Traversing the realm of option trading often brings forth a familiar adversary: trading commissions. Interactive Brokers (IBKR) stands as a popular choice among traders, yet navigating the complexities of its commission structure can prove challenging. Fear not, intrepid investor, as this comprehensive guide will illuminate strategies to mitigate IBKR’s grip on your hard-earned profits.

Image: ibkrcampus.com

Understanding IBKR’s Commission Framework

IBKR’s commission structure is a multifaceted tapestry, varying based on account type, trading volume, and contract type. Options trading incurs a per-contract fee, which can quickly accumulate for active traders. It’s imperative to grasp this framework before delving into commission minimization tactics.

Leveraging Tiered Accounts

IBKR’s tiered account system offers a progressive path toward lower commissions. As trading volume increases, traders ascend the account hierarchy, unlocking reduced rates. By strategically scaling up your trading activity, you can swiftly graduate to higher tiers and reap the benefits of lower commissions.

Optimizing Contract Selection

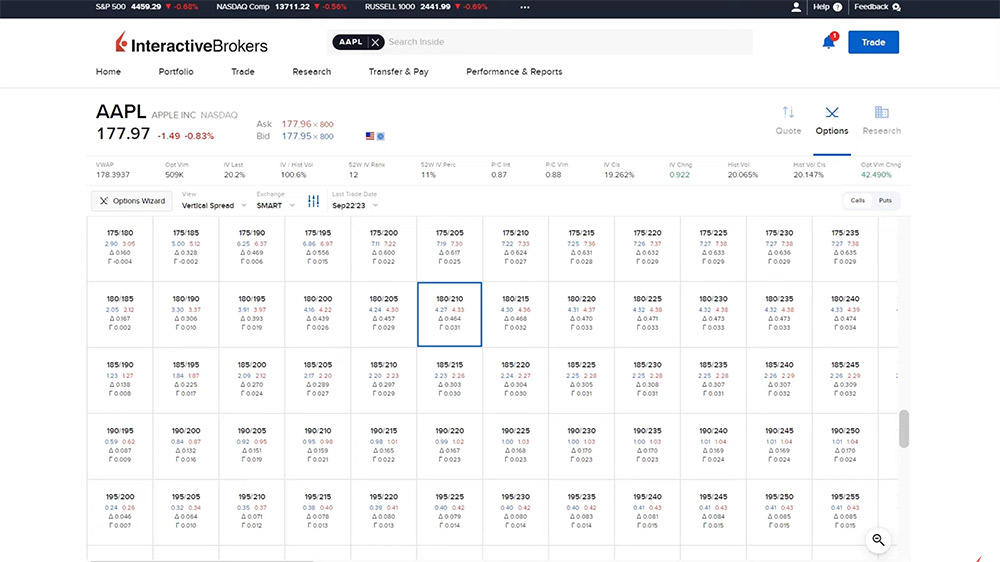

Choice of option contract plays a crucial role in commission reduction. Lower-premium options inherently entail lower per-contract fees. Identify and trade options with premiums that align with your trading strategy while minimizing commission expenditure.

Image: otebagoqe.web.fc2.com

Embracing Bulk Order Placement

IBKR rewards traders for consolidating orders. Placing larger, consolidated option orders instead of multiple smaller orders can significantly reduce trading fees. Imagine placing a single order for 10 contracts instead of 10 separate orders for one contract each. The former option offers substantial cost savings.

Harnessing Fixed Fee Accounts

For high-volume traders, IBKR’s fixed fee accounts can prove advantageous. These accounts levy a flat monthly fee irrespective of trading volume. While this model may not suit casual traders, it offers substantial savings for those who trade frequently.

Exploring Tiered Pricing

IBKR’s tiered pricing system provides volume-based discounts. The more options you trade per month, the lower the per-contract fee. By consistently meeting or exceeding the required volume thresholds, you can unlock increasingly lower commission rates.

Trading During Off-Peak Hours

IBKR often implements dynamic commission pricing, increasing fees during high-volume periods. By strategically trading during off-peak hours, such as early mornings or evenings, you can capitalize on lower commissions.

Seeking Brokerage Rebates

Certain brokerages offer rebates on IBKR commissions. By utilizing these services, you can recoup a substantial portion of your trading fees. Explore this option to maximize savings.

Becoming a Market Maker

Advanced traders can consider becoming market makers on IBKR’s SMART platform. Market makers receive rebates for providing liquidity to the market, potentially offsetting or even exceeding their own trading commissions. This strategy is, however, complex and not recommended for beginners.

Embracing the Value of Automation

Technology can enhance your commission minimization efforts. Automation tools, such as trading platforms or algorithms, can scan markets for lower-cost trading opportunities in real-time. By leveraging these tools, you can save time and ensure you’re always accessing the most cost-effective options.

Additional Strategies

Beyond the strategies outlined above, here are additional tips to further reduce IBKR commissions:

-

Promote Inactive Accounts: Reduce your monthly activity to maintain a lower account tier.

-

Negotiate: Open a dialogue with IBKR and explore potential concessions or custom commission structures tailored to your specific trading profile.

-

Consider Alternatives: Evaluate other brokerages that may offer more competitive commission rates or fee structures that better align with your trading needs.

Embrace a Comprehensive Approach

Optimizing commission expenditure on IBKR requires a holistic approach. By judiciously combining the strategies discussed in this article, you can forge a path toward reduced trading costs, unlocking greater profitability and empowering your option trading endeavors.

How To Reduce Ibkr Commission On Option Trading

Image: qartalfx.com

Conclusion

Navigating the complexities of IBKR’s commission structure can be akin to traversing a labyrinth. Fear not, intrepid trader, for this guide serves as your compass, illuminating a multitude of strategies to minimize costs and optimize your trading efficiency. Whether you’re a seasoned veteran or an aspiring market maestro, by embracing the strategies outlined herein, you will emerge victorious in the battle of commissions, setting sail toward a future of prosperous option trading.