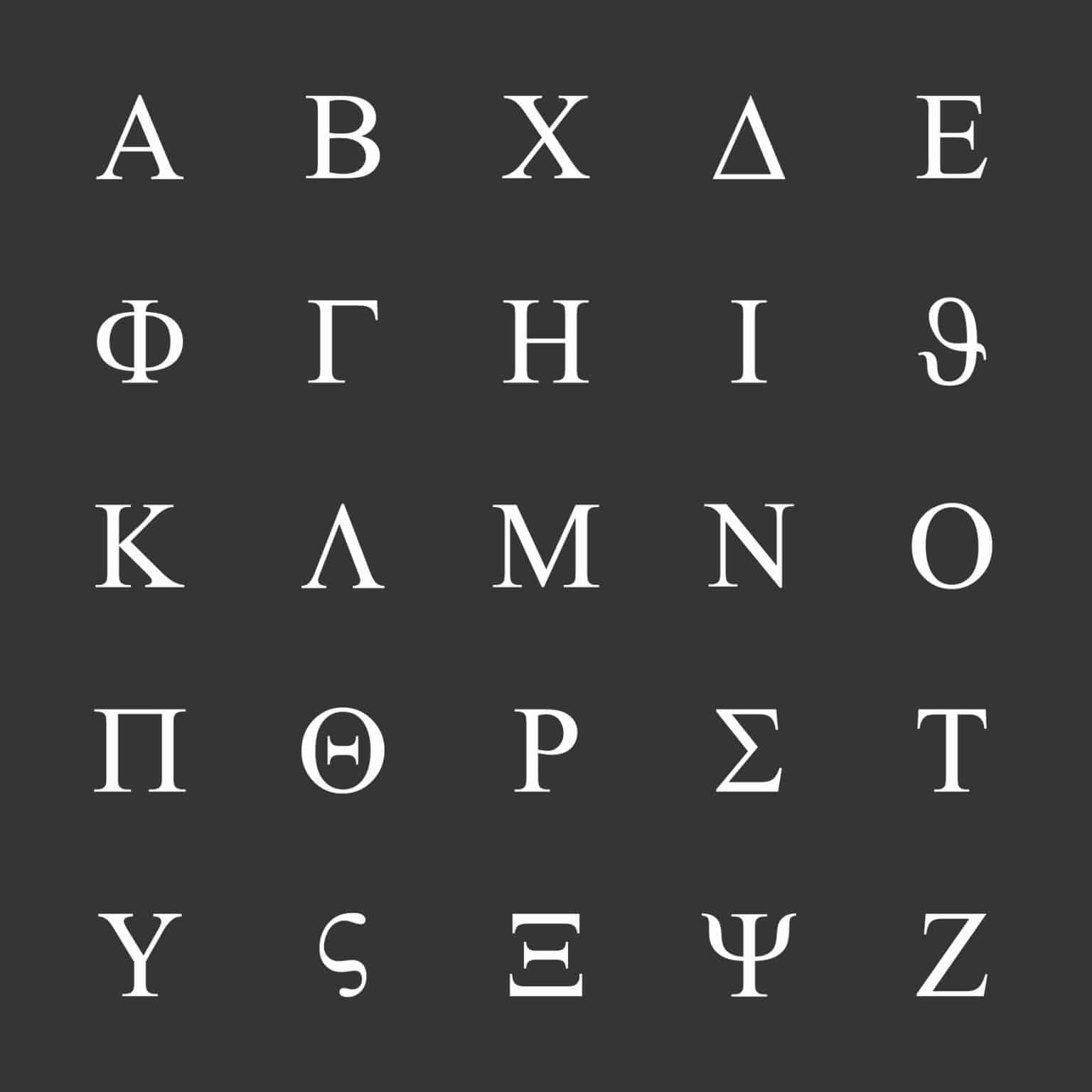

In the realm of options trading, understanding Greek letters is paramount. These enigmatic symbols hold the key to deciphering the intricate world of options and unlocking their potential for both profit and peril.

Image: www.stockinvestor.com

Greek letters, derived from their initial use as symbols in option pricing models, represent key sensitivities that measure the impact of various market factors on option prices. By delving into the depths of these Greek letters, traNavigating the Maze of Option Trading: A Guide to Greek Letters

In the realm of options trading, understanding Greek letters is paramount. These enigmatic symbols hold the key to deciphering the intricate world of options and unlocking their potential for both profit and peril.

Greek letters, derived from their initial use as symbols in option pricing models, represent key sensitivities that measure the impact of various market factors on option prices. By delving into the depths of these Greek letters, traders can gain a comprehensive understanding of how options respond to changes in market conditions.

Delta (∆): Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. A positive Delta indicates that the option’s price will move in the same direction as the underlying asset, while a negative Delta implies the opposite relationship.

Gamma (Γ): Gamma measures the rate of change in Delta in response to changes in the underlying asset’s price. A higher Gamma indicates that the Delta is more sensitive to price movements, leading to greater potential for profit or loss.

Vega (ν): Vega measures the sensitivity of an option’s price to changes in implied volatility. A positive Vega indicates that the option’s price will increase as implied volatility increases, while a negative Vega suggests the opposite relationship.

Theta (θ): Theta measures the time decay of an option’s premium as it approaches its expiration date. A positive Theta indicates that the option’s premium decreases with time, while a negative Theta implies the opposite relationship.

Rho (ρ): Rho measures the sensitivity of an option’s price to changes in interest rates. A positive Rho indicates that the option’s price will increase as interest rates increase, while a negative Rho suggests the opposite relationship.

Lambda (λ): Lambda measures the sensitivity of an option’s hedge ratio to changes in the Greeks of the underlying asset. It is an advanced Greek that is typically used by more sophisticated traders.

Understanding the Greeks in Practice

To illustrate the practical implications of Greek letters, consider the following example:

A trader purchases a call option with a Delta of 0.5 and a Gamma of 0.2. The underlying asset’s price is $100, and the option’s premium is $5.

- Delta: If the underlying asset’s price increases to $101, the option’s price is likely to increase by 0.5 * 1 = $0.5.

- Gamma: If the underlying asset’s price continues to increase, the option’s Delta is likely to increase by 0.2 * 1 = 0.2, indicating greater sensitivity to price changes.

- Vega: If implied volatility increases by 1%, the option’s premium is likely to increase by some positive amount (depending on the Vega value).

Conclusion

Mastering Greek letters is an essential aspect of options trading. By understanding how these sensitivities measure the impact of market factors on option prices, traders can make informed decisions and navigate the complexities of the options market with increased confidence. However, it is important to remember that Greek letters are only one piece of the puzzle. Traders should also consider other factors such as market trends, risk tolerance, and trading experience when making investment decisions.

Image: tradeoptionswithme.com

Option Trading Greek Letters

Image: www.marketdata.app