Introduction

Image: www.cruxinvestor.com

In the realm of stock market investment, options trading offers opportunities for substantial returns. Among the various options strategies, call options stand out as a powerful tool to capitalize on upward stock price movements. Identifying the right stocks for call options trading is crucial for maximizing profit potential. This article delves into the world of call options trading, exploring the top 10 stocks that have consistently exhibited strong growth and favorable trading conditions.

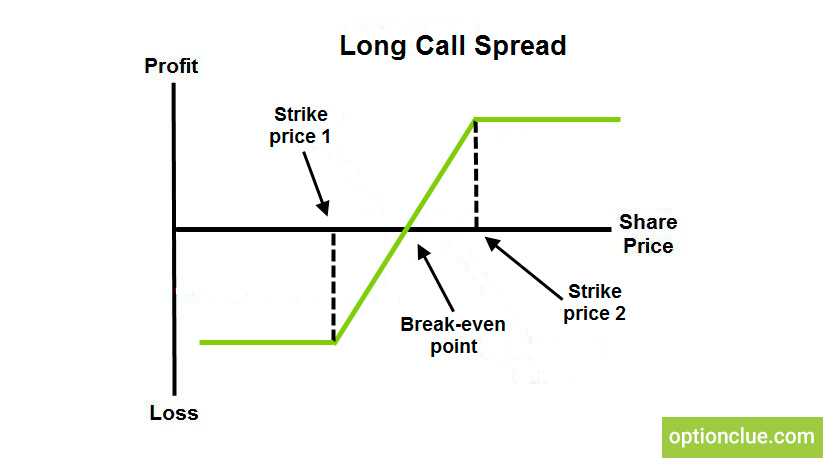

Understanding Call Options

Call options grant holders the right, but not the obligation, to purchase a specific number of shares of a stock at a set price (strike price) before a certain date (expiration date). When the underlying stock price rises above the strike price, the call option gains in value. Traders buy call options with the expectation that the stock price will continue to increase, allowing them to exercise their right to purchase the shares at a discounted price.

Top 10 Call Options Trading Stocks

-

Apple (AAPL): Apple consistently ranks among the most popular stocks for call options trading due to its high liquidity, strong fundamentals, and history of steady growth.

-

Microsoft (MSFT): As a global tech giant with a vast product portfolio and a large market share, Microsoft offers highly liquid call options with ample trading opportunities.

-

Amazon (AMZN): Amazon’s dominance in e-commerce and cloud computing makes it an attractive option for call options traders seeking growth and liquidity.

-

Tesla (TSLA): The electric vehicle industry leader, Tesla, presents high volatility and potential for significant price fluctuations, making it suitable for short-term call options trading strategies.

-

Nvidia (NVDA): Nvidia’s leadership in computer graphics and artificial intelligence drives strong demand for its call options, especially among traders betting on the future growth of these technologies.

-

Berkshire Hathaway (BRK.A): Warren Buffett’s conglomerate holds a diversified portfolio of stocks, making it a relatively stable option for long-term call options trading.

-

UnitedHealth Group (UNH): The largest health insurance provider in the United States, UnitedHealth Group, offers low volatility and attractive dividend yields, appealing to conservative call options traders.

-

Procter & Gamble (PG): As a consumer staples giant, Procter & Gamble’s stable earnings and steady stock price movements make it a popular choice for long-term call options strategies.

-

Johnson & Johnson (JNJ): JNJ’s strong pharmaceutical and consumer healthcare businesses provide stability and growth potential, making it a versatile option for both short-term and long-term call options trading.

-

Alphabet (GOOGL): Google’s dominant position in internet search and advertising creates significant opportunities for call options traders seeking high liquidity and growth potential.

Conclusion

Call options trading offers lucrative opportunities to profit from rising stock prices. By selecting the right stocks like the top 10 listed above, traders can increase their chances of successful trades. It’s important to approach call options trading with a clear understanding of the risks and rewards involved and to incorporate proper risk management strategies into your trading plan. Consult a financial advisor for guidance if needed.

Image: www.annacoulling.com

Top Call Options Trading Stocks

Image: optionclue.com