In the vibrant and ever-evolving world of financial markets, understanding the dynamics of listed equity options is crucial for traders seeking both profit and risk management. One key aspect of this understanding revolves around the precise timings when trading in these options ceases, a knowledge that can significantly influence trading strategies and risk exposure. This comprehensive guide delves into the intricacies of trading termination times for listed equity options, empowering traders with the insights necessary to navigate these marketplaces with confidence and precision.

Image: www.wallstreetmojo.com

Unveiling the Trading Landscape for Listed Equity Options

Listed equity options, a type of derivative contract, grant the buyer the right but not the obligation to buy (in the case of call options) or sell (in the case of put options) an underlying equity security at a predetermined price (strike price) on or before a specified date (expiration date). These versatile instruments offer investors a multitude of strategies, from risk mitigation to speculative plays, making them an indispensable tool in the financial arsenal.

As with other financial instruments, listed equity options have specific trading hours during which they can be bought and sold on designated exchanges. Establishing a clear understanding of these trading times is paramount for effective participation in these markets and prudent decision-making.

Demystifying the Trading Time Boundaries

To ensure orderly and fair trading practices, exchanges establish well-defined trading hours for listed equity options and other securities. These timeframes vary depending on the exchange, the jurisdiction in which it operates, and the underlying asset being traded. However, a general pattern emerges across major exchanges globally, providing traders with a consistent framework.

In most cases, trading in listed equity options commences at the opening bell of the underlying exchange and continues until the closing bell. The opening bell typically coincides with the start of the regular trading session for stocks, often around 9:30 AM local time. Similarly, the closing bell marks the end of the regular trading session, usually around 4:00 PM local time.

Exceptions and Nuances

While the aforementioned trading hours serve as a general guideline, there are certain exceptions and nuances to consider:

Image: www.pdffiller.com

Pre-Market and After-Hours Trading

Some exchanges offer pre-market trading sessions, which begin before the regular trading hours, and after-hours trading sessions, which extend beyond the regular trading hours. These sessions allow traders to execute orders outside of the standard trading window, providing greater flexibility and potential opportunities. However, it is important to note that liquidity and market depth may be lower during these extended trading sessions.

Holiday Closures

Financial exchanges adhere to established holiday schedules, during which trading is suspended. These holidays may vary depending on the country and region in which the exchange operates. Traders must be aware of these closure periods to avoid any disruptions to their trading activities.

Special Trading Sessions

In certain circumstances, exchanges may implement special trading sessions for specific events, such as corporate announcements or extraordinary market conditions. These special sessions may have modified trading hours and may require traders to adjust their trading strategies accordingly.

The Importance of Time Awareness in Equity Options Trading

Comprehending the trading time boundaries for listed equity options is crucial for several reasons:

-

Order Execution: Understanding trading hours ensures that traders can place and execute orders during the appropriate timeframes, avoiding missed opportunities or market closures.

-

Risk Management: Traders can calibrate their trading strategies and risk management techniques based on the time remaining until the end of trading. This allows them to adjust positions, adjust margins, or lock in profits as needed.

-

Market Monitoring: Staying abreast of the trading hours enables traders to monitor market movements and make informed decisions throughout the trading day.

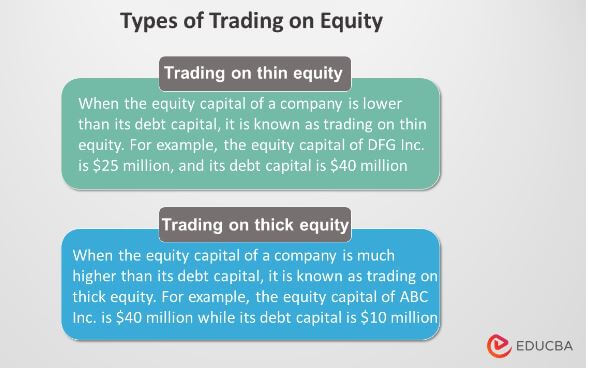

What Time Do Listed Equity Options Stop Trading

Image: www.educba.com

Conclusion

Mastering the intricate landscape of listed equity options trading requires a thorough understanding of the trading time boundaries. By comprehending these timeframes, traders can optimize their strategies, manage risk effectively, and navigate the markets with confidence. As with any financial instrument, education and diligent research are key to unlocking the full potential of equity options trading.