The premium you receive for selling the option is your potential profit, and the downside risk is limited.

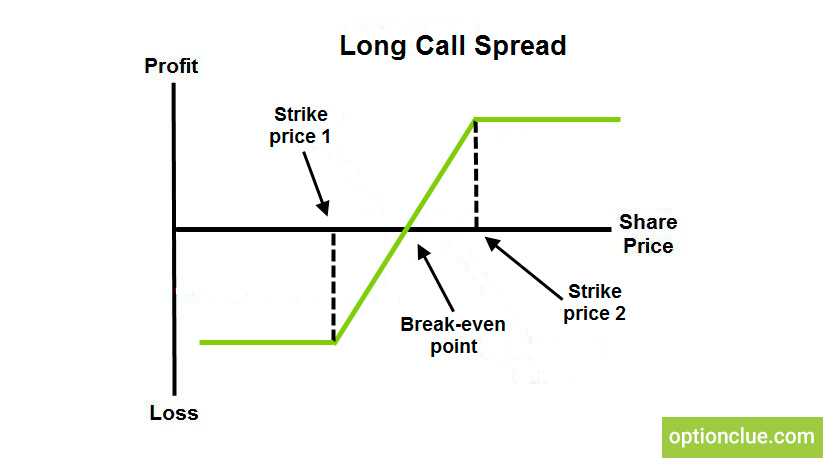

- Bullish Spread: This strategy involves buying a call option and simultaneously selling another call option with a higher strike price. The goal is to benefit from an increase in the stock price, while limiting potential losses.

Expert Advice

-

Don’t Overlook your Broker’s Guidance: Before diving into call options, speak with your broker. They can guide you on the risks, strategies, and resources available to you.

-

Start Small: Options are powerful tools, but powerful tools need to be used responsibly. Start with a small investment and gradually increase your positions as you gain experience.

-

Stay Informed: The stock market is a dynamic environment. Stay up-to-date on news events, financial trends, and economic data that can impact stock prices.

Trading Call Options

Conclusion

The call option landscape is filled with both potential and risk. By thoroughly understanding the basics, strategies, and risks involved, you can harness the power of call options to enhance your portfolio. Remember, starting small, carefully considering your risk tolerance, and seeking guidance from a financial professional are key steps in navigating the exciting world of options trading!