Call Option Trading: A Beginner’s Guide to Unleashing the Power of Options

Image: www.option-dojo.com

Introduction:

Imagine if you could predict the future and profit from it. That’s what call option trading promises. By understanding how options work and how to use them effectively, you can potentially amplify your gains in the stock market. In this comprehensive guide, we’ll delve into the intricacies of call option trading, empowering you with the knowledge to potentially unlock substantial returns.

Understanding Call Options:

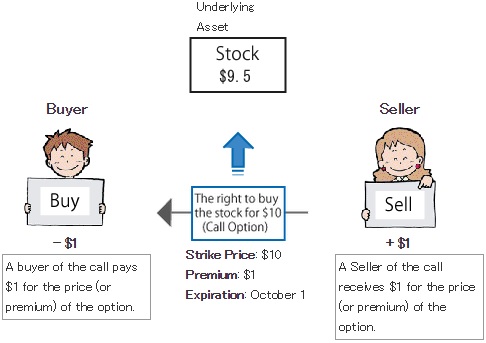

A call option is a type of derivative contract that gives the buyer the right, but not the obligation, to purchase a specific underlying asset at a pre-determined price (the strike price) on or before a certain date (the expiration date). By buying a call option, you gain the potential to profit if the underlying asset rises in value.

How Call Options Work:

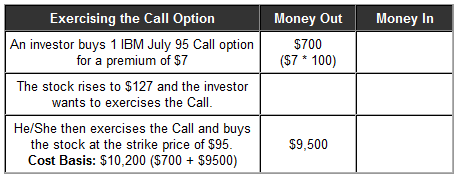

When you buy a call option, you pay a premium (the option price) to the seller of the option. If the price of the underlying asset exceeds the strike price before the expiration date, you can “exercise” your option, meaning you can purchase the asset at the strike price. This allows you to take advantage of the price increase and potentially realize a profit.

If the price of the underlying asset falls below the strike price, your call option expires worthless, and you lose the premium you paid for it. This is known as the “time decay” of an option.

Benefits of Call Option Trading:

- Leverage: Call options offer leverage, allowing you to potentially magnify your gains by controlling a larger amount of the underlying asset with a smaller investment.

- Limited Risk: Your risk as a call option buyer is limited to the premium you pay.

- Speculative Potential: Call options can provide substantial returns in volatile markets, allowing you to potentially capitalize on price movements.

How to Use Call Options:

Before trading call options, it’s crucial to conduct thorough research on the underlying asset, market conditions, and your own risk tolerance.

- Identify Potential Targets: Look for companies or sectors that have the potential to grow in value. Consider factors such as financial performance, industry trends, and market sentiment.

- Choose the Right Strike Price: The strike price should be slightly above the current market price to allow room for potential upside.

- Determine the Expiration Date: Consider the length of time you anticipate the underlying asset to rise in value before choosing the expiration date.

Expert Insights:

- “Call options are a powerful tool, but they come with both potential rewards and risks. It’s essential to understand the unique characteristics of options and to trade within your risk tolerance levels.” – David Kass, Professor at the University of Maryland

Actionable Tips for Call Option Trading:

- Understand how theta (time decay) affects option value and manage your positions accordingly.

- Avoid buying call options when the implied volatility is high, as this may limit your potential return.

- Monitor the underlying asset closely and adjust your strategy as market conditions change.

Conclusion:

Call option trading can be an effective way to potentially enhance your investment returns and capitalize on market opportunities. By grasping the fundamentals of options, conducting thorough research, and implementing smart trading strategies, you can potentially unlock the power of call options and achieve your financial goals. Remember, knowledge is key to success in the world of options trading.

Image: www.learn-stock-options-trading.com

Example Of Call Option Trading

Image: www.call-options.com