Trading d’options, an enigmatic realm in finance that allures investors with its potential for outsized rewards, yet shrouded in an aura of complexity.

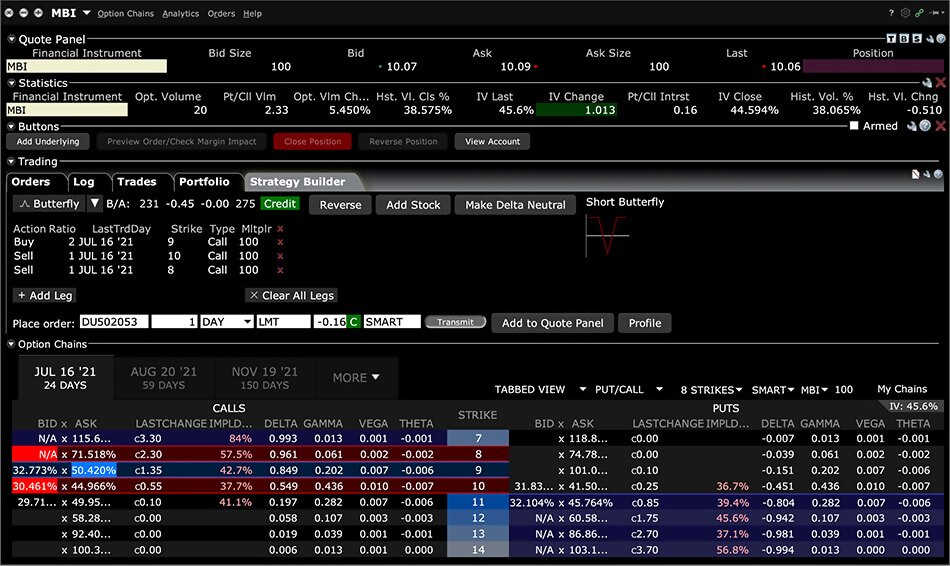

Image: www.interactivebrokers.com

Embark on a journey with me, dear reader, as we delve into the intricate tapestry of trading d’options, unraveling its intricacies and unveiling its lucrative possibilities.

Laying the Foundation: Definition and Significance

Trading d’options, in essence, is the art of contractually wagering on the future price of an underlying asset—be it stocks, commodities, or indices. Its significance lies in providing investors with a multifaceted instrument to reap returns from market movements and manage risk.

Evolution of Trading d’Options: A Historical Perspective

Tracing its roots to ancient civilizations, trading d’options has evolved drastically. Its modern incarnation took shape in the 1970s with the introduction of standardized contracts and the advent of options exchanges.

Today, trading d’options has become a cornerstone of modern finance, offering investors an unparalleled spectrum of opportunities.

Call Options: Betting on Rise

Call options grant the holder the right to purchase the underlying asset at a predetermined price (strike price) by a specific date (expiration date). When expecting a price upswing, investors may purchase call options to capitalize on potential gains.

Image: www.tradethetechnicals.com

Put Options: Hedging against Decline

Put options, on the other hand, provide insurance against falling prices. By purchasing put options, investors can secure the right to sell the underlying asset at the strike price before the expiration date.

Exploring the Nuances of Pricing and Strategies

Trading d’options hinges on an intricate understanding of pricing dynamics. Factors like underlying asset price, time to expiration, volatility, and interest rates influence option premiums. Exploring various pricing models enables investors to optimize their trading strategies.

Creating Customized Portfolio

Trading d’options empowers investors with the flexibility to tailor their portfolios according to risk tolerance and investment goals. From conservative strategies like covered calls to audacious plays like straddles, the options landscape offers a wide spectrum of strategies for every risk appetite.

Navigating the Latest Trends and Developments

The world of trading d’options is in perpetual flux, with innovative strategies and technological advancements continuously emerging. Keeping abreast of updates from industry experts, forums, and social media platforms is paramount to stay ahead of the curve.

For instance, the burgeoning use of artificial intelligence and machine learning in options trading is transforming market analysis and execution.

Expert Insights: Enhancing Your Trading acumen

Learning from seasoned traders can accelerate your understanding of trading d’options. Seek guidance from webinars, workshops, and online resources to expand your knowledge and refine your strategies.

Remember, mentorship plays a pivotal role in successful trading d’options.

Frequently Asked Questions: Demystifying Common Queries

1. Q: Is trading d’options suitable for everyone?

A: Trading d’options requires a thorough understanding of market dynamics and risk appetite.

2. Q: What are the key factors to consider before trading d’options?

A: Fundamental and technical analysis, volatility, and market trends.

Trading D’Option

Image: finance.yahoo.com

Conclusion: Embracing the Power of Trading d’Options

In the words of the legendary investor Warren Buffett, “Options are a powerful financial tool—but they are not a toy.” Trading d’options can indeed yield丰厚Financial rewards but demands thorough research, diligent risk management, and an unwavering commitment to learning.

Are you ready to navigate the enigmatic maze of trading d’options with newfound confidence and seize the opportunities it presents?