Millions of traders worldwide rely on Interactive Brokers (IBKR) for its comprehensive trading platform. One of the key considerations for traders is the cost associated with executing trades, particularly options trades. In this article, we will delve into the factors influencing IBKR’s options trading commission and explore the potential for future reductions.

Image: tokenist.com

Understanding IBKR’s Options Trading Commission Structure

IBKR employs a tiered pricing structure for options trades based on monthly contract volume. The commission per contract varies depending on the volume bracket, with higher volume tiers attracting lower per-contract charges. This tiered structure allows traders to optimize their trading costs based on their trading frequency.

Factors Influencing IBKR’s Commission Rates

Several key factors influence IBKR’s options trading commission rates:

-

Clearing fees: IBKR incurs clearing fees from exchanges and brokers involved in trade execution. These fees vary depending on the complexity and size of the trade and are passed on to traders as part of the commission.

-

Regulatory costs: IBKR is subject to regulatory expenses, including those related to compliance, oversight, and reporting. These costs also contribute to the overall commission structure.

-

Operational expenses: IBKR incurs operational costs associated with maintaining its trading platform, customer support, and technology infrastructure. These expenses are factored into the commission pricing.

-

Market competition: The competitive landscape in the online brokerage industry influences IBKR’s commission rates. IBKR aims to remain competitive while maintaining its high-quality service offerings.

Potential for Lower Commission Rates

Given the competitive nature of the brokerage industry, there is always the possibility of commission rate reductions in the future. Factors that could drive lower commissions include:

-

Technological advancements: Automation and operational efficiencies can lead to reduced clearing and operational costs, which could be passed on to traders.

-

Increased competition: If other brokerages offer lower commission rates, IBKR may face pressure to adjust its pricing to remain competitive.

-

Growth in trading volume: As IBKR’s trading volume continues to expand, it may be able to negotiate lower clearing fees with exchanges and brokers, leading to potential commission reductions.

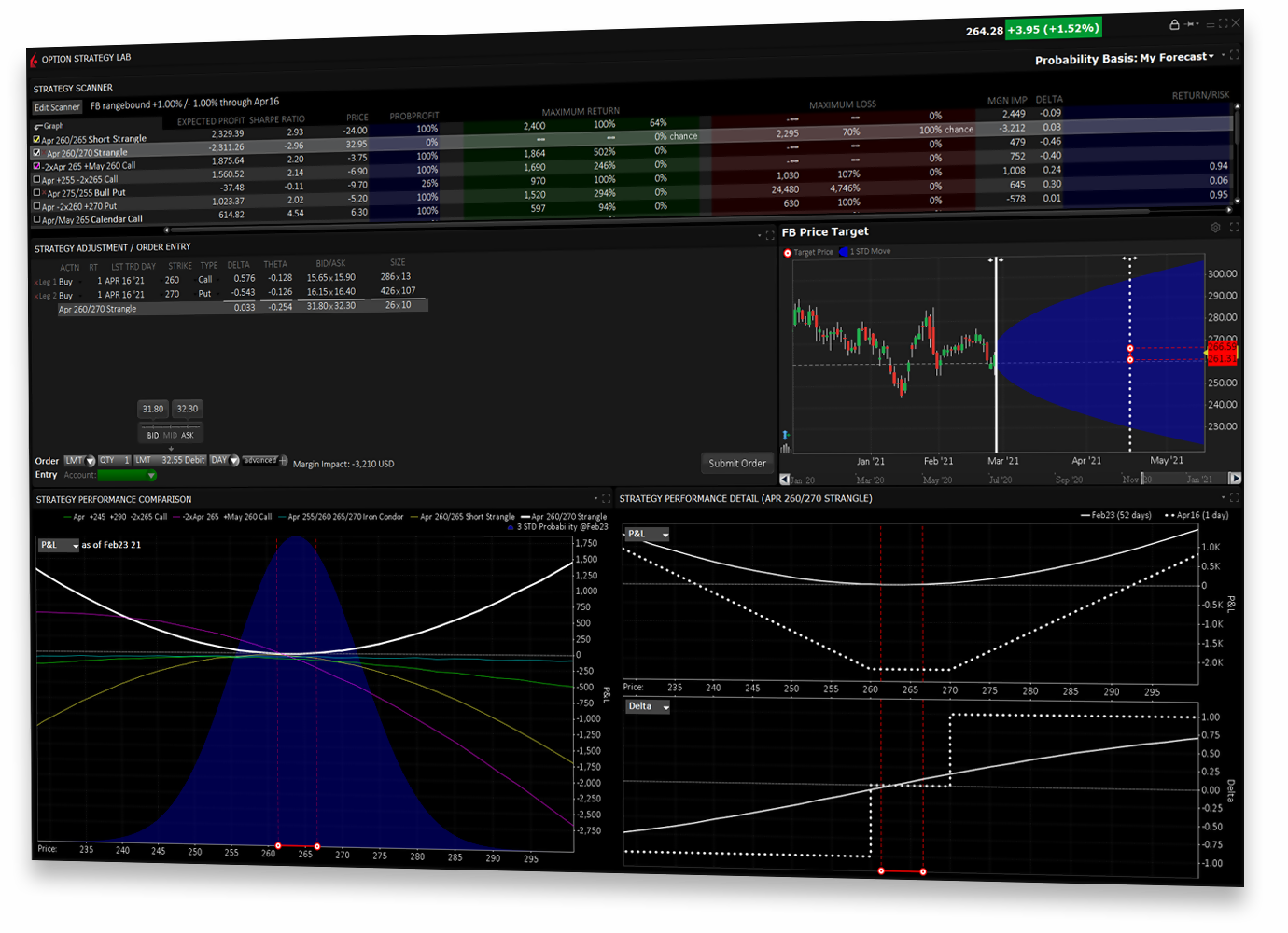

Image: www.interactivebrokers.com

Expert Insights and Actionable Tips

“Interactive Brokers offers a well-rounded trading platform with competitive pricing,” says industry analyst Sarah Jones. “Traders should consider their individual trading volume and needs when evaluating IBKR’s commission structure.”

To optimize your trading experience:

-

Calculate your average monthly options contract volume to determine the most cost-effective tier.

-

Explore other brokerages and compare their commission rates to make informed decisions.

-

Contact IBKR’s support团队 to inquire about potential discounts or promotions.

Will Interactive Brokers Lower Options Trading Comission

Image: hasani-trockenbau.de

Conclusion

The potential for Interactive Brokers to lower its options trading commission rates remains an industry topic. While factors such as clearing fees, regulatory costs, and market competition influence the current pricing, technological advancements, increased competition, and trading volume growth could drive commission reductions in the future. Traders are advised to monitor market trends, compare brokerage offerings, and stay informed to take advantage of potential cost savings.