Introduction

Image: insidebitcoins.com

Options trading, an alluring yet complex financial avenue, has long been shrouded in mystery. However, with Ally’s user-friendly platform and comprehensive resources, you can demystify this enigmatic realm and harness its transformative potential. Embark on this comprehensive tutorial to master ally options trading, equipping yourself with the knowledge and strategies to navigate the markets with confidence.

Unveiling the Essence of Ally Options Trading

Ally options trading empowers you to amplify your returns by leveraging options contracts. These contracts bestow upon you the right (but not the obligation) to buy or sell an underlying asset at a predetermined price on or before a specific date. By exercising this prerogative, you capitalize on market fluctuations without the need for outright ownership of the underlying asset, thus reducing your capital outlay.

Fundamentals of Ally Options Trading

Understanding the options language is paramount. Call options grant you the right to purchase, while put options bestow the right to sell. The strike price represents the target price at which you intend to exercise your option. The expiration date dictates the timeframe within which you must decide to execute your option.

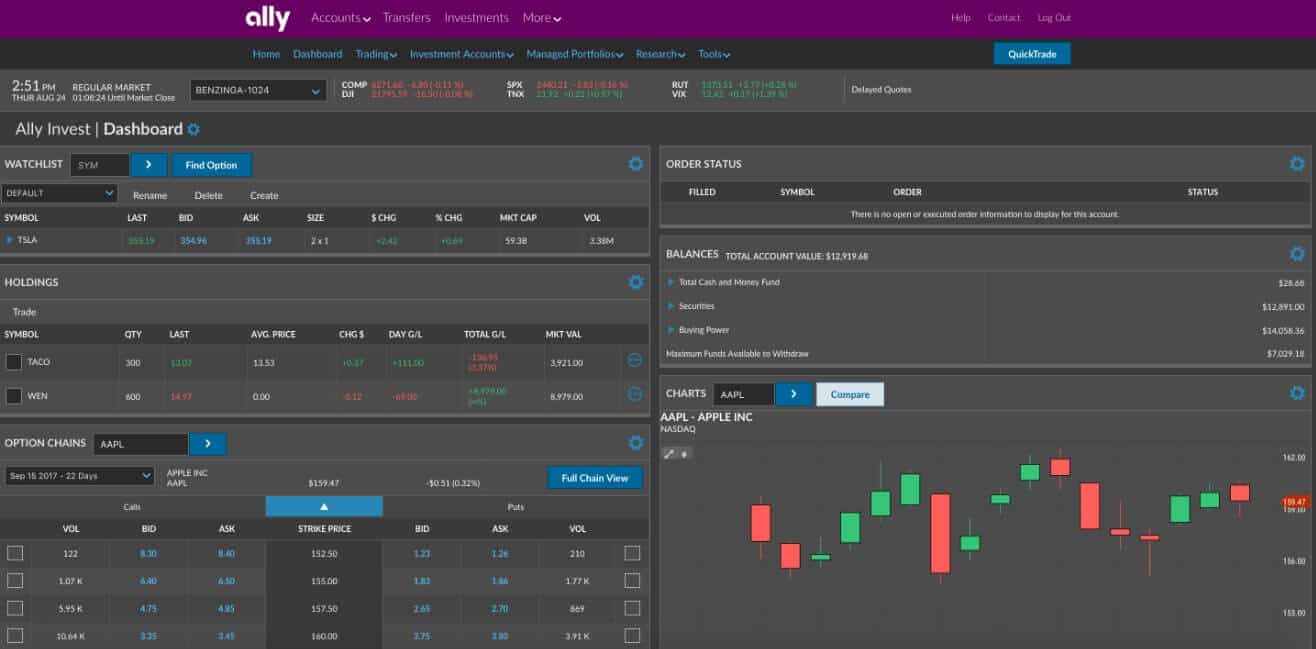

Navigating the Ally Options Trading Platform

Ally’s intuitive platform simplifies the options trading process. The “Options Screener” allows you to filter for options based on criteria such as strike price, expiration date, and implied volatility. The TradeTicket empowers you to execute trades swiftly with customizable order types. Extensive educational resources and live market commentary equip you with real-time insights.

Crafting Options Strategies

Successful ally options trading hinges on devising well-thought-out strategies. Covered calls involve selling call options against existing stock positions. Protective puts provide downside protection by allowing you to sell put options to hedge against potential losses. Iron condors combine call and put options to create a more nuanced hedging strategy.

Expert Insights and Actionable Tips

“Options trading empowers you to enhance portfolio returns and mitigate risks. However, always trade with the capital you can afford to lose.” – Dr. James A. Overdahl, PhD, Author of “Options Trading for Dummies”

- Start by paper trading to gain experience before risking real capital.

- Thoroughly research underlying assets and their market dynamics.

- Manage risk through diversification, hedging, and proper position sizing.

- Utilize technical analysis to identify potential market trends and trading opportunities.

Embracing Ally Options Trading

Ally options trading empowers you to elevate your financial game plan. By grasping the concepts, utilizing the platform effectively, implementing robust strategies, and incorporating expert insights, you can unlock the profound potential of leveraged returns. Transform your financial destiny by venturing into the world of Ally options trading with confidence and the unwavering support of one of the industry’s most trusted names. Remember, knowledge is power, and with this newfound understanding, you hold the keys to financial success at your fingertips.

Connect with us today through our Ally Options Trading Hotline at 1-800-333-8950 for personalized guidance and support. Together, let’s embark on this extraordinary journey and ignite the fire of financial empowerment within you!

Image: seekingalpha.com

Ally Options Trading Tutorial