<!DOCTYPE html>

Image: tradersunion.com

Is Options Trading Permissible or Forbidden in Islam?

Options trading has emerged as a popular investment instrument, but it begs the question for Muslims: is it permissible (halal) or forbidden (haram) under Islamic law? This article delves into this complex subject, exploring the different perspectives and providing guidance to navigate this religious and financial intersection.

Definition and Nature of Options Trading

Options trading involves contracts that give traders the right (but not the obligation) to buy or sell an underlying asset within a specified period at a predetermined price. Options can be either calls (the right to buy) or puts (the right to sell), with each carrying its own set of risks and rewards.

Islamic Perspectives on Options Trading

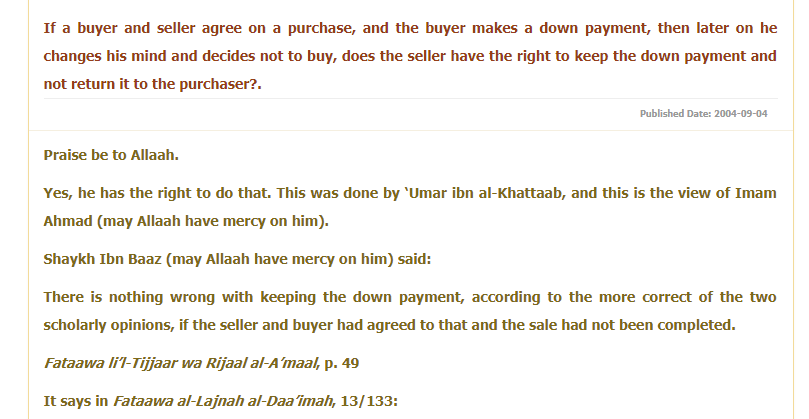

Islamic jurisprudence, or fiqh, provides the framework for determining the permissibility of financial transactions. There is no explicit prohibition against options trading in the Quran or Sunnah. However, several scholars have interpreted its principles and issued rulings on the matter.

Some scholars argue that options trading constitutes a form of gambling, which is forbidden in Islam. They reason that options give traders the potential to profit without taking on any risk, which aligns with the definition of gambling. Others, however, contend that options trading can be utilized for legitimate hedging purposes, mitigating against excessive risk in accordance with Islamic commercial practices.

Image: gudanggambar345.blogspot.com

Contemporary Considerations and Fatwas

With the advent of online trading platforms and the proliferation of financial products, contemporary scholars have been revisiting this issue. Many reputable Islamic financial institutions have issued fatwas (religious rulings) on options trading.

The majority of fatwas issued in recent years have deemed options trading permissible under certain conditions. These conditions typically include that traders:

- Have a genuine intention to hedge against risk

- Do not engage in excessive speculation

- Do not take on more risk than they can afford to lose

Tips for Navigating the Options Trading Landscape

If you are considering options trading as a Muslim investor, it is crucial to:

- Educate yourself: Thoroughly understand the mechanics of options trading and its potential risks and rewards.

- Consult with experts: Seek guidance from qualified Islamic finance scholars or experts to ensure your trading aligns with Islamic principles.

- Choose reputable brokers: Opt for brokers that offer Shariah-compliant trading accounts and adhere to Islamic ethical guidelines.

FAQ on Options Trading and Islam

Q: Is options trading inherently haram?

A: No, options trading is not inherently forbidden in Islam. However, it must comply with certain conditions, such as hedging against risk and avoiding excessive speculation.

Q: What are the risks associated with options trading from an Islamic perspective?

A: Key risks include the potential for gambling, excessive risk-taking, and excessive speculation, which could contradict Islamic ethical principles.

Options Trading Haram Or Halal

Image: www.chittorgarh.com

Conclusion

Navigating the halal and haram aspects of options trading requires careful consideration of Islamic principles and the nature of the underlying contracts. By understanding the diverse perspectives, applying contemporary fatwas, and adhering to expert guidance, Muslim investors can seek to engage in options trading responsibly.

Are you interested in learning more about options trading and its implications for Muslims? Continue reading or connect with our experts for further insights.