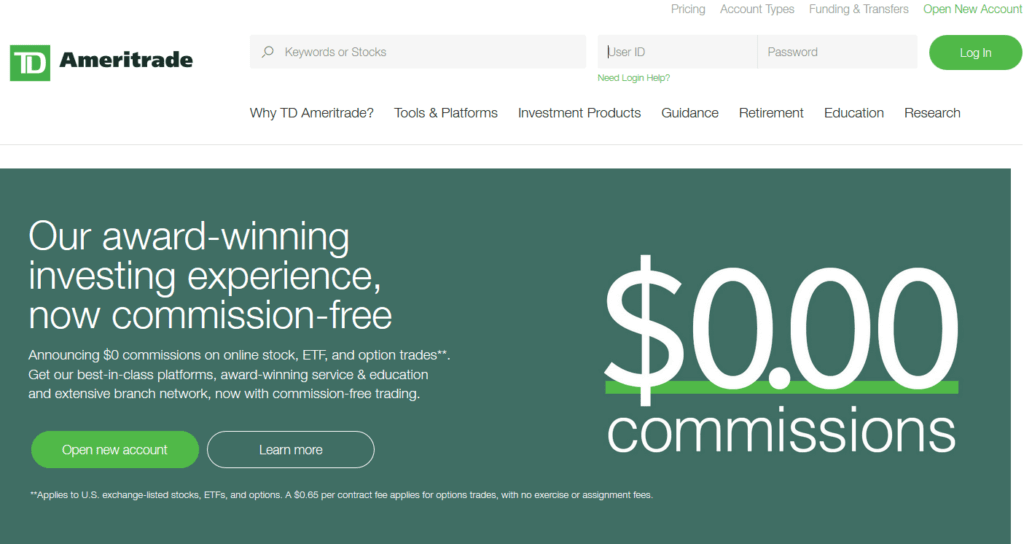

Option trading, a popular investment strategy, involves speculating on the future value of an underlying asset without actually owning it. TD Ameritrade, one of the leading online brokers, offers a comprehensive option trading platform and various pricing models that cater to traders of different experience levels and trading styles.

Image: seekingalpha.com

Understanding the intricacies of TD Ameritrade’s option trading commission structure is crucial for traders to make informed decisions and manage their potential expenses. This guide provides a detailed overview of the pricing models, commission rates, and other related fees associated with option trading at TD Ameritrade.

Commission Rates

TD Ameritrade offers two primary commission structures for option trades: a variable commission rate based on the number of contracts traded and a tiered commission rate that depends on the total amount of options volume traded per month.

Variable Commission Rate

Under the variable commission rate model, traders pay a fixed fee per contract, which varies depending on the type of option contract and the exchange where it is traded. For basic exchange-traded options (ETFs) with a multiplier of 100, the commission rate starts at $0.65 per contract for the first 99 contracts and decreases to $0.50 per contract for 100 or more contracts. For other types of options, such as those with a multiplier that differs from 100 or option spreads, the commission rates may vary.

Tiered Commission Rate

The tiered commission rate model offers a subscription-based pricing structure. Traders can select from three tiers: Bronze, Silver, and Platinum. Each tier has a different volume requirement and commission rate. For example, the Bronze tier has a volume commitment of up to 25,000 contracts per month, with a commission rate of $0.75 per contract. The Silver tier has a volume commitment of up to 200,000 contracts per month, with a commission rate of $0.60 per contract. The Platinum tier has a volume commitment of over 200,000 contracts per month, with a commission rate of $0.50 per contract. Traders need to carefully access their trading volume and the associated costs before choosing a suitable tier.

Image: www.cbinsights.com

Additional Fees

In addition to the commission charges, TD Ameritrade may also impose other related fees that traders should consider. Option contract fees, which typically consist of exchange, clearing, and regulatory fees, can vary depending on the underlying security and the venue where the contract is traded. Exercise and assignment fees, both at $15 per contract, may be applicable when traders exercise or are assigned an option contract (buying or selling the underlying asset), leading to ownership or delivery of the asset.

Choosing the Right Commission Structure

Selecting the appropriate commission structure depends on several factors, including the frequency of option trades, the number of contracts traded, and the overall trading strategy. High-volume traders who execute a significant number of option trades may benefit from the tiered commission rate model, as the discounted commission rates based on volume can result in substantial cost savings. On the other hand, traders with relatively lower trading volume may prefer the variable commission rate model to avoid fixed monthly subscription fees.

Tips for Reducing Option Trading Costs

By following a few thoughtful strategies, traders can potentially reduce their option trading costs and enhance their profit margins:

- Negotiate with TD Ameritrade for lower commission rates, especially if you have a significant trading volume.

- Consider the potential impact of exchange fees and other related costs when selecting the desired trading venue.

- When feasible, trade during low-volume periods, as liquidity providers may offer tighter spreads, leading to lower overall transaction costs.

- Explore alternative trading platforms or brokers that may offer competitive commission rates or specialized pricing tailored to your trading needs.

Common FAQs on TD Ameritrade Option Trading Commission

- What is the minimum commission rate charged by TD Ameritrade for option trades?

The minimum commission rate for basic exchange-traded options with a multiplier of 100 starts at $0.65 per contract under the variable commission rate model. - Are there any volume discounts available for option trades?

Yes, the tiered commission rate model offers volume discounts for traders who commit to a specific number of contracts per month. - What are the additional fees associated with option trading at TD Ameritrade?

Traders may incur option contract fees, exercise and assignment fees, and other exchange-related costs. - How often does TD Ameritrade update its commission rates?

TD Ameritrade periodically reviews and adjusts its commission rates, so it’s advisable to consult the official TD Ameritrade website or contact customer support for the most current information.

Td Ameritrade Option Trading Commission

Conclusion

Understanding TD Ameritrade’s option trading commission structure empowers traders to make informed decisions about their trading expenses and maximize their potential profits. By weighing the factors discussed and considering the tips outlined in this guide, traders can effectively select the right commission model and implement cost-saving strategies to enhance their overall trading experience.

Are you interested in exploring the world of option trading? If so, we encourage you to delve deeper into the topic by reading follow-up articles, consulting industry experts, and engaging in thoughtful discussions with fellow traders.