Definition and Significance: Delving into the Nuances of Greeks

The enigmatic world of options trading unfolds a complex tapestry of strategies, each meticulously crafted to harness market dynamics and navigate the uncharted seas of financial uncertainty. At the very heart of this intricate realm lie the enigmatic “Greeks” – a lexicon of parameters that quantifies the sensitivity of an option’s value to subtle shifts in underlying variables. These elusive measures, shrouded in mathematical equations and laden with Greek alphabet symbols, hold the key to unlocking the secrets of option trading.

Image: tradeoptionswithme.com

The significance of Greeks cannot be overstated. They empower traders with an unparalleled understanding of how their options positions will respond to market forces. Their numerical manifestations reveal the potential risks and rewards associated with each strategy, guiding traders towards informed decisions amidst the ever-evolving market landscape.

Unveiling the Greeks: Illuminating the Alphabet’s Hidden Power

The assemblage of Greeks, each denoted by a unique Greek letter, represents a distinct dimension of an option’s sensitivity. These metrics encompass a wide array of factors, ranging from price fluctuations and time decay to interest rate movements and volatility shifts.

Let us embark on a brief exploration of their enigmatic powers:

-

Delta: Measures an option’s price sensitivity to underlying asset price changes. A positive Delta implies that the option’s value will move in tandem with the underlying, while a negative Delta indicates an inverse relationship.

-

Gamma: Quantifies the rate of change in Delta with respect to underlying price variations. It reflects the acceleration or deceleration of an option’s price movement as the underlying asset fluctuates.

-

Theta: Calculates the erosion of an option’s value over time as it approaches its expiration date. Time decay is an inexorable force, relentlessly diminishing an option’s worth.

-

Vega: Captures the sensitivity of an option’s price to changes in implied volatility. A high Vega indicates that the option’s value is highly susceptible to volatility fluctuations.

-

Rho: Assesses how an option’s price responds to interest rate movements. Positive Rho values indicate that rising interest rates will enhance the option’s value.

Harnessing Greeks: Unveiling the Masterful Synergy

The mastery of Greek option trading strategies lies in the judicious combination of these sensitivity measures to craft tailor-made strategies that align with individual risk appetites and financial objectives. Each strategy represents a calibrated dance of Greeks, exploiting market conditions to optimize returns and mitigate risks.

One such strategy is the “straddle”, a simultaneous purchase of both a call and a put option with the same strike price and expiration date. Straddles thrive in highly volatile markets, aiming to capitalize on significant underlying price movements in either direction.

An alternative approach is the “strangle”, a strategy that resembles the straddle but with a wider spread between call and put strike prices. Strangles are deployed in anticipation of significant underlying price fluctuations but offer a lower premium outlay compared to straddles.

For those seeking a more directional strategy, the “bull call spread” emerges as a choice ally. This combination entails buying one call option at a lower strike price and simultaneously selling one call option at a higher strike price. Bull call spreads capitalize on bullish market expectations while limiting potential losses.

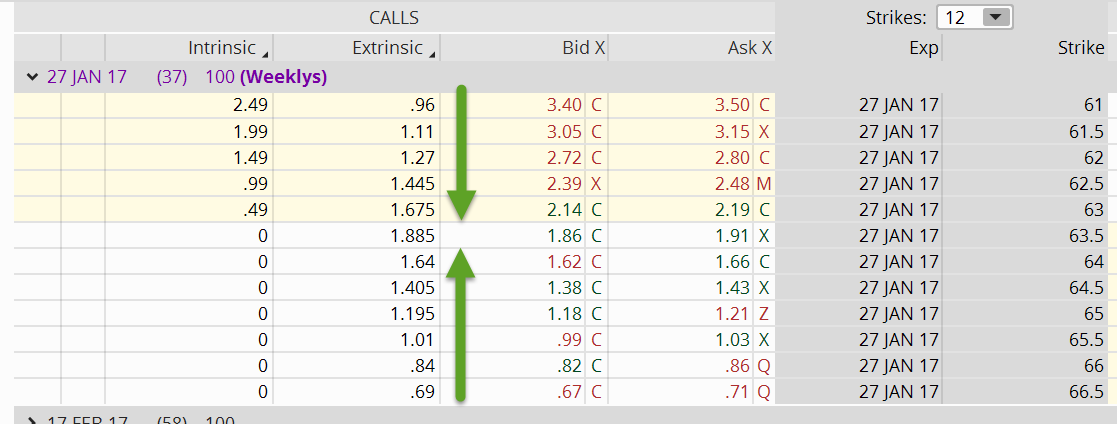

Image: tickertape.tdameritrade.com

Greek Option Trading Strategies

Conclusion: Embracing the Elusiveness of Greeks

The complex realm of Greek option trading strategies presents a formidable challenge, yet one that holds the promise of exceptional rewards for those willing to delve into its intricacies. By harnessing the power of Greeks, traders gain a profound understanding of their options positions, enabling them to navigate market uncertainties with unparalleled precision.

The pursuit of Greek mastery is a continuous journey, demanding meticulous research, unwavering patience, and a resolute commitment to unraveling the enigmatic language of options. Tread the path of Greek option trading strategies with unwavering determination, and you shall uncover a world of infinite possibilities and boundless wealth creation.