In the realm of finance, options trading stands as a tantalizing opportunity for discerning investors seeking to navigate the market’s complexities. Options, financial instruments that convey the right but not the obligation to buy or sell an underlying asset at a specified price on or before a designated date, offer a myriad of strategic advantages and income-generating possibilities. To successfully embark on this exciting venture, a thorough understanding of the essential requirements is paramount.

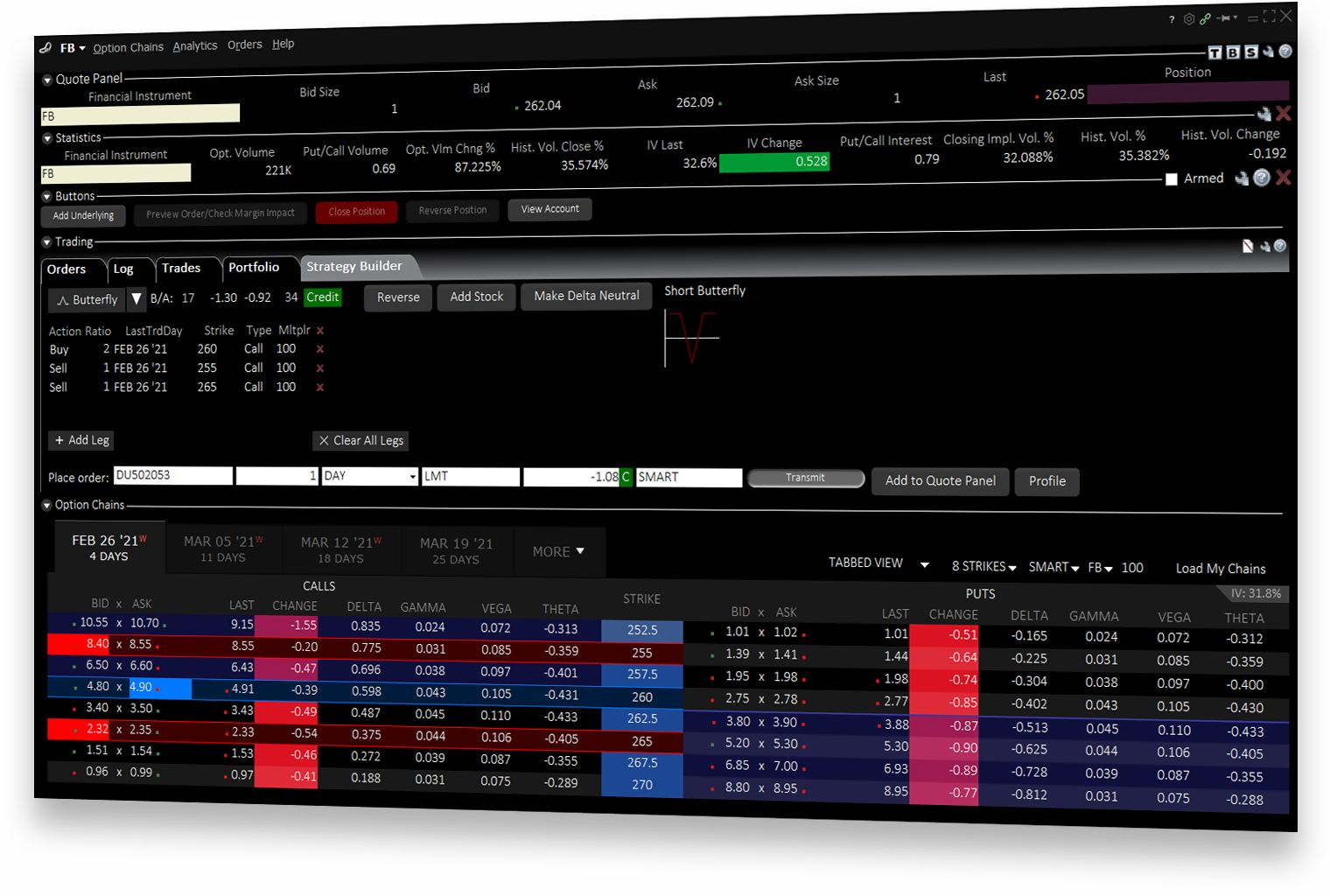

Image: www.interactivebrokers.com

Delving into the World of Options Trading: A Comprehensive Guide

Before delving into the specifics of options trading, it’s imperative to establish a foundational grasp of the underlying concepts. An option contract originates from an underlying asset, such as a stock, bond, or commodity. The holder of an option contract possesses the right to exercise the option before its expiration date. This right, however, comes at a cost, known as the option premium. The option premium essentially represents the price paid for the right to exercise the option.

Options are categorized into two primary types: calls and puts. Call options grant the holder the right to buy the underlying asset at a predetermined strike price, while put options confer the right to sell the underlying asset at the strike price. Strike price refers to the price at which the underlying asset can be bought or sold once the option is exercised. It’s crucial to note that options trading involves both rights and responsibilities. The holder of an option contract has the right to exercise the option at any time before its expiration date. However, if the option is not exercised before expiration, the contract expires worthless.

Understanding the Prerequisites: A Crucial Step

To ensure a seamless and successful options trading experience, it’s imperative to meet certain prerequisites. Firstly, a margin account is an absolute necessity. Margin accounts allow traders to borrow funds from their brokerage firm to purchase securities, including options. This feature can significantly amplify both potential gains and potential losses, so it’s essential to exercise caution and trade within one’s financial means.

Secondly, traders must meet specific suitability requirements established by the Financial Industry Regulatory Authority (FINRA). These requirements include a minimum account balance, trading experience, and a comprehensive understanding of options trading strategies. FINRA’s suitability requirements are designed to safeguard investors and ensure they possess the necessary knowledge and financial capacity to engage in options trading.

Additionally, a sound understanding of market dynamics and risk management techniques is indispensable. Traders must develop the ability to analyze market trends, assess risk-reward scenarios, and implement effective risk management strategies to mitigate potential losses. Continuous learning and staying abreast of the latest market developments are also essential for successful options trading.

Harnessing the Power of Options Trading: Unlocking Its Benefits

Options trading offers a diverse array of potential benefits that can enhance an investor’s financial portfolio. One of the most significant advantages is the ability to hedge against potential losses. By employing options strategies such as protective puts, traders can safeguard their investments from adverse market movements.

Furthermore, options trading provides the opportunity to generate income through premium collection. Selling options contracts with favorable terms can yield a steady stream of income, irrespective of the underlying asset’s price fluctuations. This income-generating aspect makes options trading an attractive proposition for both experienced traders and those seeking passive income streams.

The flexibility of options trading strategies is yet another compelling benefit. Options can be employed in a variety of ways to suit different market conditions and risk tolerance levels. Whether it’s seeking capital appreciation, generating income, or hedging against risk, options trading offers a versatile toolset to achieve financial objectives.

Image: www.youtube.com

What Are Requirements Of Trading Options

Image: www.interactivebrokers.com

Embracing the Journey of Options Trading: A Path to Financial Empowerment

Embarking on the path of options trading can be both an enriching and potentially lucrative experience. By meeting the essential requirements, understanding the complexities of options contracts, and developing a comprehensive trading strategy, investors can unlock the full potential of this dynamic financial instrument. Options trading empowers individuals to take control of their financial future, navigate market uncertainties, and pursue their investment goals with informed decision-making. Embrace the thrill of options trading today and witness the transformative possibilities that lie within.