Understanding Greek Letters in Options

In the world of options trading, Greek letters are used to represent key metrics that measure different aspects of an option’s performance. These metrics are used by traders to assess the risk and return potential of an option, and to make informed decisions about their trades. While there are many different Greek letters used in options trading, four of them are considered the most important: Delta, Gamma, Theta, and Vega.

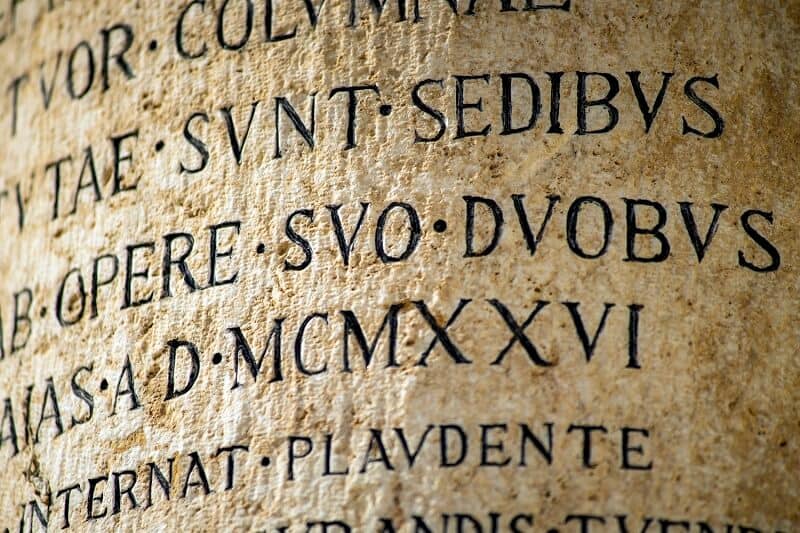

Image: optionalpha.com

Delta

Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. A positive Delta indicates that the option’s price will move in the same direction as the underlying asset’s price, while a negative Delta indicates that the option’s price will move in the opposite direction.

Gamma

Gamma measures the sensitivity of an option’s Delta to changes in the underlying asset’s price. A positive Gamma indicates that the Delta will increase as the underlying asset’s price moves in the option’s favor, while a negative Gamma indicates that the Delta will decrease as the underlying asset’s price moves against the option.

Theta

Theta measures the sensitivity of an option’s price to changes in time. A positive Theta indicates that the option’s price will decay as time passes, while a negative Theta indicates that the option’s price will increase as time passes.

Image: traders-paradise.com

Vega

Vega measures the sensitivity of an option’s price to changes in volatility. A positive Vega indicates that the option’s price will increase as volatility increases, while a negative Vega indicates that the option’s price will decrease as volatility increases.

Tips for Using Greek Letters in Options Trading

There are a number of ways to use Greek letters in options trading to improve your decision-making process, including:

- Using Delta to assess the direction of an option’s movement

- Using Gamma to assess the rate of change of an option’s Delta

- Using Theta to assess the impact of time on an option’s price

- Using Vega to assess the impact of volatility on an option’s price

By incorporating Greek letters into your options analysis, you can gain a better understanding of the risks and rewards associated with each trade, and make more informed decisions.

FAQ on Greek Letters in Options Trading

Q: What are the most important Greek letters in options trading?

A: The most important Greek letters in options trading are Delta, Gamma, Theta, and Vega.

Q: How can I use Greek letters to assess the risk of an options trade?

A: You can use Delta to assess the direction of an option’s movement, Gamma to assess the rate of change of an option’s Delta, Theta to assess the impact of time on an option’s price, and Vega to assess the impact of volatility on an option’s price.

Q: How can I use Greek letters to improve my decision-making in options trading?

A: By incorporating Greek letters into your options analysis, you can gain a better understanding of the risks and rewards associated with each trade, and make more informed decisions.

Whoch Greeks Matter In Options Trading

Image: www.youtube.com

Conclusion

Greek letters are a powerful tool that can help you achieve success in options trading. By understanding the meaning of each Greek letter and how to use it, you can make more informed decisions about your trades, which will increase your chances of making a profit.

Are you ready to take your options trading to the next level? Start by learning about Greek letters today!