Introduction

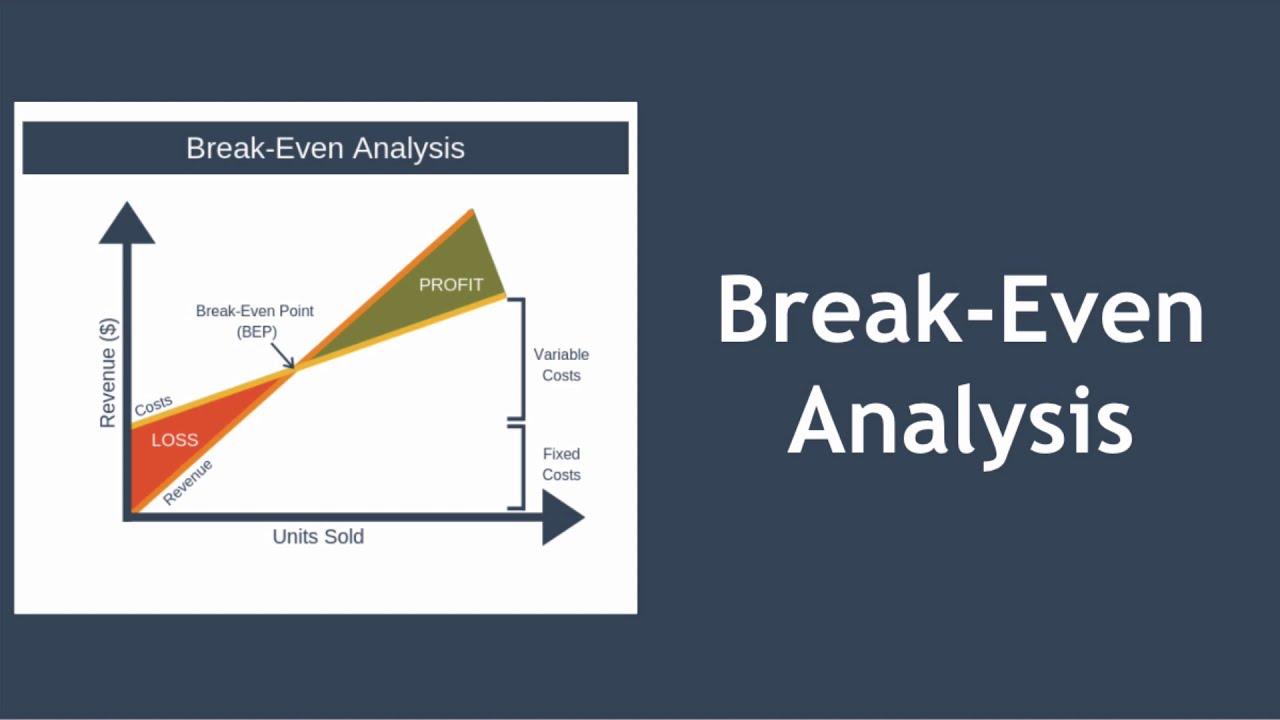

In the realm of options trading, understanding break-even points is crucial for successful and strategic investing. When an option contract is bought, the trader aims to sell it for a profit at some point in the future. The break-even point represents the price at which the trader will neither lose nor gain money on the trade. However, in certain scenarios, an option contract may have a negative break-even percentage, which calls for a deeper understanding of this concept.

Image: www.youtube.com

Defining Break-Even Point

The break-even point in options trading is the price at which the option’s premium plus (or minus, in case of puts) the strike price equals the underlying asset’s price. At this point, the trader neither profits nor loses from the trade. For example, if a trader buys a call option with a strike price of $100 and pays a premium of $5, the break-even point would be $105 ($100 + $5). If the underlying asset’s price rises above $105, the trader can exercise the option and sell the asset for a profit. Conversely, if the underlying asset’s price falls below $105, the option will expire worthless, resulting in a loss of the premium paid.

Understanding Negative Break-Even Percentage

In options trading, it’s not uncommon to encounter situations where the break-even percentage turns negative. This occurs when the option loses value over time due to factors such as theta decay (time decay), unfavorable market conditions, or changes in the implied volatility of the underlying asset. When the break-even percentage is negative, it means that the option’s price has declined significantly, and the trader must sell it at a lower price to break even.

Causes of Negative Break-Even Percentage

Several factors can lead to a negative break-even percentage in options trading:

-

Theta Decay: Options lose value over time as they approach their expiration date. This is due to the time decay component of the option’s price, also known as theta decay.

-

Unfavorable Market Conditions: If the underlying asset’s price moves against the trader’s position, the option’s value will decline, potentially resulting in a negative break-even percentage.

-

Changes in Implied Volatility: Implied volatility is the market’s expectation of how much the underlying asset’s price will fluctuate over the option’s life. If the implied volatility decreases, the option’s value will also decrease, potentially leading to a negative break-even percentage.

Image: www.cleverproductdevelopment.com

Managing Options with Negative Break-Even Percentage

Traders can employ several strategies to manage options with negative break-even percentages:

-

Adjusting Position: Traders can consider adjusting their position by selling some of the contracts or adjusting the strike price to reduce the negative impact on their overall portfolio.

-

Hedging: Hedging with opposite options positions or other financial instruments can help offset the risk associated with negative break-even percentages.

-

Monitoring Market Conditions: Keeping a close eye on market conditions and underlying asset price movements allows traders to make informed decisions and adjust their strategies accordingly.

What Does Break Even Mean In Options Trading Negative Percentage

Image: forums.babypips.com

Conclusion

Understanding break-even points, including scenarios with negative percentages, is essential for successful options trading. Traders must continuously monitor their positions and consider adjusting their strategies to mitigate risk and maintain a profitable trading approach. By embracing knowledge and adopting effective risk management techniques, traders can navigate the complexities of options trading and make well-informed decisions.